- VPN services are a growth opportunity for MSPs in 2025 as businesses demand secure, reliable, and privacy-focused remote access solutions.

- WireGuard is reshaping performance and security standards with faster speeds, simplified management, and stronger encryption, making it ideal for MSP-managed VPNs.

- White-label VPN platforms like PureVPN let MSPs offer fully branded, scalable VPN services without heavy infrastructure costs.

- Differentiation and client retention come from offering managed VPNs with custom tiers, dedicated IPs, analytics, and seamless remote access.

- MSPs who embed VPN solutions now position themselves as strategic security partners, turning connectivity into a recurring, high-margin revenue stream.

Most managed service providers (MSPs) are searching for new ways to stand out in this competitive market. One clear opportunity in 2025 is adding VPN services for MSPs to their portfolio.

As clients demand more secure remote access and privacy-focused connectivity, MSPs are finding that offering branded VPN solutions for business not only meets this demand but also opens a steady new revenue stream.

With advancements like WireGuard improving speed and security, VPN services have become easier to deliver and manage, especially through white-label platforms. This shift is transforming how MSPs package, sell, and scale network security, turning VPN access into a core part of managed IT strategy rather than an add-on feature.

What Are MSPs?

Managed Service Providers (MSPs) are companies that remotely manage and support a client’s IT infrastructure and end-user systems. They handle services like network management, cybersecurity, data backup, and cloud operations on a subscription basis, allowing businesses to focus on growth while MSPs ensure reliability, security, and performance behind the scenes.

The Market and Opportunity Landscape

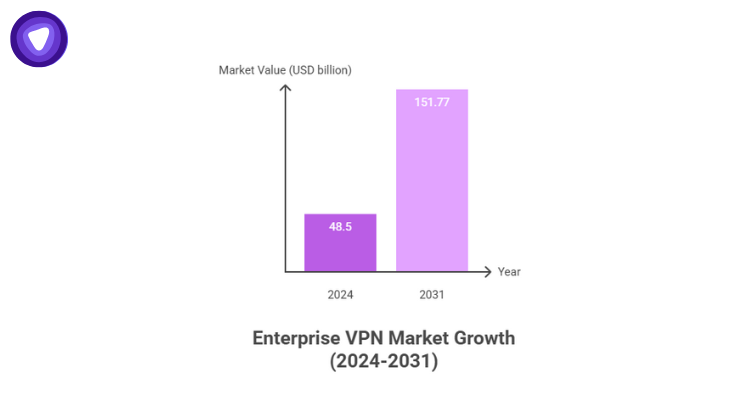

The broader market for corporate VPNs is growing rapidly. According to one forecast, the enterprise VPN market was valued around USD 48.5 billion in 2024 and is projected to reach about USD 151.77 billion by 2031, reflecting a CAGR of ~17.7%.

Another estimate shows the overall VPN market valued at USD 48.02 billion in 2024 and projected to grow to USD 147.43 billion by 2033 (CAGR ~12.6%). And a third source projects the global VPN market at USD 77.8 billion in 2025, growing to USD 481.5 billion by 2035 (CAGR ~20%).

What this means for MSPs: there’s a large and expanding market of organizations looking for VPN solutions for business, and MSPs who embed them can ride that wave.

Key Drivers Pushing Adoption in 2025

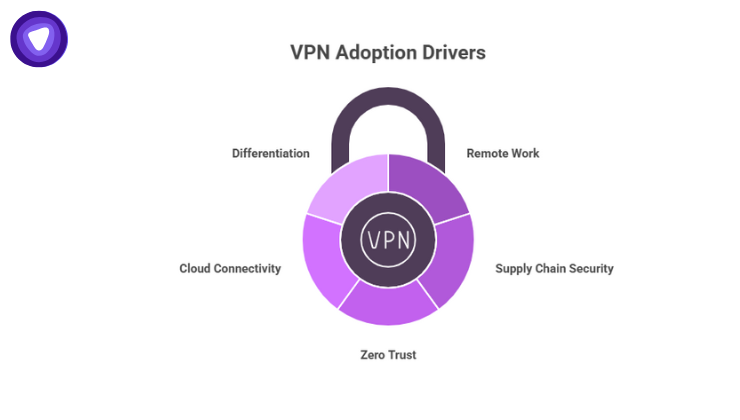

Several factors are forcing this shift:

- Remote/hybrid work means more users and endpoints outside traditional firewalls; VPN access is no longer optional.

- Supply-chain and third-party access: clients want secure connectivity for vendor/contractor/partner access; MSPs can provide turnkey VPN access.

