In the digital age, scammers are constantly finding new ways to prey on unsuspecting users of popular payment apps like Cash App. From fake giveaways to investment schemes, these scammers can be sly and convincing.

The United States Federal Reserve claims that there were 2.8 million fraud reports nationwide in 2021, with losses increasing by 70% annually to $5.8 billion.

But fear not! In this eye-opening guide, we’ll uncover the common types of Cash App scams, reveal the red flags to watch out for and equip you with the knowledge to safeguard yourself against these cunning fraudsters.

Get ready to outsmart those swindlers! With this guide, you can uncover the secrets to reporting scams and keeping your hard-earned cash safe. Let’s dive in and show that scammer who is really in charge!”

Cash App security: Unraveling the mystery of whether it’s a safe bet or a scam set!

Just like any other online payment platform, Cash App has its safety measures in place, including industry-standard encryption technology that shields your data, financial transactions, and personal information.

On top of that, Cash App offers customizable security settings, such as fingerprint or Face ID recognition and PIN code options, to provide additional layers of protection for your account. These security features act like trusted bodyguards, keeping your transactions and personal data safe from prying eyes.

But, hold on to your hat! Despite these security measures, Cash App is vulnerable to scammers and fraudsters. These tricksters may try to deceive you into divulging your account information or send fake money requests, among other fraudulent activities.

That’s why you must exercise caution, and follow best practices to safeguard yourself against potential scams. But first, you need to know how to spot these scams.

