Telecom operators face a persistent dilemma: revenues per subscriber grow slowly, while network and support costs rise steadily. To maintain profitability, operators and service providers need strategies that add revenue without inflating infrastructure spending. This is where white label telecom comes into play.

By offering telecom and digital services under their own brand without investing in costly infrastructure, businesses gain new revenue streams, improve contribution margins, and reduce churn. For telcos, MSPs, and entrepreneurs, white label programs are a low-capex entry point into new services that directly support ARPU growth.

- White label telecom: Sell telecom services under your own brand without investing in infrastructure.

- Models: VoIP, UCaaS, and MVNO offer low-capex revenue paths.

- ARPU growth: Driven by bundling high-margin add-ons like VPNs and password managers.

- Challenges: Complaints usually come from poor branding control, weak SLAs, or billing disputes.

- Profitability tools: ARPU and CMPU calculators guide margin strategy.

- PureVPN – White Label: Boosts ARPU by letting telcos and MSPs bundle secure digital services.

What Is White Label Telecom?

White label telecom refers to telecom services sold under a third party’s infrastructure but branded entirely by the reseller. Instead of building costly networks, resellers focus on customer acquisition and brand positioning.

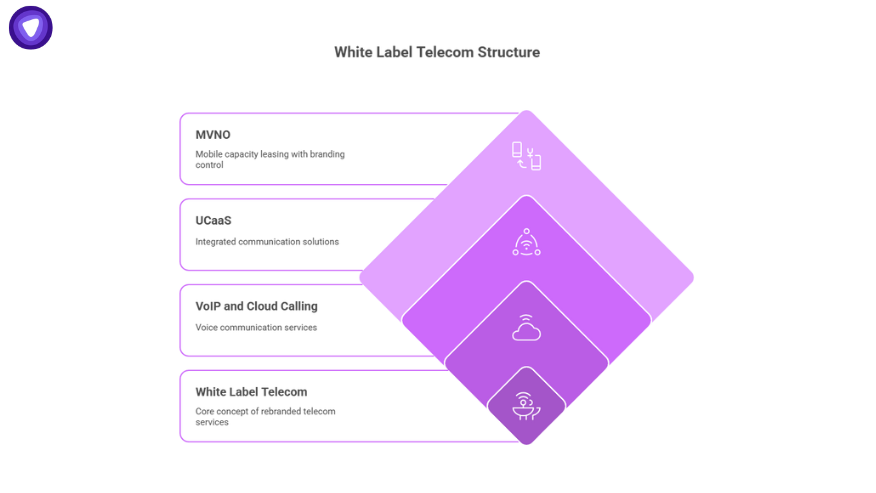

In practice, this spans several models:

- VoIP and cloud calling services

- Unified Communications as a Service (UCaaS), including messaging, conferencing, and collaboration

- Mobile Virtual Network Operator (MVNO) models where partners lease mobile capacity but control branding and billing

This distinction explains what does being a white label mean in telecom: owning the customer relationship while outsourcing the underlying network.

ARPU Calculator

ARPU Calculator

Advanced: Edit VPN add-on uplift

The ARPU Pressure – Why Operators Look to White Label

Global telecom ARPU growth remains under pressure. Data consumption rises, but price per gigabyte falls. Margins thin further due to infrastructure upgrades for 5G and fiber rollouts.

White label telecom offers a release valve. Instead of chasing higher data prices, operators can use white label asset management strategies to bundle digital services that cost little to deliver but add measurable ARPU.

This is why many white label telecom reviews highlight both opportunity and frustration. Partners who fail to align services with ARPU strategy face complaints about thin margins. In contrast, those who combine core connectivity with digital add-ons show better retention and profitability.

Core Models of White Label Telecom

White label telecom spans several operational models. Each has its own capex profile, ARPU potential, and use cases.