- Zero-trust/least-privilege demands: as companies adopt more granular access models, VPNs remain a foundational element of secure remote access.

- Cloud and multi-site connectivity: VPNs for business are critical to connect branches, cloud services, SaaS systems and remote workers into a cohesive network.

- Opportunity for differentiation: Many MSPs are competing on price and generic services; offering VPN services for MSPs enables them to sell a differentiated stack, often at a higher margin than just break/fix.

Key Considerations for MSPs Offering VPN Services

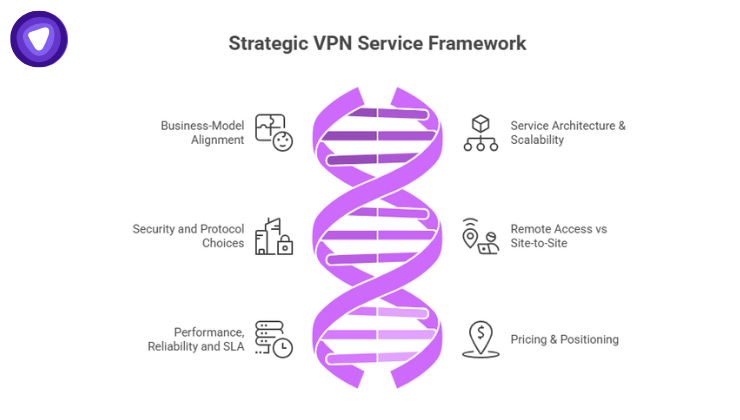

When an MSP decides to embed VPN offerings into their portfolio, there are several strategic and technical considerations to ensure success.

1. Business-model alignment

- Recurring revenue: VPN services for MSPs should be offered as a monthly or annual subscription to align with managed services models.

- Bundling: Package VPN with other services (remote monitoring, endpoint security, backup) to increase value and retention.

- Service tiers: Offer multiple tiers (basic remote access, dedicated servers, site-to-site connectivity, global access) to cater to different client needs and budgets.

- Branding/white-labeling: Choose a solution that allows the MSP to brand the VPN service as their own offering (important for trust and client retention).

2. Service architecture & scalability

- Multi-tenant architecture: The system must support multiple clients securely with proper isolation.

- Dedicated resources vs shared: Some clients will want dedicated IPs or dedicated servers for compliance or performance needs.

- Global server access: For clients with remote sites or a global workforce, the VPN network should have global coverage.

- Performance: VPN solutions for business must avoid degrading user experience; latency, throughput and reliability matter.

3. Security and protocol choices

- Protocol support: Modern protocols like WireGuard are gaining traction for their performance and security benefits.

- For example, WireGuard’s streamlined codebase (≈4,000 lines) and modern cryptography make it easier to audit and manage.

- It supports fast connections, low latency, and is well suited for businesses that value speed and efficiency.

- For example, WireGuard’s streamlined codebase (≈4,000 lines) and modern cryptography make it easier to audit and manage.

- Strong encryption, frequent key rotation, and trusted handshake mechanisms are non-negotiables.

- Access controls & user management: Role-based access, multi-factor authentication (MFA), session monitoring must be built in.

- Compliance readiness: Even if you’re not positioning for compliance as primary, the VPN must meet enterprise standards (encryption, auditing, logging).

- Reporting/analytics: MSP clients will expect dashboards showing usage, performance, security incidents.

4. Remote access vs site-to-site

There are different use cases within VPN services for MSPs:

| Use case | Description | MSP opportunities |

| Remote access VPN (client-to-site) | Individual devices connect securely to the corporate network | Great for remote/hybrid workers; upsell thin-client and secure access bundles |

| Site-to-site VPN | Branch offices or partner locations connect to headquarters or data centres | Valuable for clients with multiple locations; MSP can manage both ends of the link |

| Client access for third parties | Vendor, partner, contractor access via VPN | MSP can segment access, enforce least-privilege, sell as “contractor access service” |

| Global workforce/roaming access | Employees connect from anywhere globally | Premium offering: managed global endpoints, dedicated IPs, performance SLAs |

5. Performance, reliability and SLA

MSPs must control the user experience:

- Choose VPN infrastructure that allows for high-availability (HA), redundant servers, load-balancing.

- Latency and throughput matter, if the VPN slows down remote workers, churn risk increases.

- Offer service-level agreements (SLAs) on uptime, support response times, and remedial actions.

- Monitor and report on quality of service metrics (connection latency, drop-outs, throughput trends).

6. Pricing & positioning

- Cost structure: Understand the underlying costs (bandwidth, server infrastructure, global peering, license fees) so you can price profitably.

- Value proposition: Emphasize security, ease of use, managed support and branding over simply “we offer VPN.”

- Modular pricing: Offer add-ons (dedicated IP, dedicated server, global access, advanced protocol support) to upsell.

- Renewal management: As with any MSP recurring service, ensure contract renewal processes, account management and client value-metrics are in place.

Why 2025 is a Tipping Point for MSP VPN Services

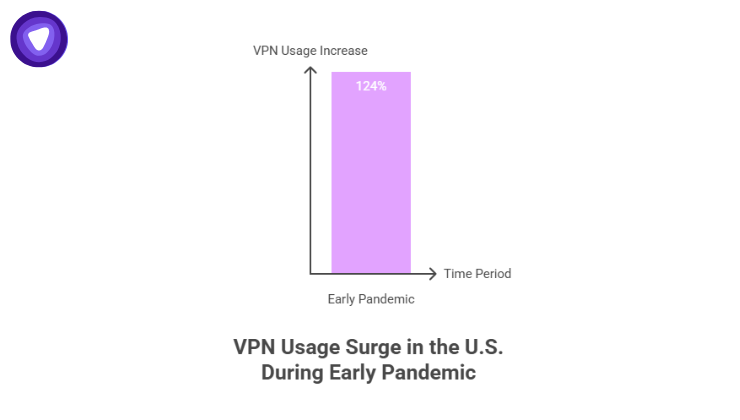

By 2025, remote and hybrid working models are entrenched; VPN access has shifted from “temporary workaround” to core business infrastructure. With more devices and distributed users, there is greater demand for secure connections.

The data supports this: for example, research shows VPN usage surged over 124% in the U.S. during early pandemic phases. This means MSPs offering VPN services for MSPs now are hitting a mature market rather than early adoption.

Protocol advances (e.g., WireGuard)

The rise of modern protocols like WireGuard is lowering barriers: faster performance, easier configuration, lower overhead. These benefits make VPN solutions for business more compelling. WireGuard’s streamlined codebase, simplicity and performance are resonating in enterprise environments.

For MSPs, this means the underlying technology is becoming more manageable, performant and cost-efficient, making the business model more attractive.

Competitive differentiation

Many MSPs offer standard managed services but lack specialized offerings. By embedding a branded VPN service, they can differentiate in crowded markets. Clients increasingly expect “security-by-default” from their MSPs.

The MSP that offers seamless, secure remote connectivity as part of its suite strengthens its stickiness and strategic value to clients.

Rising global VPN market valuation

As shown in the market data above, the business demand for VPN solutions is scaling. Higher volumes mean better economies of scale for MSPs who can roll-out at scale across their client base and shared infrastructure, while still offering differentiated options (dedicated IPs, premium protocols, custom branding).

Shift in purchase-decision dynamics

Historically, corporate VPN deployments may have been driven by network architects or IT teams. Now, C-suite executives and business owners demand secure remote operations as part of digital strategy. MSPs that can articulate how VPN services for MSPs support business continuity, risk mitigation and operational agility will win.

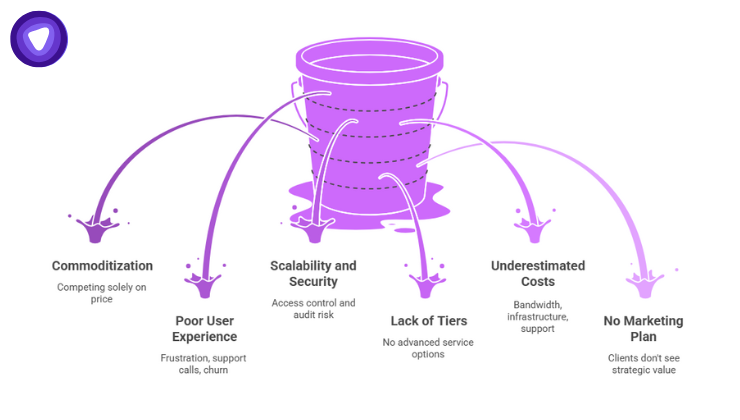

Common Mistakes MSPs Should Avoid When Launching VPN Services

These are the main mistakes that MSPs should be careful about:

- Treating VPN as a commodity: If you simply “add VPN” with no branding, management dashboard, service packaging or support differentiation, you’ll compete solely on price and get squeezed.

- Neglecting user experience: A clunky, hard-to-deploy, slow VPN will cause client frustration, increased support calls and churn. Performance matters.

- Ignoring scalability and security operations: Rolling out VPN access without proper access controls, audit logs, segmentation, and monitoring creates risk for both you and your clients.

