Cybersecurity has become a board-level priority in 2025 as AI-driven attacks, ransomware-as-a-service, and strict data regulations reshape risk models. Spending reflects the shift: the market is projected to grow from $227.59 billion in 2025 to $351.92 billion by 2030 at 9.1 % CAGR , with some forecasts reaching $500 billion–$878 billion by the early 2030s . Cybercrime costs are expected to hit $10.5 trillion annually by 2025 , pushing enterprises to adopt zero trust, identity-centric networking, and quantum-safe encryption.

According to PureVPN partners, bundling identity-aware VPN with endpoint posture checks has cut remote credential abuse by ~40 %, and security add-ons have driven 6–9 % ARPU uplift for service providers. This report examines the latest cybersecurity market growth figures and the technical trends shaping budgets and architectures through 2025 and beyond.

- Baseline 2025 → 2030 projection: $227.59B → $351.92B at 9.1% CAGR.

- High-growth scenarios point to $500B–$878B by 2030–2034 at ~12%–13% CAGR.

- Alternate 2025 → 2032 model: $218.98B → $562.77B at 14.4% CAGR.

- Cybercrime costs on track for $10.5T annually by 2025; FBI logged >$16B in 2024 losses despite under-reporting.

- Ransomware: average recovery or payment figures cluster around ~$2.73M per incident in 2024; 2025 shows mixed movement by study and region.

- Deepfakes: projected growth from ~500k assets in 2023 to ~8M in 2025.

According to PureVPN partners (internal 2025 pulse)

- Telco + SaaS bundles that include VPN are seeing conversion uplifts of 8–12% for new plans with security add-ons.

- Churn reduction of 2–4 percentage points is reported when VPN is bundled with identity or DLP controls for remote teams.

- ARPU uplift of 6–9% is reported where dedicated IP and geo-routing options are packaged for B2B remote access.

The 2025 Market Sizing Picture

Multiple reputable models now bracket a realistic range for cybersecurity market growth:

| Model | Baseline Year | 2030–2035 Target | CAGR | Notes |

| MarketsandMarkets | 2025: $227.59B | 2030: $351.92B | 9.1% | Frequently quoted enterprise baseline. |

| Fortune Business Insights | 2025: $218.98B | 2032: $562.77B | 14.4% | Higher growth tail with AI-security spend. |

| Grand View / Research Insights cluster | 2024–2025: $245.62B–$272.62B | 2030: $500.70B | ~12.9% | Reinforces $500B landmark by 2030. |

| Precedence Research | 2025: $301.91B | 2034: $878.48B | 12.6% | Upper-bound, services-heavy mix. |

Methodological choices differ on: component mix weighting, SMB capture, and services inflation. Yet all credible models converge on double-digit growth through the early-to-mid 2030s.

Cost gravity that drives spend

- Cybercrime: long-standing benchmark projects $10.5T annual impact in 2025; 2024 FBI filings confirm >$16B in recorded losses despite obvious undercounting.

- Breach costs: IBM’s 2025 study shows global average = $4.44M; U.S. average = $10.22M. AI security reduced breach lifecycles by ~80 days for adopters and saved ~$1.9M on average.

- Ransomware economics: 2024–2025 reporting centers on $2.73M for either recovery or payment averages, with 2025 recovery costs down to $1.53M in one large survey.

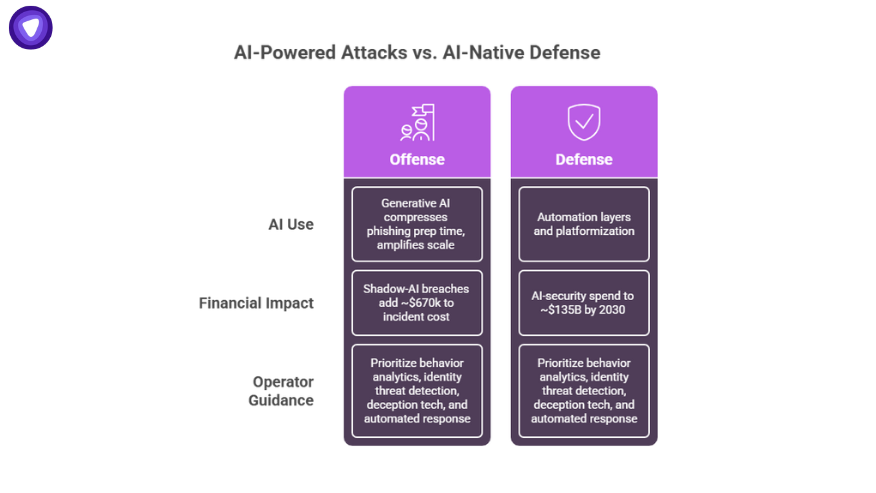

Trend 1 – AI-powered attacks and AI-native defense

- Offense: attacker use of generative AI and agents is compressing phishing prep time to minutes and amplifying scale; IBM notes shadow-AI breaches add ~$670k to incident cost.