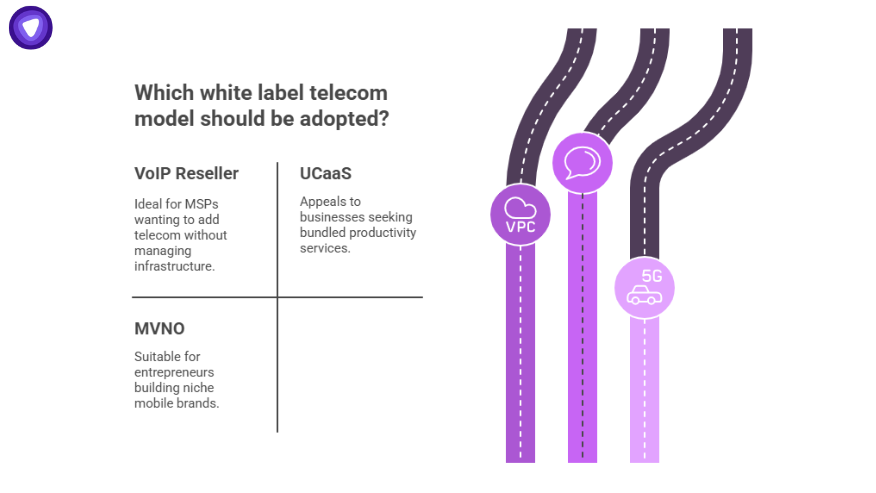

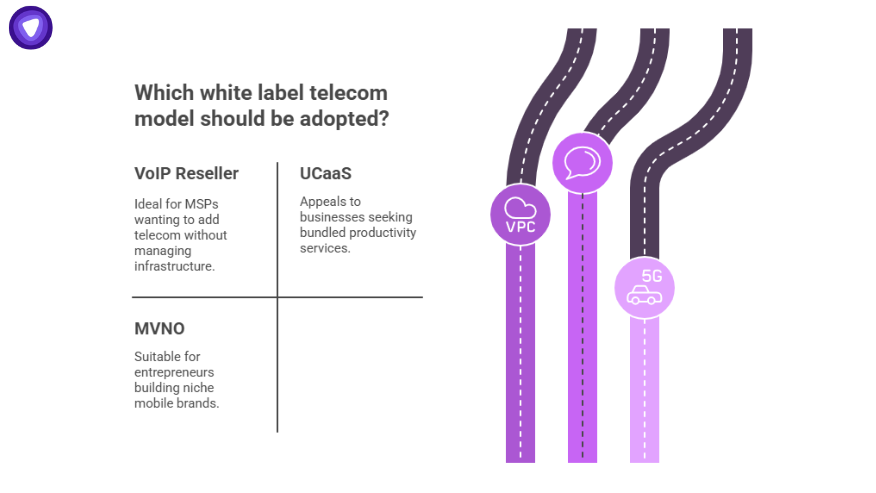

1. White Label VoIP Reseller Programs

Partners sell VoIP bundles cloud PBX, SIP trunks, and conferencing under their own brand. Ideal for MSPs seeking to add telecom without managing a switch.

2. White Label UCaaS

Unified communications platforms let resellers offer voice, messaging, video meetings, and collaboration tools under one brand. These white label UCaaS programs appeal to businesses looking for bundled productivity services.

3. White Label MVNO

MVNOs lease mobile network capacity but bill, support, and brand under their own name. These programs are common in regions where entrepreneurs build niche mobile brands.

Table: CAPEX vs OPEX in White Label Models

| Model | CAPEX | OPEX | Typical ARPU Impact |

| VoIP Reseller | Minimal | Support + billing | Moderate, with add-ons |

| UCaaS | Low | Licensing + integrations | Higher, due to bundled tools |

| MVNO | Medium | Wholesale network fees | High, but margin depends on scale |

What Businesses Look for in Providers?

Operators and resellers evaluate white label telecom providers based on several key factors:

- Branding control: From white label telecom login pages to branded portals and custom domains, vendors must allow full rebranding.

- Automation and billing: Support for multi-client billing, invoicing, and usage-based accounting.

