As digital threats rise and data privacy becomes non-negotiable, VPNs have shifted from being niche tech tools to everyday essentials. Consumers now expect secure browsing, unrestricted streaming, and reliable connections abroad—creating a massive demand wave.

For entrepreneurs, this means recurring revenue, global scalability, and a product that addresses real pain points for both businesses and consumers. With the right partner, infrastructure, compliance, and delivery are taken care of, allowing you to focus on branding, sales, and growth.

Below, we break down why VPN reselling stands out as a premier exit strategy—exploring market trends, technical considerations, strategic advantages, and how the PureVPN Reseller solution delivers a turnkey opportunity.

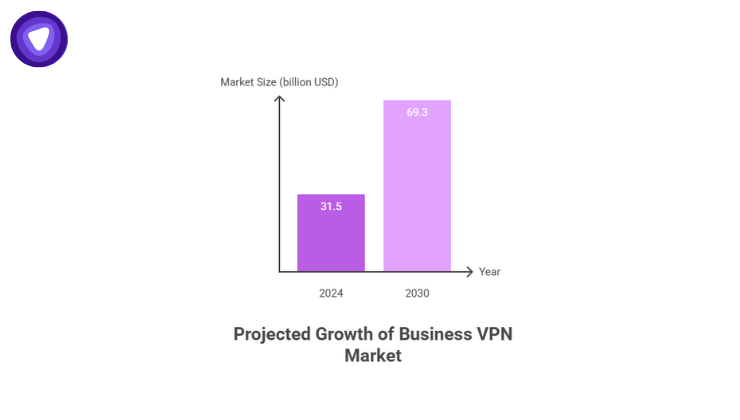

- Massive Market Growth – The VPN industry is set to expand from $61.42B in 2024 to $151B by 2029 (16% CAGR), with the business VPN segment nearly doubling to $69.3B by 2030—creating a ripe environment for resellers.

- High Margins, Low Overhead – VPN reselling offers up to 95% profit margins with startup costs as low as $500, making it one of the most capital-efficient exit plays for entrepreneurs.

- Enterprise-Driven Demand – Despite the rise of Zero Trust, businesses (especially SMEs and legacy-heavy sectors) continue to rely on VPNs for remote access, compliance, and security.

- Tech & Integration Edge – Success hinges on offering modern protocols (WireGuard, OpenVPN, IKEv2), developer APIs, SSO integration, geo-distributed gateways, and strict privacy/logging policies—while avoiding pitfalls like overpromising performance.

- Exit-Ready with PureVPN Reseller Program – Entrepreneurs gain turnkey infrastructure, white-label branding, developer-friendly APIs, and enterprise-ready features, making their ventures highly attractive for acquisition or strategic sale.

Market Momentum: Riding a Growth Wave

VPN Market in Rapid Ascent

These numbers underscore the explosive demand for VPN, security, remote access, and performance capabilities in the enterprise sector. For serial entrepreneurs, this environment is ideal for launching—and ultimately exiting, a VPN reselling venture.

Here’s a surprising fact: the global VPN market is poised to grow from $61.42 billion in 2024 to $71.25 billion in 2025, an impressive 16% CAGR and forecasted to hit $151 billion by 2029. Simultaneously, the business VPN segment alone is projected to surge from $31.5 billion in 2024 to $69.3 billion by 2030.

Why Entrepreneurs Should Consider a VPN Resale Exit

Scalability Meets Low Overhead

White-label VPN offerings allow entrepreneurs to bypass infrastructure-heavy development. With ~$500 startup costs and potential margins of up to 95%, entrepreneurs can build fast, brand their way, and scale quickly.

Strong Demand from Enterprises

Despite the rise of Zero Trust models, traditional business VPNs remain foundational—expected to almost double in market size by 2033. Many organizations struggle to transition fully. A VPN reseller can serve as a pragmatic, incremental solution—especially for SMEs and legacy-heavy enterprises.

Diversified Revenue Streams

VPN reselling opens multiple revenue channels:

- Recurring subscription fees (monthly/yearly).

- Up-sell opportunities (higher-tier protocols, speed optimizations).

- Enterprise packages (bulk licensing, dedicated gateways).

- Cross-sell into genres like secure remote access and performance-optimized paths.

Exit-Readiness Quiz: Is Your VPN Reselling Venture Built to Sell?

Developer/CTO Insights: Integration, Security & Pitfalls

For developers and CTOs evaluating VPN reselling opportunities, integration should be a top priority. Choosing providers that are API-first makes a significant difference, as REST APIs enable automation of user management, usage analytics, and billing processes. At the same time, incorporating Single Sign-On (SSO) through SAML or OpenID Connect ensures that VPN access aligns smoothly with existing corporate identity frameworks, making adoption less disruptive. Some vendors also provide custom client SDKs, which allow enterprises to embed or rebrand VPN clients within their internal tools—helping create a seamless user experience.