- Defense: vendors and enterprises push automation layers and platformization; Morgan Stanley estimates AI-security spend from $15B (2021) to ~$135B by 2030.

- Operator guidance: prioritize behavior analytics, identity threat detection, deception tech, and automated response.

According to PureVPN partners: B2B customers who added behavior-analytics on top of VPN reported ~22% faster incident triage times in Q2–Q3 2025, measured from alert to containment.

Trend 2 – Deepfakes: executive impersonation and payments fraud

- Multiple sources project ~8M deepfakes in 2025, up from ~500k in 2023, with rapid growth in voice cloning used for fraud.

- Practical controls: verified call-back, multi-channel confirmation for payment approvals, liveness-checked IDV, voiceprint risk scoring.

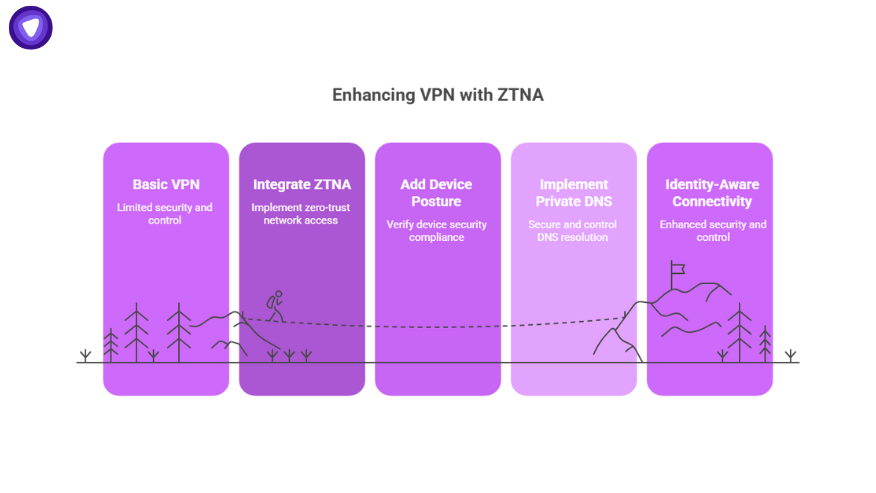

Trend 3 – Zero Trust becomes the default operating posture

- Adoption momentum: surveys indicate 43% already adopted, 46% in transition, and only ~11% with no program; other 2025 datasets place full/partial adoption near ~81%.

- Access mechanics still lag: only ~33% report just-in-time access and ~26% enforce least privilege with approvals, which leaves room for credential misuse.

- ZTNA is now the common entry for SSE programs; 46% cite ZTNA as the starting point for 2025 deployments.

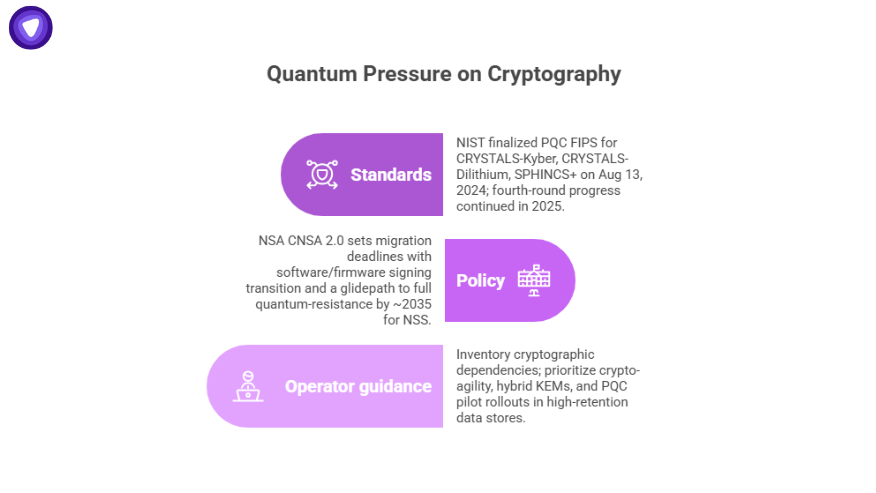

Trend 4 – Quantum pressure on cryptography and roadmaps

- Standards: NIST finalized PQC FIPS for CRYSTALS-Kyber, CRYSTALS-Dilithium, SPHINCS+ on Aug 13, 2024; fourth-round progress continued in 2025

- Policy: NSA CNSA 2.0 sets migration deadlines with software/firmware signing transition and a glidepath to full quantum-resistance by ~2035 for NSS.