- APIs and integrations: Open APIs for CRM, helpdesk, and OSS/BSS systems.

- SLAs and compliance: Strong guarantees on uptime, 911/E911 compliance, and lawful intercept.

- Transparency in reviews: Many businesses rely on white label communications reviews to assess reliability and support.

Low-Capex, High-ARPU Strategy

The most sustainable growth comes from pairing telecom services with high-margin add-ons. For example:

- Bundling VoIP with a VPN or UCaaS with secure password management.

- Using CMPU (Contribution Margin Per User) to calculate profitability:

CMPU = (ARPU × Gross Margin %) – Support Cost Per User

This formula highlights how telecom ARPU growth 2025 depends less on raw pricing and more on services with minimal delivery costs.

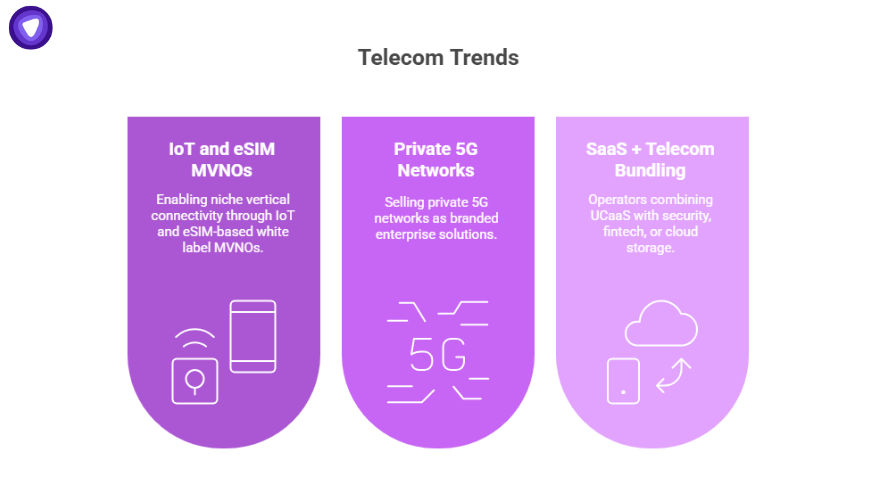

Emerging Trends in White Label Telecom

Looking ahead to telecom trends, several shifts stand out:

- IoT and eSIM-based white label MVNOs enabling niche vertical connectivity.

- Private 5G networks sold as branded enterprise solutions.

- SaaS + Telecom bundling, where operators combine UCaaS with security, fintech, or cloud storage.

This bundling trend explains why industry analysts predict steady global telecom market size expansion despite flat traditional ARPU.

Common Pitfalls and Complaints

Even with potential, pitfalls remain. The most common white label telecom complaints include:

- Vendors exposing their brand in URLs or support links.

- Hidden fees in billing and poor margin transparency.

- SLA breaches without strong remedies.

- Insufficient compliance documentation for enterprise clients.

To avoid these, resellers need a clear procurement checklist: SLA review, compliance validation, and sandbox testing before onboarding clients.

Practical Use Cases & Vertical Playbooks

Here are examples where white label telecom improves retention and ARPU:

- MSPs – Add VoIP, VPN, and password management for SMB clients.

- Regional ISPs – Resell UCaaS with cloud storage for local businesses.

- Entrepreneurs – Launch micro-MVNOs targeting IoT, student, or migrant communities.

Each scenario demonstrates how bundling reduces churn while maximizing profitability.

Conclusion

White label telecom is no longer just a reseller play. It is a strategic way to counter stagnant ARPU, reduce churn, and add value through bundled digital services. By focusing on branding control, reliable providers, and margin-based growth metrics, businesses can transform telecom from a cost-heavy model into a high-return channel.

PureVPN White Label helps operators take this step without additional infrastructure. With branded VPN apps, password managers, and APIs, telecom resellers gain secure services to boost ARPU and strengthen client retention.