Managed Service Providers (MSPs) face a critical pricing challenge. Security is now a non-negotiable part of every managed IT agreement, yet margins are shrinking as tool costs rise and clients demand predictable fees. The right pricing strategy determines whether an MSP grows Monthly Recurring Revenue (MRR) and retains clients long term or stays stuck in low-margin work.

This guide examines proven MSP security pricing models, explains how to calculate true margins, and outlines tactics to increase revenue per client without sacrificing trust.

- MSP security pricing directly impacts Monthly Recurring Revenue (MRR) and client retention.

- Common pricing models include per-user, per-device, tiered bundles, value-based, and monitoring-only approaches.

- Accurate pricing requires calculating all delivery costs (labor, tools, support, onboarding) and aiming for 60–70% gross margin.

- Tiered packages (Basic, Standard, Premium) help upsell while keeping margins predictable.

- Price increases work best when tied to measurable risk reduction and presented at contract renewals.

- ROI calculators help demonstrate the financial value of security services by showing breach cost avoidance and compliance savings.

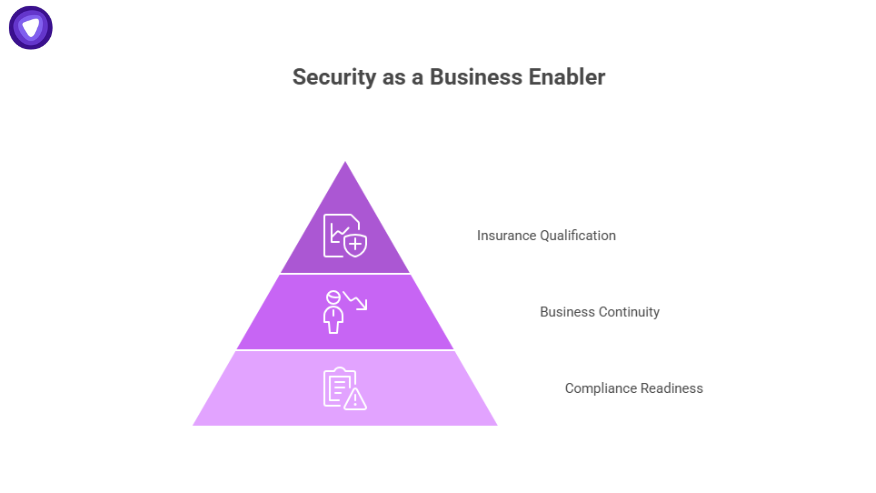

- Positioning security as a business enabler (compliance, insurance qualification, business continuity) improves client buy-in.

- Regularly review and adjust pricing to match vendor cost changes, inflation, and compliance updates.

- Adding white-label VPN services boosts ARPU and retention without building new infrastructure.

How MSPs Price Security Services?

Pricing frameworks vary, but most MSPs rely on one or more of these models:

| Pricing Model | How It Works | Best For | Weakness |

| Per-User | Fixed fee for each user account. | Simple IT stacks, clear headcounts. | Fails when users share devices or usage spikes. |

| Per-Device | Fee per workstation, server, or mobile device. | Mixed device environments, remote endpoints. | Harder to scale for IoT and BYOD. |

| Tiered Bundles | Bronze/Silver/Gold packages with preset tools and support levels. | MSPs that want clear upsell paths. | Requires careful margin analysis per tier. |

| Value-Based | Price linked to business risk or compliance demands. | Regulated industries, high-stakes security. | Sales team must justify value clearly. |

| Monitoring-Only | Low flat fee for alerting, client handles response. | Price-sensitive SMBs. | Little room for profit or retention. |

Many MSPs use a hybrid approach, starting with per-user or per-device pricing, then adding bundled services such as Managed Detection and Response (MDR), email filtering, or compliance reporting.