- Operator guidance: inventory cryptographic dependencies; prioritize crypto-agility, hybrid KEMs, and PQC pilot rollouts in high-retention data stores.

Trend 5 – Ransomware-as-a-Service: scaling access and monetization

- Average recovery and payment figures center on ~$2.73M per event in 2024; 2025 shows mixed signals by sector, with median payments near $1.0–$2.0M and a shift to exfiltration-only extortion.

- Controls that change outcomes: immutable backups, MFA on backup consoles, outbound egress controls, staged IR playbooks, claims-ready logging.

According to PureVPN partners: forcing all remote admin access through dedicated IP + device posture reduced successful credential-stuffing on RDP and admin panels by ~40% over two quarters.

Trend 6 – 5G and edge: identity and workload isolation at the perimeter-less edge

- Enterprises process ~75% of data at the edge by 2025; risk shifts to workload identity, API integrity, and local break-glass access.

- Security communities flag rising edge exposure across IoT and ICS; analyst primers and threat roundups warn of edge node disruption impacts to critical services.

Trend 7 – Insider risk in hybrid work

- 2025 data-security studies show insider-driven loss remains prevalent, with many organizations reassessing legacy DLP in favor of behavior-centric controls.

- Practitioner reports place annual insider-risk cost near the tens of millions for large enterprises, with credential theft a prime driver.

What This Means for VPN and White-Label Providers?

Identity-aware connectivity is now table stakes for regulated teams and distributed workforces. Pairing white-label VPN with ZTNA, device posture, and private DNS addresses real cost centers:

- Breach cost delta: AI-assisted detection shortened lifecycles by ~80 days and saved ~$1.9M on average in IBM’s 2025 cohort, which provides a business case for automating controls at the access layer.

- SSE ramp: with ZTNA as the entry for nearly half of new SSE programs, packaging VPN with policy-based access and app segmentation maps to current buying centers.

According to PureVPN partners: dedicated IP for back-office systems cut false-positive geo-fraud flags by ~30%, improving payment authorization rates in cross-border flows for SMB SaaS.

Technical Recommendations For 2025 Buyers

| Objective | What to implement | Why it matters |

| Reduce breach blast radius | Micro-segmentation + identity-bound tunnels | Contain lateral movement and token replay in hybrid estates. |

| Prepare for PQC | Crypto-agility inventory + pilot Kyber/Dilithium | Long-retention records require pre-emptive PQC adoption. |

| Counter RaaS | Immutable backups, EDR + deception, egress rules | Lowers exfiltration leverage and restores cleanly. |

| Secure edge | Device posture at edge, signed workloads, private DNS | Limits rogue nodes and API abuse at 5G/edge. |

| Tame insider risk | Context-aware DLP + UEBA | Catches intent, not only content patterns. |

Conclusion

The 2025 data is clear. Cybersecurity market growth is sustained by measurable cost gravity, credible adoption signals in Zero Trust and SSE, and architectural shifts at edge and identity layers. Buyers that standardize on identity-aware networking, crypto-agility, and automated response will lower both incident frequency and loss magnitude while aligning with regulatory expectations. For MSPs, telcos, and SaaS platforms, a white-label VPN that integrates policy-based access, device posture, and private routing is a direct route to new revenue and stickier accounts.

Sources

- MarketsandMarkets: 2025–2030 projection. PR Newswire+2MarketsandMarkets+2

- Fortune Business Insights: 2025–2032 projection. Fortune Business Insights+1

- Grand View / FinanceWire: 2030 at ~$500.7B; 12.9% CAGR. Grand View Research+2Yahoo Finance+2

- Precedence Research: 2025–2034 to ~$878.5B; 12.6% CAGR. Precedence Research+1

- Cybercrime macro cost: Cybersecurity Ventures; FBI IC3 2024 losses. cybersecurityventures.com+1

- Ransomware cost and payments: Spacelift, N2WS, Halcyon, Sophos 2025. SOPHOS+3Spacelift+3N2W Software+3

- Deepfakes: European Parliament brief; WEF note; sector roundups. DeepStrike+3European Parliament+3World Economic Forum+3

- Zero Trust adoption: Expert Insights; StrongDM; Tailscale; Astute Analytica. GlobeNewswire+3Expert Insights+3StrongDM+3

- PQC: NIST FIPS 203/204/205; NSA CNSA 2.0 timelines. U.S. Department of War+3NIST+3NIST Computer Security Resource Center+3

- Edge/5G security: Gartner edge data share via Otava; SentinelOne primer; peer-review on edge privacy risk. OTAVA+2SentinelOne+2

- Breach cost details and AI impact: IBM 2025 report briefings and secondary coverage. All Covered+3IBM+3IBM+3