When a major institution like USAA experiences a data breach, it sends a ripple effect far beyond the affected accounts. We’re not just talking about a one-time security lapse. We’re looking at a moment that could redefine how veterans, military families, and enterprise clients view trust, data control, and digital responsibility.

In April 2025, USAA agreed to a $3.25 million class action settlement related to a 2021 breach that potentially compromised personal and financial data of thousands of its members. With the USAA data breach settlement claim deadline already over on April 7th, many are still scrambling to understand: Am I eligible? What’s the payout? How do I claim?

This guide breaks it all down—no fluff, no vague language. Just what you need to know to act fast, secure your compensation, and stay informed.

What Happened in the USAA Data Breach?

Click a dot above to view timeline details

Follow the key legal and payout events related to the USAA data breach class action. Stay informed on every step of the settlement journey.

In May 2021, a security vulnerability in USAA’s digital infrastructure allowed unauthorized access to user data. While the full list of what was accessed has not been made public, the following data were reported by a corporation:

- Names

- Social Security numbers

- Driver’s license information

- Addresses

- Possibly banking details and contact numbers

While USAA has not admitted fault, the breach led to investigations and a class action lawsuit, culminating in the current USAA data breach settlement.

Who Qualifies for the Settlement?

Do I Qualify?

Answer 3 quick questions to check your eligibility for the USAA data breach settlement.

To qualify for the settlement:

- You must have received direct notification from USAA that your data was exposed in the May 2021 breach.

- You must submit your USAA data breach settlement claim form before the deadline, which was 7th April 2025.

- No proof of damages is required to claim the standard benefit.

How do I know if I qualify for USAA data breach settlement?

If you received a settlement notice from USAA—via mail or email—you likely qualify. Check the letter for your Claim ID and follow the instructions online.

Understanding the USAA Data Breach Settlement Amount

The USAA data breach settlement amount totals $3.25 million. However, this includes:

- Administrative costs

- Attorney fees

- Incentive payments to named plaintiffs

- Actual claimant payouts

Estimate Your Potential Payout

Estimated payout per claimant:

Based on 65% net fund distribution after fees.

Once deductions are made, the amount available for payout is distributed evenly among eligible claimants who file before the deadline.

How much compensation can you get for a data breach?

Average payouts vary, but for USAA, projections estimate between $95 to $140 per valid claim, depending on the total number of submissions.

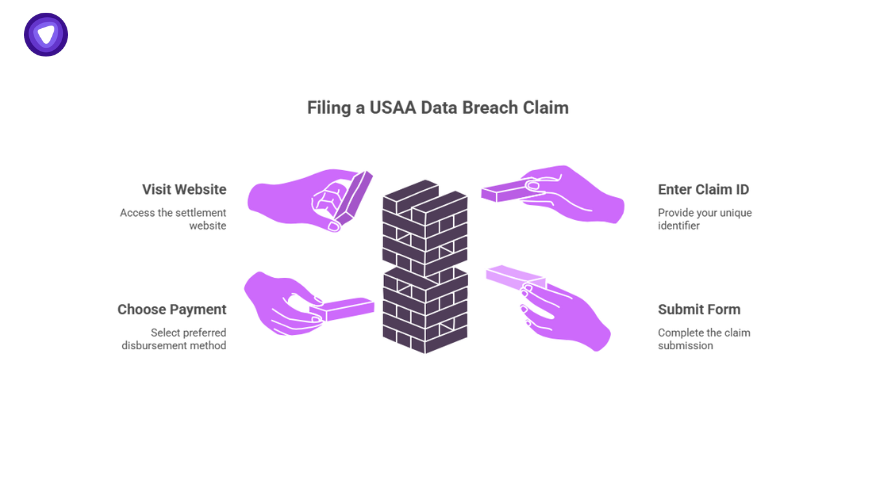

How to File Your Claim (Step-by-Step)

Filing a USAA data breach settlement claim form is straightforward:

- Visit the official settlement website (usually included in the notification email or letter).

- Enter your Claim ID (provided by USAA).

- Choose your payment method: direct deposit, mailed check, PayPal, or Venmo.

- Submit before April 7, 2025.

How do I get my data breach settlement money?

After submitting your claim form with a valid payment method, expect disbursements a few weeks after the court’s final approval, which took place on May 21, 2025.

Key Dates to Remember

| Milestone | Date |

| Data Breach Occurred | May 2021 |

| Claim Deadline | April 7, 2025 |

| Final Court Hearing | May 21, 2025 |

| Expected Payout Window | Summer 2025 |

How to Check the Status of Your Claim?

Auto-Filled Claim Form Link Generator

Paste your Claim ID below to get a direct link to the USAA settlement portal.

Many are asking, “Where’s my money?” or “How do I check the status of my USAA settlement check?”

Here’s how:

- Return to the official claims portal.

- Log in using your Claim ID and email.

- Navigate to “Claim Status” tab.

If your form was accepted and your payment details verified, your claim will show as “Approved.”

USAA data breach settlement check claim info is not mailed unless you choose a check as your payment method.

The Bigger Picture: What Businesses Can Learn from USAA

This wasn’t just a tech failure—it was a trust failure. When businesses, especially those handling sensitive user data, don’t prioritize proactive cybersecurity, the costs ripple beyond settlements. There’s brand erosion, customer churn, and—more damaging—loss of future business.

That’s where things get real for other organizations watching this unfold. If you operate in finance, healthcare, government, or even SaaS, this case should be your wake-up call.

How Secure Are You?

Could You Prevent a Breach Like USAA’s? Answer 5 quick questions.

How PureVPN White Label Can Shield Your Brand?

For ISPs, telecoms, app developers, and fintech firms, protecting user data is more than good practice—it’s a business imperative.

With PureVPN’s White Label VPN solution, you get:

- AES-256 encrypted browsing for end users

- Fully branded VPN apps under your name

- A global network of 7,000+ servers

- Built-in support for GDPR, SOC 2, and ISO 27001 compliance

By embedding a trusted VPN into your infrastructure, you reduce the surface area for data leaks and give users peace of mind. Unlike traditional vendors, PureVPN lets you own the experience—UI, pricing, policies, and all.

In a world where breaches hit headlines faster than ever, security is no longer optional.

What if This Breach Happened to You?

Simulate your potential exposure based on industry, risk, and security posture. Built for CISOs, CTOs, and security teams making real decisions.

What Are People Saying?

USAA data breach settlement Reddit discussions reveal mixed feelings. Some are pleased USAA settled. Others are frustrated by the lack of clarity about payout amounts and communication.

We recommend following official updates—not third-party speculation—through the official settlement portal.

Stay Connected & Learn With Us

Join our growing community and connect with peers who build secure networks and resell privacy tools worldwide.

Final Thoughts: File Now, Secure Later

The USAA data breach is a reminder that even trusted institutions can slip. But what you do next matters. If you’re eligible, file your claim now—don’t wait until the last minute.

And if you’re a business decision-maker? Don’t be the next headline.

Explore PureVPN’s White Label platform and take control of your users’ privacy without building infrastructure from scratch. It’s the fastest, most secure way to add real protection—and new revenue—to your stack.

Need guidance? Connect with us: