Exit scams keep evolving with crypto, law-enforcement tactics, and marketplace design. The last 18 months alone have seen high-profile cases and new analysis from blockchain-security firms and Europol indicating shifts in how the dark web operates and how funds move.

That combination —continuing criminal innovation and improved forensic tracking, means staying current matters for researchers, journalists, and anyone concerned about online fraud.

Your email could be compromised.

Scan it on the dark web for free – no signup required.

What is an Exit Scam?

An exit scam (sometimes called a “rug pull”) is a fraud in which an operator of a marketplace, an exchange, a vendor, or a crypto project intentionally shuts down operations and runs away with funds that belong to users, commonly the funds held in escrow, deposits, or invested capital.

In regulated markets, victims can sometimes pursue chargebacks or legal remedies; on darknet markets or unregulated crypto projects, payments are irreversible, and participants are often anonymous, making recovery extremely difficult.

Types of Exit Scams Seen Commonly

It’s no secret, the dark web runs on trust, even though it’s built for anonymity. Buyers trust vendors, vendors trust marketplaces, and everyone trusts that escrow will hold their funds safely.

But what happens when that trust gets flipped into a trap? You guessed it: an exit scam.

Let’s break down the main ways these scams play out so you know exactly what to watch for.

- Vendor exit scam – A seller takes orders, pockets the crypto, and vanishes without ever delivering the goods.

- Marketplace operator exit scam – Entire darknet markets shut down overnight, with admins disappearing along with millions in escrowed funds.

- Project rug pull – Shady crypto or token projects suddenly collapse as founders dump coins or drain liquidity pools, leaving users stranded.

- Phased or blackmail exit scam – Operators first freeze withdrawals, then pressure vendors and buyers to pay extra by threatening to expose private chats or transaction details.

How Exit Scams Work on the Dark Web

At first glance, an exit scam might sound like a sudden “smash-and-grab” move. In reality, most of them are carefully planned. Dark web vendors and marketplace operators know that trust is currency, and they exploit it until the very last moment. Here’s how it usually plays out:

1. Building Trust and Reputation

Scammers rarely disappear on day one. Instead, they spend months (sometimes years) gaining positive feedback. Vendors deliver real goods at first, and marketplace admins run escrow services smoothly. On forums like Dread and Reddit, users recommend them, which builds credibility.

2. Increasing Transaction Volume

Once trust is secured, vendors or marketplaces encourage bigger orders. Discounts for bulk buys, limited-time promotions, or even “holiday sales” are common tricks. Behind the scenes, scammers are setting the stage for a big cash-out.

3. Timing the Exit

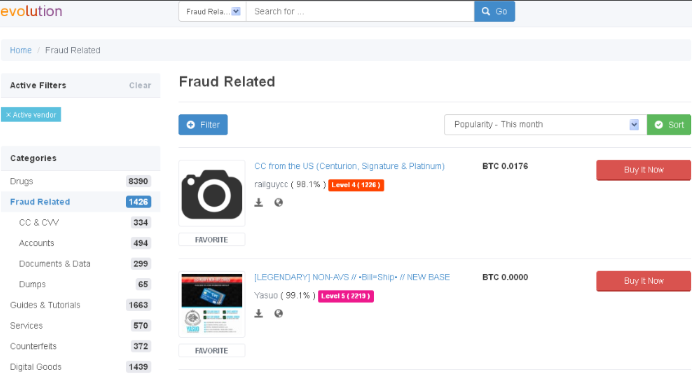

The scam usually peaks when enough crypto (Bitcoin, Monero, or Ethereum) has piled up in escrow wallets. Marketplace operators, for example, wait until both buyers and sellers have significant amounts tied up. Then, without warning, they vanish. For example, Evolution Market (2015) waited until it had millions of dollars locked in escrow before disappearing.

4. Sudden Shutdown or ‘Maintenance Mode’

When the scam begins, marketplaces often claim “technical problems” or “server maintenance.” This lures users into waiting, hoping withdrawals will resume. By the time they realize it’s an exit scam, the operators are already gone.

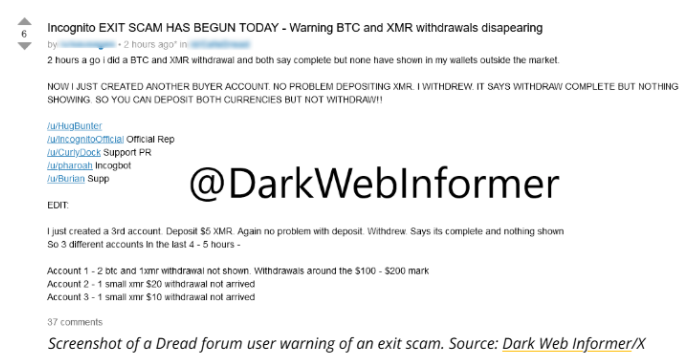

5. Optional Extortion (blackmail scams)

Some modern exit scams add an ugly twist: blackmail. Operators freeze withdrawals and then threaten to leak transaction data unless extra “fees” are paid. Incognito Market (2024) didn’t just vanish; it extorted both buyers and sellers before shutting down.

6. Cashing Out and Disappearing

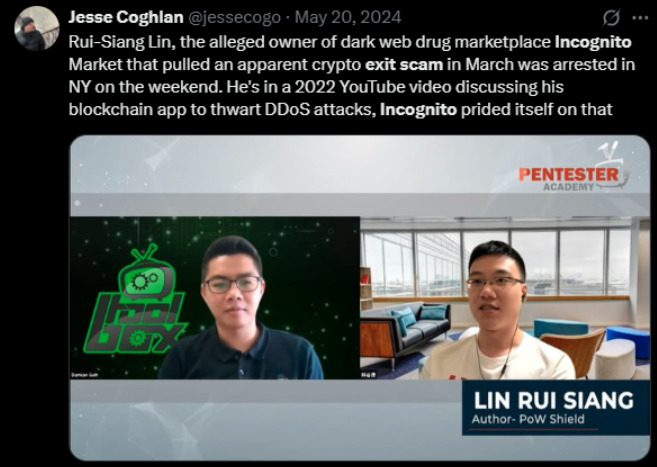

Finally, the stolen crypto is laundered through mixers, DeFi protocols, or converted into Monero for better privacy. Since dark web markets run anonymously, catching operators after the fact is rare, though law enforcement has had success in a few cases, such as the arrest of Rui-Siang Lin (Incognito’s alleged operator) in 2024.

Why the Dark Web and Crypto Make Exit Scams Attractive & Resilient

Let’s be real, the dark web is practically designed to make exit scams possible. Here’s why these scams are so attractive and resilient:

- Irreversible Payments & Pseudonymity

When you pay with Bitcoin or Monero, there’s no “chargeback” button. Once funds leave your wallet, they’re gone. Add in pseudonymous wallet addresses, and tracing who’s behind a transaction becomes a nightmare. That’s why recovery is next to impossible.

- No Regulation or Safety Net

Unlike Amazon or eBay, dark web marketplaces don’t have legal protections or real-world escrow enforcement. Europol reports have highlighted that if a deal goes wrong, you can’t file a complaint or sue, the system simply doesn’t protect consumers.

- The Escrow Paradox

Escrow sounds safe, right? Buyers park their funds until the order is confirmed. But in darknet markets, escrow is centralized. That means millions in crypto often sit in one place. If the operators decide to bail (or if someone compromises the wallet), the entire stash can vanish overnight.

- Operational Playbook & Agility

Exit scammers don’t just take the money and run. They’ve got a playbook. They switch domains, launch mirror sites, and hop across crypto chains using mixers to launder stolen funds.

Famous Dark Web Exit Scams We Have Seen Over the Decade

Exit scams don’t just wipe out shady marketplaces, they leave regular people broke, anxious, and with no path to recovery. Over the last decade, we’ve seen several high-profile scams that perfectly capture how trust gets built, and then shattered overnight. Let’s look at some of the most infamous cases.

Evolution (2015)

Evolution was one of the largest dark markets of its time. In March 2015, administrators froze user withdrawals, citing maintenance, then disappeared, reportedly taking about $12 million in Bitcoin held in escrow. The case crystallized the exit-scam model and triggered a wave of mistrust across darknet markets. Brian Krebs, The Guardian, and many security outlets covered the collapse.

Lesson learnt: even markets with strong reputations can fold; escrow concentration poses existential risk.

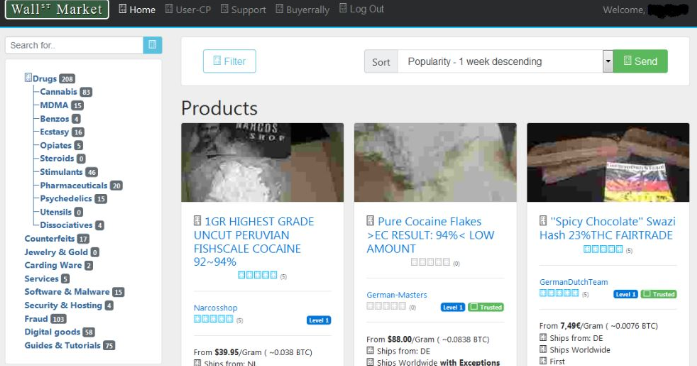

Wall Street Market (2019)

Wall Street Market (WSM) was targeted and taken down in May 2019; initial reporting suggested operator theft of funds (~$14–30 million estimates), but investigators later described a law enforcement seizure that enabled a broader takedown (Operation Disruptor).

The distinction between an exit scam and a law-enforcement seizure can be murky early on, both look like sudden disappearances and frozen funds.

Lesson learnt: sudden shutdowns can be exit scams or covert seizures, timing, seizure banners, and wallet tracing often reveal the true story.

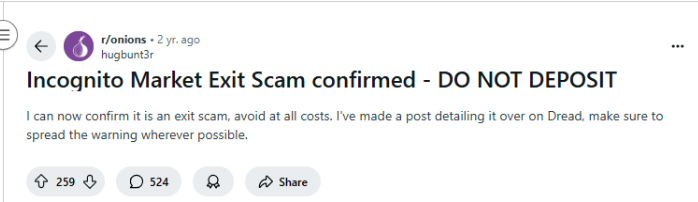

Incognito Market (2024)

Incognito’s collapse in 2024 combined an exit-scam pattern with extortion. Administrators reportedly froze withdrawals and began blackmailing vendors and buyers, demanding “fees” to avoid leaking private chats and data. Law enforcement arrested an alleged operator (Rui-Siang Lin) in May 2024; subsequent charges illuminated how operators combined exit-scam behavior with additional criminal leverage.

Lesson learnt: exit scams can be hybrid operations, freezing funds, extortion and data threats increase pressure on victims and complicate response.

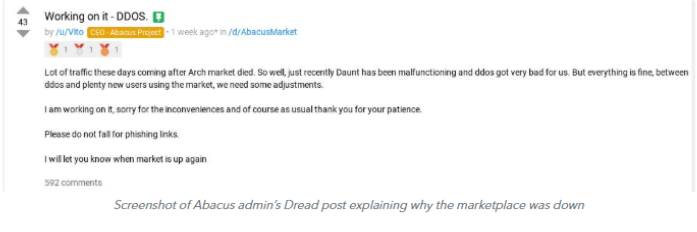

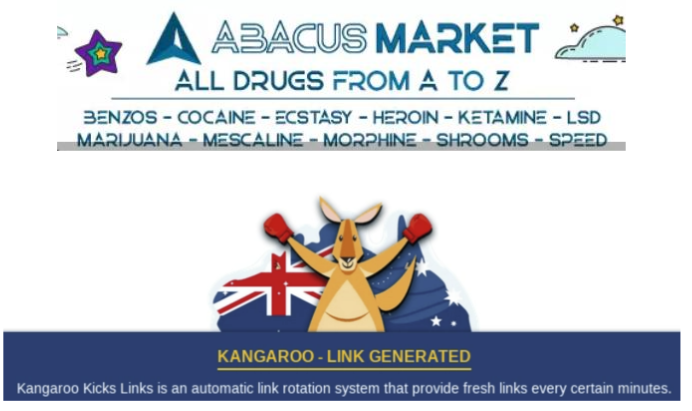

Abacus Market (2025)

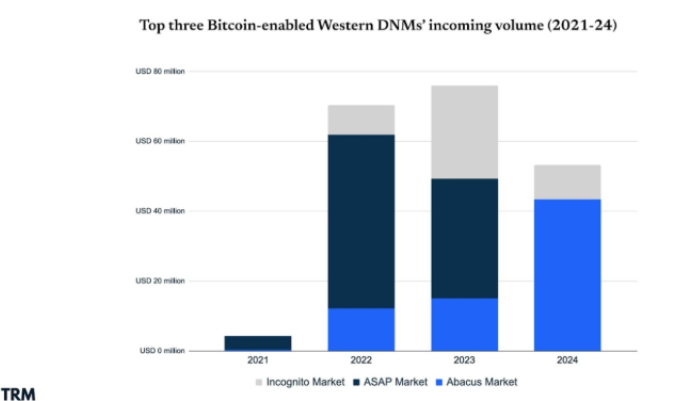

In mid-2025, Abacus Market (a major Bitcoin-enabled Western DNM) went offline and TRM Labs publicly assessed the event as a likely exit scam, although a covert law-enforcement seizure remained a possibility. Analysts noted that consolidation in the market plus operator instability, have coincided with higher exit risks.

Lesson learnt: despite better chain-analysis tools, exit scams continue; public forensic teams (TRM, Chainalysis) quickly publish assessments after such disappearances.

By the Numbers: What Exit Scams and Darknet Markets Really Cost

Let’s talk numbers, because the scale of dark web exit scams is bigger than most people realize. We’re not just dealing with a few shady vendors cashing out, we’re looking at billions in cumulative losses across the past decade. And while researchers try to pin down the damage, anonymity and sketchy reporting make the data messy.

Combined losses from darknet scams and crypto fraud have reached eye-watering levels — around $4.3 billion in certain years. But the numbers are hard to nail down since reports often mix up seizures (where police recover funds) with outright theft.

Blockchain analysts at TRM Labs noted that crypto-enabled drug sales actually rose by ~19% from 2023 to 2024, hitting roughly $2.4 billion in on-chain volume. At the same time, fewer new darknet marketplaces were launched, a sign that the ecosystem is consolidating, with fewer platforms controlling more risk.

Operations like the takedown of Wall Street Market, part of Operation Disruptor, prove that global agencies can cripple even the biggest darknet hubs. But history shows that sellers and buyers adapt quickly, migrating to encrypted messaging apps or social platforms to keep business alive.

As Europol points out, it’s almost impossible to get clean, reliable figures. Transactions get laundered through mixers or off-chain brokers, victims rarely report losses (for obvious reasons), and even police stats sometimes blur the line between “funds seized” and “funds stolen.” That’s why researchers rely on a patchwork of chain forensics, news reports, and even dark web forum chatter to estimate the true impact.

Can You Spot a Market (or vendor) Preparing an Exit

Yes, you can, but these are probabilistic, none are proof, but multiple flags together raise an alarm.

Operational Red Flags

- Sudden maintenance messages or prolonged “withdrawals disabled” notices.

- Administrators limit withdrawals to certain amounts without a clear timeline.

- Owner accounts start deleting posts or removing staff contact info.

- Migration of DNS records or a sudden move to a new clearnet mirror while cutting Tor access.

Blockchain/Financial Red Flags

- Large transfers from marketplace wallets to mixers or to new cold wallets.

- Unusual “dusting” or chain-hopping activity.

- Rapid consolidation of funds into a few wallets (suggests aggregation before laundering).

Community Red Flags

- Growing threads on Dread/Reddit about withdrawal problems.

- Vendor complaints about withheld funds and increased admin silence

- Heavy moderator activity trying to quiet panic (often the wrong signal).

If you encounter any of these flags, withdraw small amounts where possible, avoid new deposits, screenshot communications, and read community channels carefully. However, remember that illegal markets do have consequences. If you have accidentally been a part of any of these, stay cautious and report it to the relevant authorities.

Wrap Up

Exit scams are a structural hazard of any unregulated online marketplace that centralizes funds. The dark web has produced some of the most headline-grabbing examples in the past, but modern variants, such as Abacus in 2025, show the threat keeps mutating. Analysts, law enforcement, and forensic firms are better at tracing crypto flows, but that does not mean scams stop, they only become different.

Frequently Asked Questions

Both can look identical at first: a site goes offline and withdrawals freeze. A seizure usually involves law enforcement replacing the site with a seizure banner and public statements; an exit scam is operator theft. Blockchain tracing and legal filings eventually clarify which occurred.

Rarely, recovery is possible only if funds reach regulated exchanges with KYC or law enforcement intervenes quickly. Many victims never recover assets because of anonymous wallets and cross-chain laundering.

No. Exit or rug pulls occur in DeFi projects, ICOs, centralized exchanges and vendor scams. The dark web’s anonymity amplifies the risk, but the scam architecture is similar elsewhere.