Security reviews rarely stop at your own network perimeter anymore. Data now travels through dozens of outside vendors. If even one mishandles it, the damage still lands on your business.

Radius Global Solutions is one of those vendors. Known for handling large-scale accounts receivable and customer service operations, the company touches millions of sensitive consumer records for clients in finance, healthcare, and utilities.

When they experience errors or breaches, businesses that depend on them can inherit the consequences. This article examines Radius Global Solutions from a security perspective. It explains how they operate, the nature of their data risks, and what safeguards businesses need when working with third-party processors. The focus is on helping decision makers reduce vendor-related security exposure.

- Who: Radius Global Solutions — a licensed debt collection firm handling sensitive data for banks, healthcare, and utilities.

- Incident: Impacted by the 2023 MOVEit breach, exposing customer data and highlighting vendor risk.

- Risks: Vendors can become breach entry points if not secured and monitored.

- Best practices: Vet vendor security (SOC 2, breach history), enforce encrypted VPN + MFA, limit shared data, and record all sessions.

- Solution: Use PureVPN’s White-Label VPN to control vendor access, encrypt sessions, and protect sensitive data from breaches.

What Is Radius Global Solutions

Radius Global Solutions is an accounts receivable management and customer contact company. It operates under the registered legal name Radius Global Solutions LLC.

The company provides services such as:

- Debt collection

- Call center support

- Billing follow-ups

- Payment processing assistance

Public data shows an estimated workforce of 500–1000 employees across several U.S. locations. Their main office is in Bloomington, Minnesota.

Who is Radius Global Solutions in practice?

They act as a third-party agent on behalf of creditors and service providers. They are not a lender or credit bureau. They operate under federal oversight, including the Fair Debt Collection Practices Act (FDCPA) and Consumer Financial Protection Bureau (CFPB) regulations.

Their typical clients include banks, hospitals, energy utilities, telecommunications firms, and education service providers. Engaging Radius gives those organizations a way to manage overdue balances at scale without internal teams.

Because Radius handles sensitive personal and financial data, understanding their security posture is essential for any business that sends them customer information.

Who Does Radius Global Solutions Collect For?

Radius Global Solutions collects debts on behalf of other companies. They do not buy debts. They collect payments and manage customer communications for businesses that want to outsource these tasks.

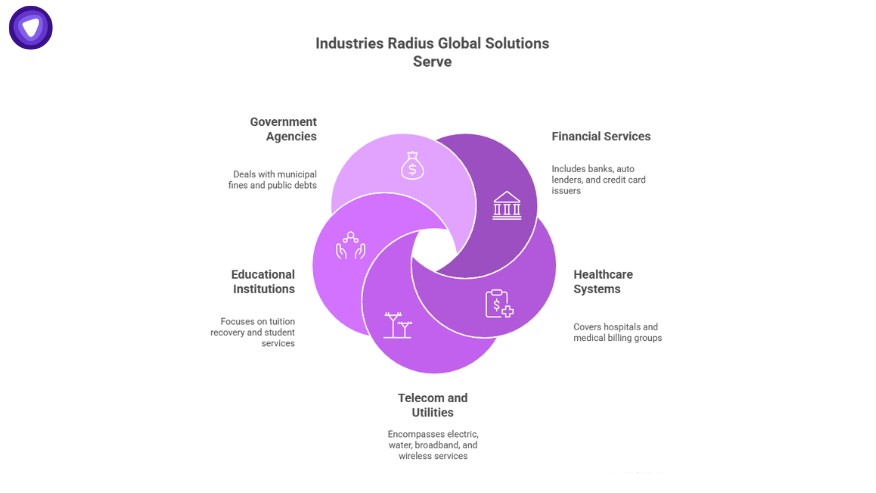

Industries they serve include:

- Financial services (banks, auto lenders, credit card issuers)

- Healthcare systems (hospitals, medical billing groups)

- Telecom and utilities (electric, water, broadband, wireless)

- Educational institutions (tuition recovery, student services)

- Government agencies (municipal fines, public debts)

Clients transmit lists of delinquent accounts that include names, balances, contact details, and Radius Global Solutions reference numbers for tracking. This means Radius temporarily stores and processes personally identifiable information such as:

- Social Security numbers

- Addresses

- Account histories

- Payment records

For B2B teams, the key security implication is that Radius receives full access to sensitive customer datasets during engagements. Any compromise of their systems can create legal, financial, and reputational risk for the businesses that supplied the data.