14 Common Cash App Scams to look out for

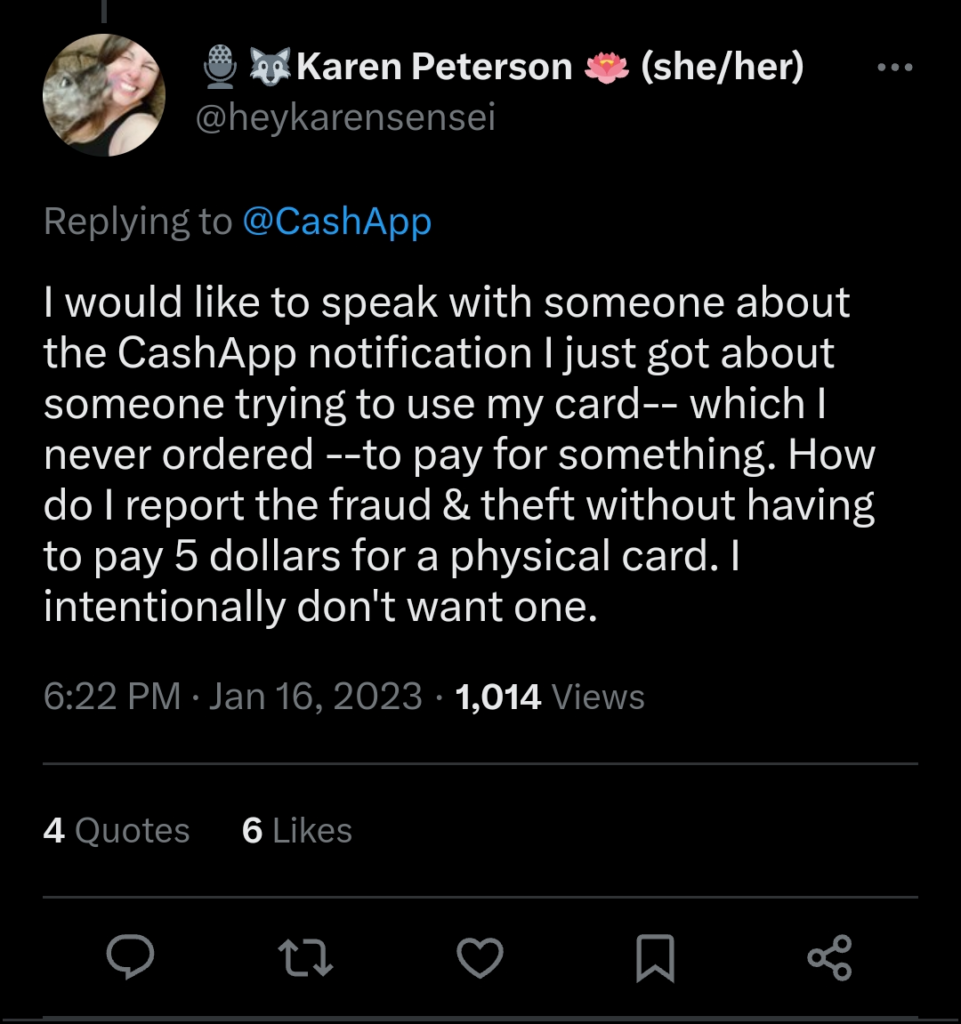

- Fake security alerts

In this crafty scam, scammers send you a deceptive security alert, alleging that your Cash App account has been compromised in a data breach. They’ll cleverly include a link to a fraudulent website that tricks you into changing your Cash App login credentials.

Once you get hooked, these cunning criminals will exploit any account information you provide them to drain your hard-earned money from your Cash App account.

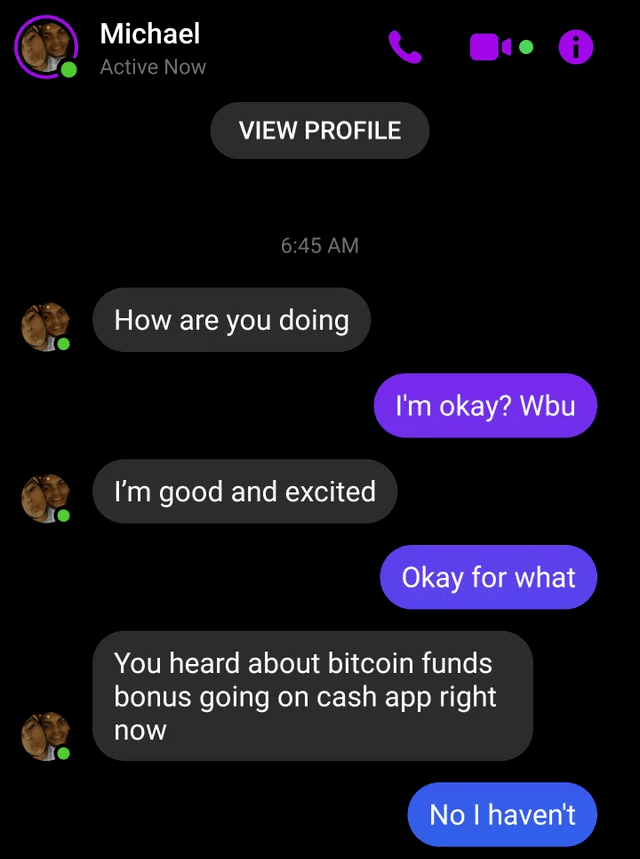

Here’s what it looks like:

Source: Twitter

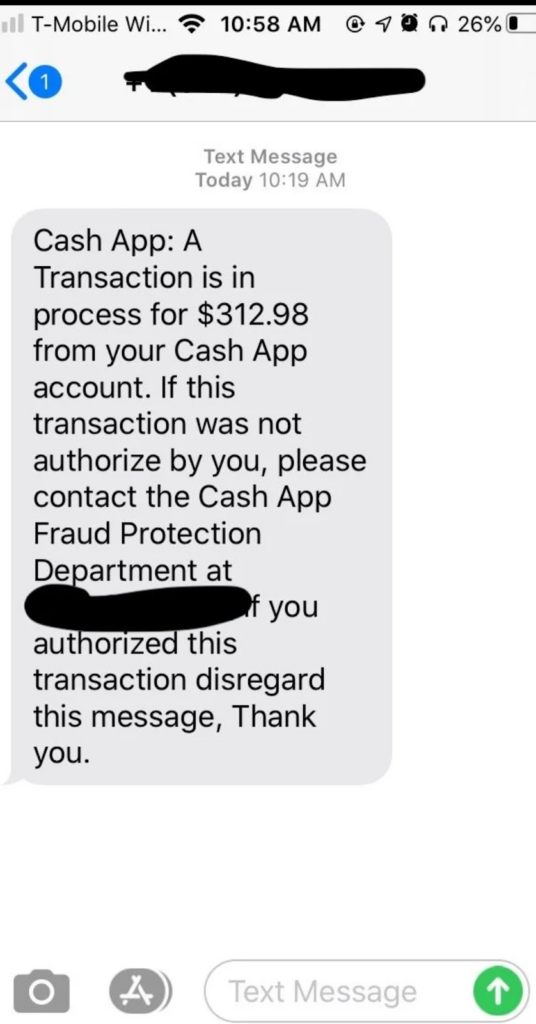

- Phishing scams

Scammers may send fake emails, texts, or messages that appear to be from Cash App, asking users to provide their personal information, account details, or verification codes.

Pro tip:

A non-secure domain (one that uses “HTTP” rather than “HTTPS”), will have grammatical and spelling problems, an odd layout, or an unregistered domain name. So, always check before clicking on any link.

Here’s what it looks like:

- Cash App scams on Coronavirus

Since the COVID-19 pandemic, contactless payment solutions like Cash App have gained popularity. However, this surge in usage has also attracted scammers. Shockingly, the Federal Trade Commission (FTC) has received a staggering 750,000+ complaints related to Coronavirus scams.

Among these Covid scams, one prevalent tactic involves fake grants and relief programs. Scammers create fraudulent websites or send phishing emails that promise support, but with a catch – you have to pay a “fee” via Cash App to avail of the service.

Here’s what it might look like:

- “Accidental” payment on Cash App

This sneaky plan involves scammers fraudulently depositing money into your Cash App account under the pretense of an “accident” or as part of a deliberate scheme to win your trust through social engineering.

They might use the deposit as a ruse to get you talking, which could lead to more scams. Or they could insist that it was a mistake and ask to have their money returned that they probably funded with stolen credit cards.

Here’s how this scam works:

- Cryptocurrency frauds

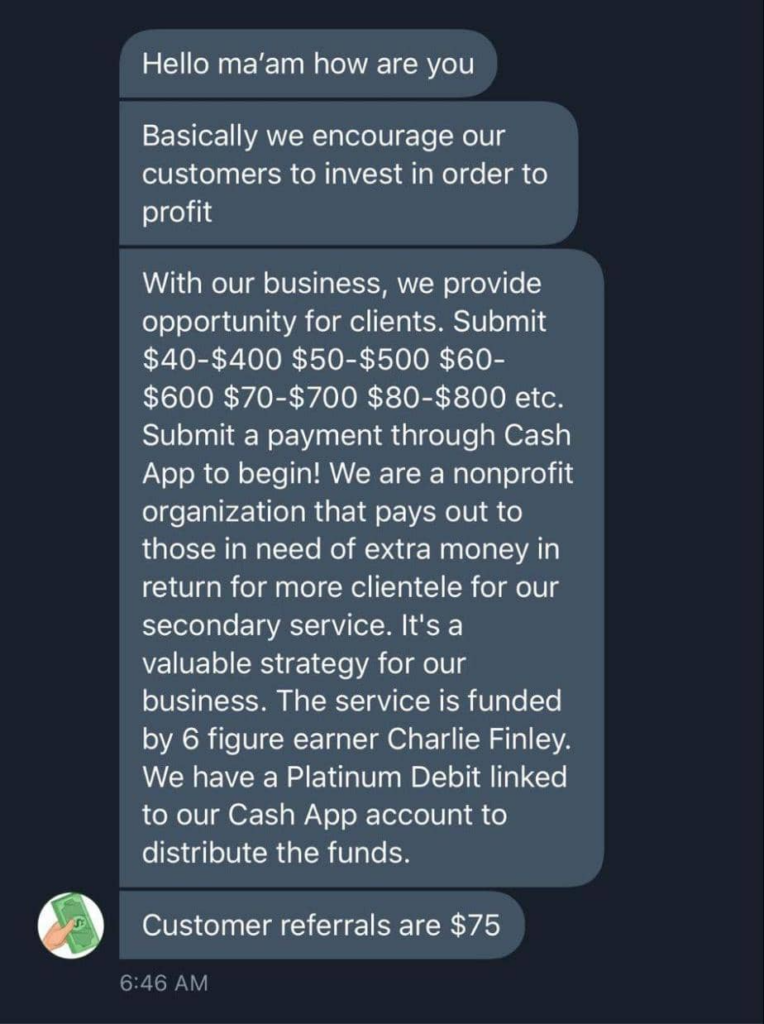

To scam you, con artists might promise high returns on investments using cryptocurrency, convincing users to send money using Cash App, but then disappear without delivering on their promises.

Source: Reddit

- Fake Cash App cash flips

Scammers have a method for “flipping” or multiplying money on Cash App, luring users into sending them money in exchange for fake promises of increased returns.

Here’s what this scam may look like:

- Social media scams

Fraudsters might create fake Cash App accounts on social media platforms to trick users into sending them money for various reasons, such as fake giveaways or contests.

Here’s what it looks like:

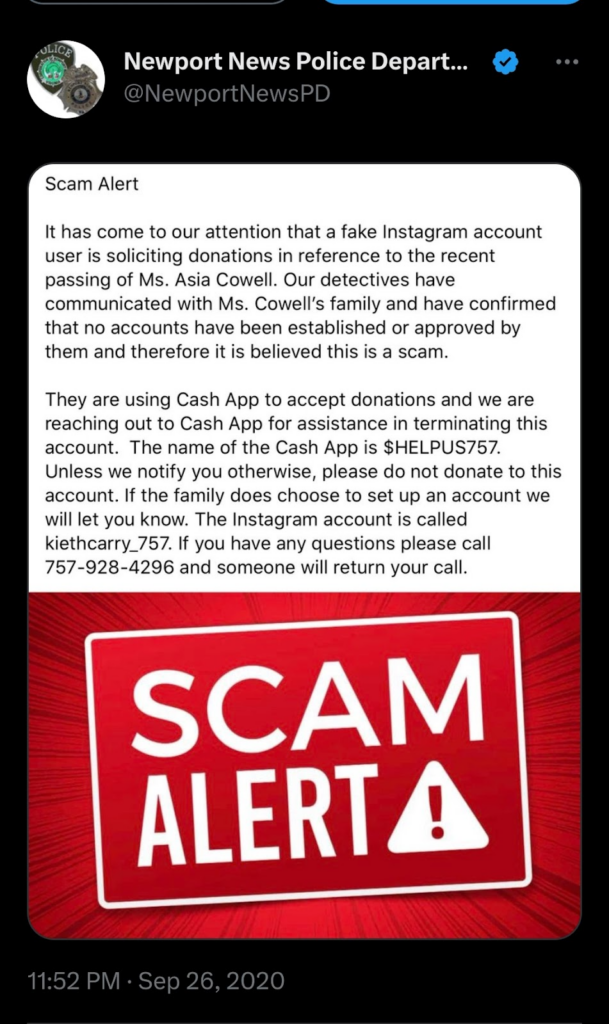

- Fake charity scams

Creating fake charity accounts on Cash App and asking users for donations is an old trick that scammers use. They collect the donation money for a supposedly great cause, but your money will end up in their pocket instead of going to a legitimate charitable organization.