From a technical standpoint, support for modern protocols like WireGuard, OpenVPN, and IKEv2 is essential, since these deliver both high encryption standards and minimal latency. Load balancing and geo-distribution capabilities are equally important, ensuring high availability and helping businesses meet regional data sovereignty requirements. Privacy is another non-negotiable area; resellers need to establish clear policies around logging and retention in order to reassure enterprises that their security standards will be maintained.

However, pitfalls exist. One of the most common mistakes is overpromising performance, since remote access VPN latency can vary widely depending on geography and concurrent load. Security complacency is another issue, as poorly isolated VPN setups can introduce vulnerabilities unless per-user access controls and audit trails are enforced. Finally, it’s important not to ignore the broader trajectory of Zero Trust. While VPNs remain highly relevant today, they are increasingly viewed as part of a layered security strategy rather than a standalone solution, and resellers should position their offerings accordingly.

Industry Trends Shaping the Future

- Zero Trust isn’t replacing VPN—yet: Despite buzz, adoption is still limited, and legacy infrastructure relies on VPNs.

- Cyberthreats are accelerating demand: With remote and hybrid work models entrenched, encrypted access is non-negotiable.

- Regulatory friction is fueling VPN usage spikes: Consider the UK, where VPN signups spiked 1,400% overnight due to new age-check laws.

- Education is lagging adoption: While awareness is high, actual usage varies, creating room for enterprise-targeted evangelism and positioning.

Build vs. Buy: A Comparison Table

| Strategy | Pros | Cons |

| Building your own VPN | Full control, custom optimizations | High cost, time-consuming, requires deep security expertise |

| Reselling (white-label) | Low startup cost, quick to market, profitable | Dependent on vendor, limited differentiation |

For serial entrepreneurs focused on efficient exits—with branding, customer base, and predictable margins—reselling strongly outpaces building from scratch.

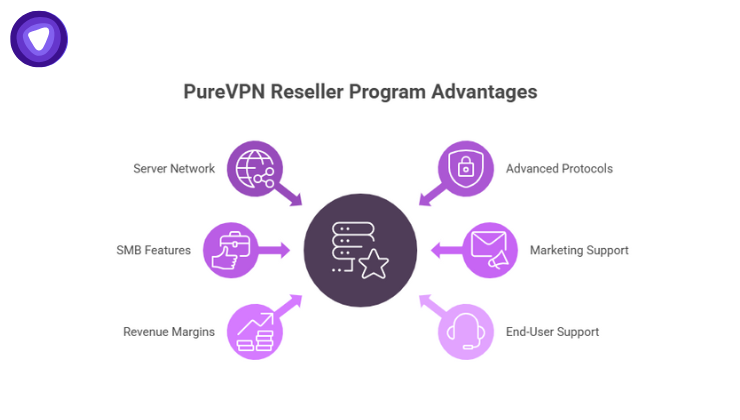

The PureVPN Reseller Solution: Your Exit Partner

Towards the endgame of your venture, positioning your company for acquisition or sale is key. Here's where the PureVPN Reseller Program offering shines:

- Turnkey infrastructure: Skip the VPN engine building and maintenance.

- High margins & low cost: Tap into the aforementioned 95% margin with minimal overhead.

- Brand freedom with control:

- Rebrand clients, portals, and dashboards.

- Set pricing, billing cycles, and user tiers.

- Rebrand clients, portals, and dashboards.

- Modern, secure protocols: Supports WireGuard, OpenVPN, and more for optimal security and performance.

- Developer-friendly APIs: Automate provisioning, scaling, and reporting.

- Enterprise-ready: Multi-geography gateways, compliance-ready logs, and dedicated gateways.

These features position you as a serious, scalable VPN provider—a highly attractive profile for strategic acquirers or investors seeking plug-and-play security products.

Future Outlook: The VPN Reseller Opportunity

- Market Expansion: Multiple forecasts peg the VPN industry to double or even triple in size within the next 5–7 years.

- Hybrid work is here to stay: Secure remote access is no longer optional—it’s foundational.

- Regulatory opacity drives demand: VPN use surges amid privacy concerns and censorship—even at rapid rates—as seen in the UK.

- Mergers and consolidation beckon: Entrepreneurial VPN resellers with customers and brand equity could be prime acquisition targets.

Actionable Takeaways for Entrepreneurs

- Leverage high margins by reselling rather than building.

- Target underserved business segments—SMEs, legacy verticals, and regions with compliance pressure.

- Differentiate with enterprise-friendly features: custom protocols, APIs, SSO, support packages.

- Position for exit early: build customer relationships, brand equity, and recurring revenue.

- Monitor Zero Trust trends, adjusting offerings to integrate with identity-first models.

Conclusion

VPN reselling is a smart exit strategy for serial entrepreneurs: it taps into a booming global market, offers high margins and low capital expenditure, and allows for rapid scaling—all while leveraging existing infrastructure. With enterprise demand, regulatory tailwinds, and evolving access models, a well-structured VPN reselling business especially one powered by a flexible, developer-friendly solution like PureVPN Reseller Program is well-positioned for acquisition or strategic sale. The key is to execute fast, stay secure, and remain positioned as a turnkey, enterprise-ready VPN brand.