How to Contact Radius Global Solutions and Make Payments?

Radius Global Solutions provides multiple communication and payment channels for consumers and business clients.

Radius Global Solutions phone number:

(888) 852-1651 — their main customer contact line.

Radius Global Solutions address:

7831 Glenroy Road, Suite 250, Bloomington, MN 55439

Radius Global Solutions payment options:

Payments can be made through their secure web portal. To use it, users must log in with their account details and Radius Global Solutions reference number. This ensures payments are applied to the correct account.

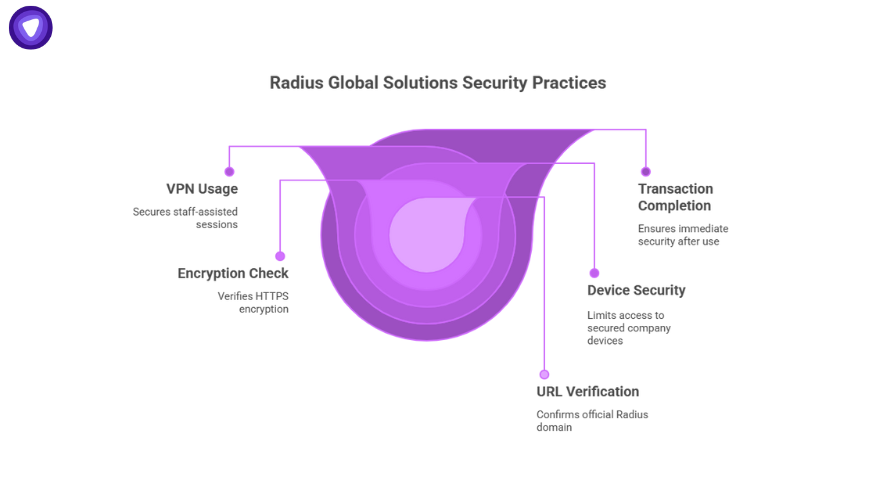

Radius Global Solutions payment login security practices:

- Confirm the URL is the official Radius domain before logging in

- Check for HTTPS encryption in the browser bar

- Access the portal only from secured company devices

- Use company VPN tunnels for all staff-assisted sessions

- Log out and close the browser immediately after completing a transaction

Is Radius Global Solutions Legit

Radius Global Solutions LLC is a legitimate and licensed company. It operates in compliance with U.S. federal and state consumer protection laws.

They are listed on the Better Business Bureau and tracked by the CFPB. Consumer complaints exist, as they do for all large collection firms, but that reflects the nature of debt collection disputes rather than fraud.

Radius Global Solutions is a real entity with registered offices, active contracts, and known leadership.

Data Breach History

Radius was impacted by the 2023 MOVEit data breach, which affected hundreds of organizations. MOVEit is a file transfer platform that was exploited by cybercriminals. Radius used this platform to transmit customer data files.

Exposed data included:

- Names

- Social Security numbers

- Addresses

- Account balances

- Contact information

Radius informed affected individuals and offered credit monitoring, but the incident illustrates how even regulated firms can become breach points.

Radius Global Solutions LLC legit is not in question, but legitimacy does not equal immunity from cyber risk. Businesses remain accountable if their vendors leak entrusted data.

Security Risks for Businesses Working with Debt Collectors

When a business hires a vendor like Radius, it is also outsourcing custody of sensitive customer data. That creates downstream risk.