Source: Twitter

- Loan scams

Scammers might pose as legitimate lenders on Cash App and offer loans but then ask you to send them an upfront fee or personal information, and then they’ll disappear in thin air with your money and information in hand.

- Romance scams

Scammers might use the same old catfishing trick on innocent victims by creating fake profiles on dating websites or social media platforms, establishing relationships with them, and then asking for money through Cash App for various reasons, such as medical emergencies or travel expenses.

Here’s what this scam may seem like:

https://mobile.twitter.com/jeffrcvg/status/1624070734837346304

- Lottery or Sweepstakes scams

Scammers might lure you by claiming that you have won a lottery or sweepstakes and ask for money to claim the prize, but the prize doesn’t exist and you’ll lose your money instead of getting anything in return.

Here’s what it looks like:

Official Cash App giveaway rules are mentioned here.

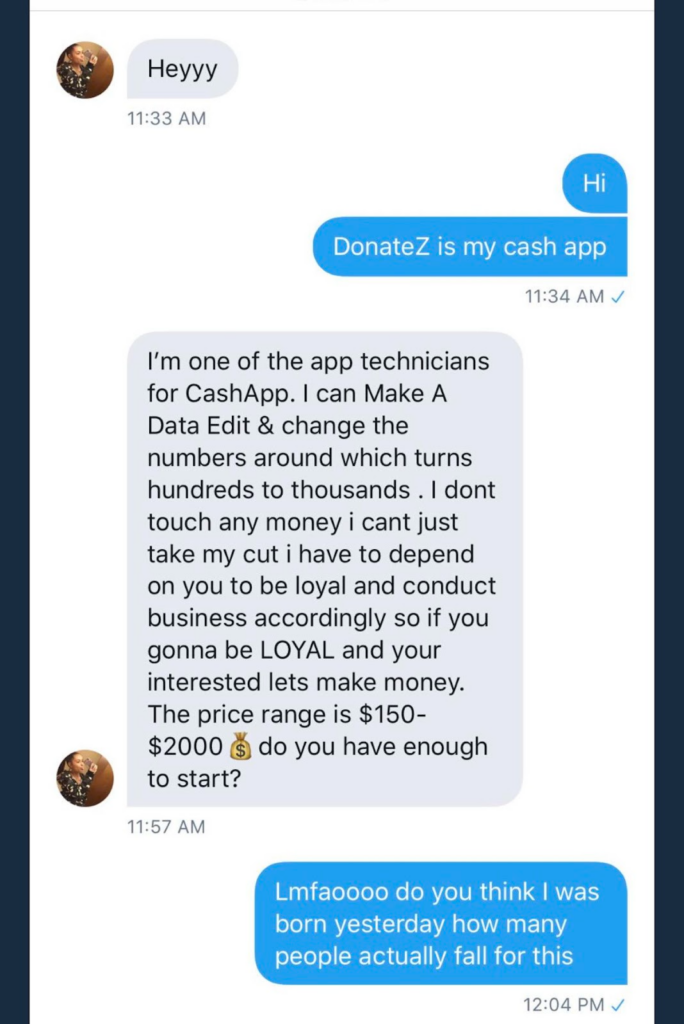

- Tech support scams

Scammers might pose as Cash App technical support representatives and trick users into providing access to their accounts or making payments for fake tech support services.

Here’s what it might look like:

Source: Reddit

Here’s another example where a scam artist tries to get your information.

- Cash App refund scams

Cash App fake refund scams are gaining popularity among scammers. They’ll promise you to send a refund for a previous scam or transaction, but they’ll ask for a payment or your personal information to process the refund, and you’ll end up with more woes on your hands.

Here’s what this scam may look like:

- Fake Cash App card scams

Scammers claim to have a Cash App card for sale or offer to load money onto users’ Cash App cards for a fee, but they disappear without providing the card or the loaded funds after receiving payment.