Building a Cost and Margin Framework

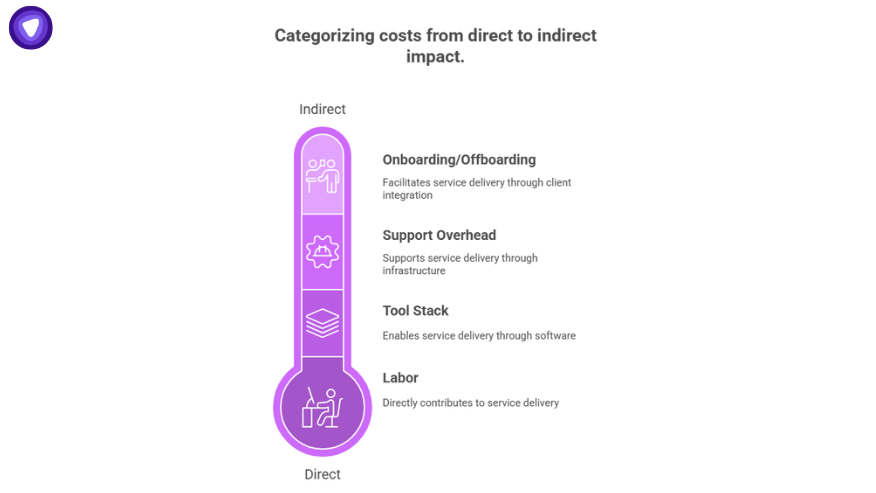

Accurate pricing starts with understanding the full cost of service delivery:

- Labor: Salaries for SOC analysts, engineers, and helpdesk.

- Tool Stack: Security software licensing (endpoint protection, EDR, SIEM, backup).

- Support Overhead: Training, ticketing systems, insurance, compliance audits.

- Onboarding & Offboarding: Time spent integrating clients into systems.

Once true costs are clear, add your target gross margin. Many profitable MSPs aim for 60–70% gross margin on security services.

Large IT projects historically exceed budget by 45% and deliver 56% less value than predicted. Pricing with margin buffers prevents losses from unexpected scope creep.

Structuring Tiered Security Packages

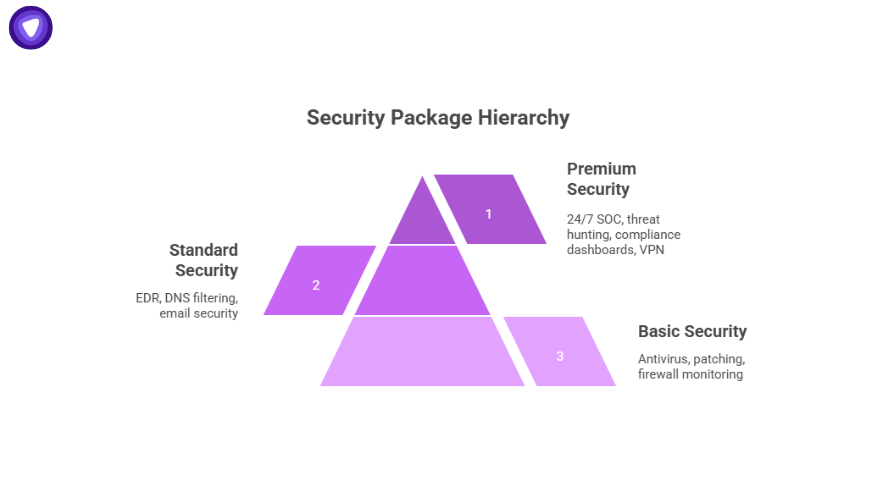

Tiered models help sell security at different price points while keeping high-value add-ons profitable.

- Basic: Antivirus, patching, firewall monitoring.

- Standard: Add EDR, DNS filtering, email security.

- Premium: Add 24/7 SOC monitoring, threat hunting, compliance dashboards, VPN.

Each tier should have clear feature separation and documented Service Level Agreements (SLAs). Avoid giving enterprise-level support inside entry-level packages.

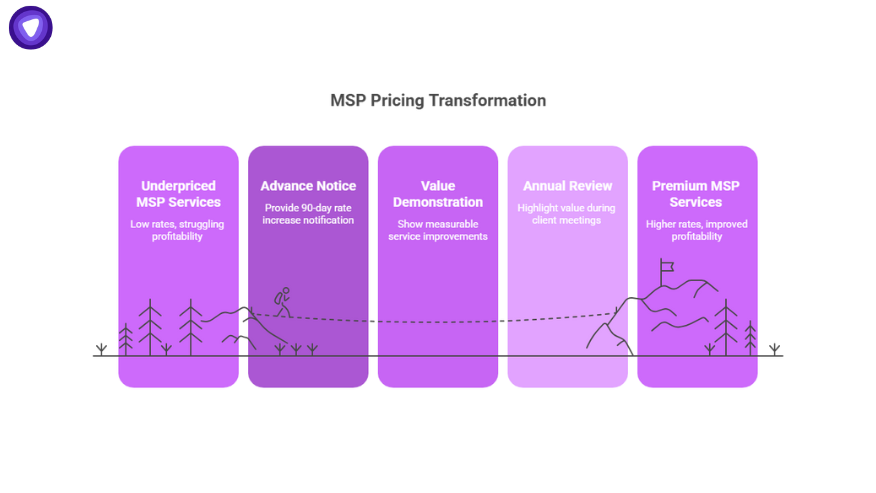

Increasing Prices Without Losing Clients

Many MSPs underprice initially and struggle to raise rates. Successful providers:

- Introduce increases at contract renewal, with 90-day notice.