Typical risks include:

- Transmission of unencrypted personal data during bulk uploads

- Agents handling live customer data without proper endpoint security

- Shared credentials among large contact center teams

- Limited session logging or audit trails

- Inconsistent MFA or identity verification

If a breach occurs on the vendor’s side, your business may still face:

- Data breach disclosure obligations

- Regulatory investigations from the FTC or state authorities

- Class action lawsuits from affected consumers

- Permanent damage to customer trust and brand perception

Debt collection firms are frequent targets because they hold identity data, financial account data, and often operate on older infrastructure. Even if your systems remain uncompromised, their exposure becomes your incident.

For security-conscious organizations, Radius Global Solutions is an example of why vendor security assessments are as important as internal security audits.

How Businesses Can Protect Sensitive Data?

Working with vendors does not have to introduce unacceptable risk if controls are applied consistently. Businesses should treat vendor data connections as part of their core infrastructure and secure them accordingly.

1. Conduct Vendor Security Due Diligence

- Request SOC 2 or equivalent audit reports

- Review breach history and response protocols

- Validate compliance with FDCPA, GDPR, HIPAA, or other relevant regulations

- Confirm endpoint security on their contact center devices

2. Enforce Encrypted Communication

- Require all vendor connections to run through company-managed VPN tunnels

- Use encrypted SFTP or API channels for data transfers

- Require MFA on all vendor accounts accessing internal portals

- Restrict access to company-managed devices only

3. Control Access Scope and Audit Activity

- Grant least-privilege access for vendor systems

- Record all sessions and activity logs

- Rotate vendor credentials regularly

- Use just-in-time access provisioning

4. Segment and Minimize Data Shared

- Share only the minimum data fields required for their work

- Use tokenized or anonymized identifiers instead of full PII where possible

- Revoke vendor data access immediately after engagement ends

By applying these controls, organizations can work with firms like Radius Global Solutions while reducing the blast radius of any potential compromise.

Future of Data Security in the Collections Industry

Debt collection firms are beginning to modernize their security environments. Several trends are reshaping the industry:

- Encrypted-by-default systems: More vendors are adopting encryption at rest and in transit across all systems

- SOC 2 as a baseline requirement: Large enterprise clients increasingly demand SOC 2 compliance before contracting with vendors

- Zero-trust access controls: Session isolation, MFA, and device posture checks are becoming standard requirements

- Automated compliance monitoring: Firms are deploying monitoring systems to detect abnormal data access and insider threats

Businesses that engage with these vendors will need to enforce the same security standards they apply internally. Contracts must include security requirements and consequences for noncompliance. Vendor risk is now part of regulatory scrutiny and brand due diligence.

Strengthen Vendor Security with PureWL’s White-Label VPN Solutions

Radius Global Solutions demonstrates how easily third-party vendors can become security liabilities, even when they operate legitimately. Businesses cannot eliminate vendor risk, but they can control how vendors connect to their systems.

PureVPN’s White-Label VPN platform gives you that control.

With PureVPN, you can:

- Provide secure VPN access for all vendors and remote staff

- Isolate sensitive networks from public exposure

- Enforce MFA, device posture checks, and logging for all vendor sessions

- Offer the VPN as a branded security product under your own name

Embedding a white-label VPN into your infrastructure creates a protected boundary between your data and every external vendor session. It prevents credential theft, session hijacking, and man-in-the-middle interception.

If your business shares sensitive data with external vendors such as Radius Global Solutions, now is the time to build encrypted access into your architecture.

Conclusion

Radius Global Solutions is a legitimate debt collection agency, but its 2023 data breach showed how vendor security gaps can damage the businesses that depend on them. Companies that share sensitive data with third-party vendors need controlled, encrypted access to protect customer information and meet compliance demands.

PureVPN’s White-Label VPN helps achieve this by enforcing secure tunnels, MFA, and device checks for every vendor session, under your own brand.