Source: Twitter

Combat scams: How to report a Scam on Cash App

Change your login credentials

If you get scammed, the first thing you should do is change your credentials because the scammer might have access to your account information and can deplete all your money using it.

Ask the recipient for a refund

There are 3 ways to get a refund for the amount you paid.

- The scam was a mistake and the recipient agrees to refund your money.

- You canceled your payment at the last moment.

- Cash App support accepts your dispute and refunds your money.

To request a refund on Cash App you can do this:

- Navigate to your home screen on the app and select the “Activity” tab.

- Locate the payment transaction you want to refund and tap on the “…” icon in the top right corner.

- From the options that appear, select “Refund” and confirm by tapping “OK.”

It’s important to note that the recipient of the payment will still need to accept the refund for it to be processed and for you to receive the refund amount.

Try to reverse the payment

You may try to stop the transfer if you spot the fraud in time.

To do this:

- Check your activity tab to see if the fraudulent payment is there.

- If you can “Cancel” it, the transfer still hasn’t been completed by the con artist.

- You should immediately select “Cancel” to receive a refund of your payment.

Report the scammer to Cash App support

To connect with the Cash Support team you can do this:

- Visit cash.app/help.

- Tap the “profile icon” on your Cash App home screen.

- Select “Support.”

- Select “Start a Chat” and send a message.

- Or Navigate to the issue and tap “Contact Support.”

Or you can call the Cash App on their phone by dialing 1 (800) 969-1940.

Open dispute on Cash App

You have the option to dispute a Cash App transaction in the following situations:

Unexpected outcome: If the transaction resulted in an outcome that was not as expected, such as duplicate charges or an incorrect amount being charged.

Fraudulent transactions: If your Cash App card is lost or stolen, or if your account is compromised, you can dispute transactions that were not authorized by you.

To dispute a transaction, you can do this:

- Go to your “Activity” tab, locate the payment, and select the “…” option.

- Then, click on “Need Help & Cash App Support” to contact Cash App support.

- Choose the option to “Dispute this transaction.”

The Cash App team will investigate the dispute and provide you with their decision.

File a Police report

In cases like fraudulent transactions or lost money on Cash App, filing a police report can be crucial to dispute the issue and seek a refund.

- Contact your local law enforcement’s non-emergency line (not 911) and request to speak with their fraud department.

- Provide them with a detailed account of what happened and the steps you have already taken.

- The police will create a file for reference as you continue your efforts to recover your money.

Inform your Bank

When you catch the scam, immediately inform your bank and check your account details for any fraudulent activity. Let your bank know about the con to ensure they stay vigilant if any fishy transaction happens from your account.

If you linked your Cash App account to a debit or credit card, you might have the option to file a dispute for the transaction with your bank.

Block the scammer

It is crucial to block the scammer quickly when you notice the fraud.

To do this:

- Open your Cash App and go to the profile of the scam account.

- Tap on the three dots (…) or the settings icon to access the account’s settings.

- From there, you should have the option to block the account.

Submit a complaint to the FTC

The Federal Trade Commission actively tracks and reports on scams to help protect consumers.

If you have fallen victim to a scam and lost money or you have provided sensitive information that could be used for identity theft, it’s important to report it to the FTC.

To do this:

- You can visit their website ReportFraud.ftc.gov and submit proof of the scam.

- Or you can call them at 1-877-FTC-HELP and file the complaint.

Put your credit on hold

To put a halt to unauthorized access to your credit report, you can initiate a credit freeze.

- Contact the three major credit bureaus, namely Experian, Equifax, and TransUnion, and request a credit freeze.

- This will restrict access to your credit report, helping to prevent identity theft and unauthorized use of your credit information.

- You may need to provide certain information and follow the credit bureau’s procedures to freeze your credit.

It’s a proactive step to safeguard your credit and personal information from potential misuse.

Can you get your stolen money back?

While Cash App does have a dispute process for transactions, refunds are not guaranteed for fraudulent transactions. Cash App’s team will investigate each disputed transaction, and the outcome may vary.