- Show measurable improvements: response time reductions, compliance achievements, reduced incidents.

- Use annual review meetings to demonstrate value delivered.

- Bundle additional services (MFA rollout, vulnerability scanning) to justify a higher rate.

Retention improves when clients see price increases tied to stronger risk protection rather than unexplained markups.

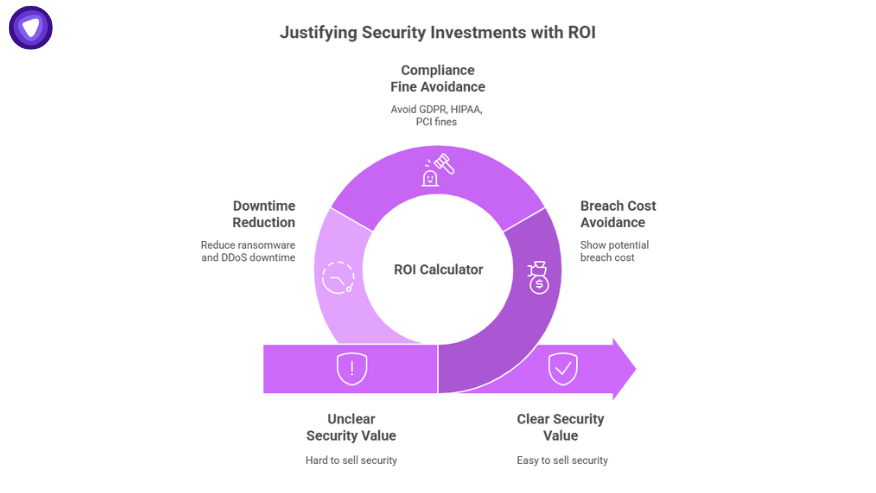

Using ROI and Cost-Avoidance Calculators

Security is easier to sell when tied to financial impact. A well-designed ROI calculator can show:

- Potential breach cost avoided (industry averages often exceed $4.8M per incident for mid-size firms).

- Compliance fine avoidance (GDPR, HIPAA, PCI).

- Downtime reduction due to ransomware or DDoS.

MSPs can present calculators during renewals or new proposals, framing services as risk cost savings rather than an expense.

Positioning Security as a Business Enabler

Clients rarely buy security for its own sake. MSPs who succeed at premium pricing focus on:

- Compliance readiness: Demonstrate how services support frameworks like ISO 27001, SOC 2, HIPAA.

- Business continuity: Show reduced downtime and data loss.

- Insurance qualification: Cyber insurance premiums can rise 40–70% without documented controls.

By framing security as an enabler of revenue continuity, MSPs reduce pricing objections.

Adjusting Pricing for Market Shifts

Threat complexity and vendor costs change yearly. High-performing MSPs:

- Review tool spend and margins annually.

- Include inflation and vendor cost clauses in contracts.

- Track competitors but avoid racing to the lowest price.

- Monitor compliance changes that demand new services (e.g., mandatory MFA, endpoint logging).

Increasing ARPU with White-Label VPN and Security Add-Ons

One of the fastest ways to increase revenue per user without heavy engineering is to add white-label VPN services.

By bundling a branded VPN with security packages, MSPs:

- Provide encrypted remote access to SMB and enterprise clients.

- Differentiate from basic IT providers.

- Increase stickiness and retention with a single secure access platform.

PureVPN White Label lets MSPs launch a fully branded VPN platform under their own name without building network infrastructure. This approach allows faster go-to-market and better control over user experience while adding high-margin recurring revenue.

Conclusion

MSP security pricing now determines long-term growth. Providers who combine accurate cost modeling, margin-smart tiered packaging, and ROI-driven client conversations achieve stronger MRR and higher retention.

Strategic add-ons like white-label VPN services create new revenue layers without expensive infrastructure, helping MSPs compete at scale.

If you want to expand your portfolio with a fully branded VPN solution that integrates into your security stack, PureVPN – White Label provides the platform to launch quickly and increase recurring revenue while retaining full brand control.