- Failing to offer tiers or advanced options: Not every client needs the highest level of service. Offer baseline services plus premium add-ons (global access, dedicated resources, advanced protocols).

- Underestimating support and infrastructure costs: VPN services for MSPs come with bandwidth, server infrastructure and support costs. If you under-price or don’t monitor usage, profitability will suffer.

- Launching without a marketing/brand plan: Clients should perceive your VPN offering as strategic, highlight how it helps them meet business risks, remote access needs, and continuity goals. Don’t just say “we have VPN”.

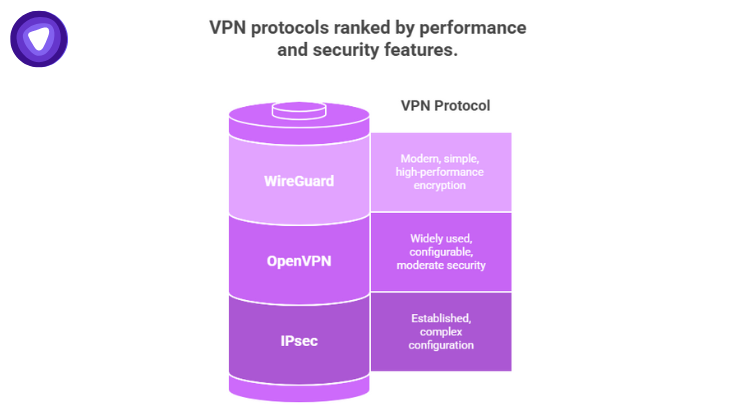

The Role of WireGuard and Modern Protocols

Modern protocol choices are not just “nice to have”, they are fast becoming a competitive differentiator. Here’s how:

- Performance & simplicity: As documented, WireGuard offers faster connections, lower latency and simpler configuration compared to legacy protocols like IPsec and OpenVPN.

- Security posture: WireGuard uses modern cryptographic primitives (ChaCha20, Poly1305, Curve25519) and has a smaller codebase which reduces attack surface.

- Ease of deployment: For MSPs serving multiple clients, the simpler setup and management of WireGuard translates into lower operational overhead.

- Business appeal: When pitching “VPN solutions for business”, you gain credibility by citing modern protocol support; many clients will ask “which protocol, how fast, how secure?”

- Future-proofing: As remote work, IoT, multi-cloud and edge computing expand, protocol efficiency and scalability matter more. WireGuard supports that direction.

By embedding support for WireGuard (alongside other relevant protocols) into your VPN services for MSPs offering, you make your proposition stronger and more future-oriented.

Comparing VPN Offering Elements for MSPs

See how a well-structured VPN offering can transform your MSP business, from a basic service to a premium, revenue-generating solution.

| Element | Minimum Offering | Premium Value Offering |

| Branding | MSP logo on client apps, standard server network | Fully white-label portal, custom domain, client portal with your brand |

| Access & Scope | Remote access for users only | Remote + site-to-site + global roaming + dedicated IP |

| Protocol support | Standard protocols (IPsec, OpenVPN) | Modern protocol (WireGuard), optimized for high performance |

| Infrastructure | Shared server pool | Dedicated servers or dedicated IP per client, SLA backing |

| Management & Reporting | Basic usage dashboard | Full analytics, latency reporting, security logs, integration with MSP portal |

| Pricing model | Single flat fee per user | Tiered pricing (basic, standard, premium), add-ons (e.g., global access, dedicated IP) |

| Upsell/Value-add | Client uses access only | Bundle with endpoint security, identity management, managed firewall, zero-trust access |

Why PureVPN White Label Solution Makes Sense for MSPs

The PureVPN White Label Solution gives MSPs a ready-made, enterprise-grade VPN platform they can brand as their own. It manages the heavy lifting, from global infrastructure and multi-tenant control to performance optimization, while supporting advanced protocols like WireGuard for secure, high-speed connectivity.

By partnering with PureVPN, MSPs can quickly launch and scale their own VPN services for businesses without the cost or complexity of building a network from scratch. This allows providers to focus on client relationships, packaging, and support while offering a trusted, revenue-generating VPN service backed by PureVPN’s 6500+ servers across 70+ locations.

Final Thoughts

The rise of VPN services for MSPs marks a strategic shift from basic IT support to secure connectivity leadership. As demand for VPN solutions for business grows in 2025, MSPs that integrate modern protocols like WireGuard, scalable infrastructure, and branded service tiers can boost revenue, strengthen client trust, and position themselves for long-term growth.