While some users may receive a refund, others may have their disputes denied, and unfortunately, not all users scammed on Cash App will get their money back.

Don’t let the scammers Cash In! Save your money with these savvy methods!

Cash App scams are like sneaky ninjas, but you can be a scam-fighting ninja too! Follow these witty tips to avoid getting duped:

Double-check your transactions and the recipient’s info

- Confirm your transactions before sending your money. Also, check the recipient’s info, including their Cash App username or phone number, to avoid accidentally sending your money to a scammer.

Dodge the unsolicited money beggars

- Don’t be fooled by fake giveaways, phony charities, or urgent money pleas from strangers. Keep your generosity in check and be cautious of unsolicited requests for funds.

Lock down your info

- Keep your Cash App information on lockdown. Never share your account details, password, PIN, or other sensitive info with anyone you don’t trust. Cash App won’t ask for it via email, calls, or texts.

Watch out for fake-outs

- Stay alert for fake websites and emails pretending to be from Cash App. Verify their legitimacy by checking the official Cash App website or contacting customer support directly. Cash App emails will come from @squareup.com, @square.com, @cash.app, or support@drivewealth.com if you have an open brokerage account.

Stay in the loop

- Keep up with the latest scamming tactics and fraud trends. Stay informed, savvy, and one step ahead of those sneaky scammers.

Report, report, report

- Notify Cash App and the authorities, like the FTC or your local law enforcement agency, if you suspect any scammy activity on your account.

Use an additional security tool

- Level up your security game with an all-in-one app, PureSquare. It will cover all digital security flaws so your information and money stay safe. Extra protection for the win!

PureSquare: Your one-stop shop for digital defense!

Say goodbye to cyber worries and say hello to the dream team of digital defense – PureVPN, PureKeep, PureEncrypt, and PurePrivacy bundled up in PureSquare!

PureVPN

Browse Cash App like a pro while keeping your identity under wraps with PureVPN’s cutting-edge features. Stay anonymous, stay secure, and uncover classified treasures without leaving a trace!

PureKeep

Tired of juggling passwords like a circus performer? Enter PureKeep, your very own password superhero! Store all your passwords securely, generate ironclad ones on the fly, and access them effortlessly on all your devices.

PureEncrypt

Lock away your data like a boss with PureEncrypt, the ultimate vault for your files! Enjoy bank-grade security and convenient cloud storage for anytime, anywhere access. No more data breaches!

PurePrivacy

Take control of your digital world with PurePrivacy. Discover at-risk data, dodge pesky targeted ads, and keep your info in check. Stay incognito and call the shots with PurePrivacy by your side!

Bottom line

In conclusion, when it comes to scams on Cash App, remember that you’re in control! So, don’t let scammers rain on your digital parade. Take charge by blocking and reporting any suspicious accounts, reaching out to Cash App support, and reporting the scam to the FTC and local Police. With your keen eye for scams and savvy reporting skills, you can keep Cash App scam-free!

For any assistance regarding PureSquare, don’t hesitate to reach out via the LiveChat option.

Frequently Asked Questions

Yes, you can cancel a pending Cash App payment. To do so, simply go to your Cash App home screen, tap on the clock icon (which represents pending transactions), select the payment you wish to cancel, and then tap on the “Cancel Payment” option.

Yes, you may be able to get your money back from the Cash App in certain situations. You can dispute a transaction for reasons such as duplicate charges, fraudulent transactions, or errors in the transaction amount.

Yes, if you have linked your Cash App account to a debit card or credit card, you may be able to dispute a Cash App transaction with your bank. You can contact your bank and provide them with the details of the disputed transaction.

Cash App transactions are generally untraceable, but Cash App transactions may be subject to investigation by law enforcement or other legal authorities in case of suspected fraud, illegal activities, or other violations. Also, Cash App may collect and retain transaction data for internal purposes, as outlined in their privacy policy.