If you’ve ever wondered “Is Ally Bank safe?” before moving your savings online, you’re not alone. As more people ditch traditional banks for digital-only options, the concern around online security has never been higher.

In this guide, we’ll break down exactly how safe Ally Bank really is, what protections it offers, and what every smart customer should know before trusting a fully online financial institution.

Is Ally Bank Safe for Your Money in 2025?

Yes, Ally Bank is safe, mainly because it’s FDIC insured. That means your deposits are insured up to $250,000 per depositor, per ownership category, just like at traditional banks such as Chase or Wells Fargo.

If Ally Bank were ever to fail, the Federal Deposit Insurance Corporation would reimburse eligible deposits. So, your savings, checking, and CDs all fall under federal protection. In other words, Ally’s lack of physical branches doesn’t mean your money is any less secure.

Is Ally Bank Safe from Cyber Threats and Hackers?

While Ally Bank has strong security practices and a tech stack on par with top online banks, it has still suffered serious data breach incidents. For example, in April 2024 an unauthorized party gained access to a vendor’s system and exposed customer names, Social Security numbers, account numbers and other sensitive information.

Given that history, even though Ally Bank deploys industry-standard protections, the fact remains that it’s not entirely “safe” by default; your personal banking safety still depends heavily on what you do (passwords, device hygiene, alerts) and how comfortable you are accepting some residual risk.

Is Ally Bank Safe Compared to Traditional Banks?

A common hesitation users have is whether an online-only bank can match traditional bank safety. So is Ally Bank safe compared to big-name institutions like Citi or Bank of America?

Yes, in most ways, it’s equally or even more secure.

Because Ally doesn’t maintain branches, it channels more resources into digital defense and infrastructure. Customer data is stored in secure servers, and account access requires multiple verification steps. Ally has earned high customer satisfaction scores, often outranking traditional banks for transparency and reliability.

However, one trade-off exists: no physical locations. This means cash deposits can only be done through linked ATMs or money transfers. It’s a minor inconvenience, not a safety flaw.

The Security Features That Make Ally Bank Safe

Here’s a closer look at what actually makes Ally Bank safe from both fraud and data theft:

- FDIC Insurance – Covers deposits up to $250,000.

- Advanced Encryption – Protects data transmitted between you and Ally’s servers.

- Fraud Monitoring – Tracks account activity 24/7 for anomalies.

- Zero Liability Protection – You’re not held responsible for unauthorized online transactions.

- Card Controls – Instantly lock/unlock your debit card via the Ally app.

- Security Alerts – Get notified for every login, password change, or transaction.

- Automatic Logouts & Device Recognition – Keeps strangers from staying signed in on your device.

Each of these measures strengthens Ally’s digital walls, ensuring both privacy and peace of mind.

How Ally Bank Handles Fraud & Disputes

If you ever spot an unauthorized transaction on your account, you’ll want to know exactly how Ally manages the fallout. They have a zero-liability policy, meaning that if you report fraudulent charges promptly, you should not be held responsible.

Once you alert Ally’s fraud or dispute team, they begin investigating immediately. They’ll typically block or suspend the affected account, issue a provisional credit while the claim is verified, and work to restore your access. Customers can initiate disputes directly through the Ally mobile app, no long hold-times via phone if everything goes smoothly.

Beyond the mechanics, the bank also runs fraud-awareness campaigns. They emphasise things like, never click a link in a suspicious message claiming to be from Ally, always log in via the official site or app, and enable alerts. The idea is, the bank’s side of the safety net is solid, but your vigilance is still a key part of protection.

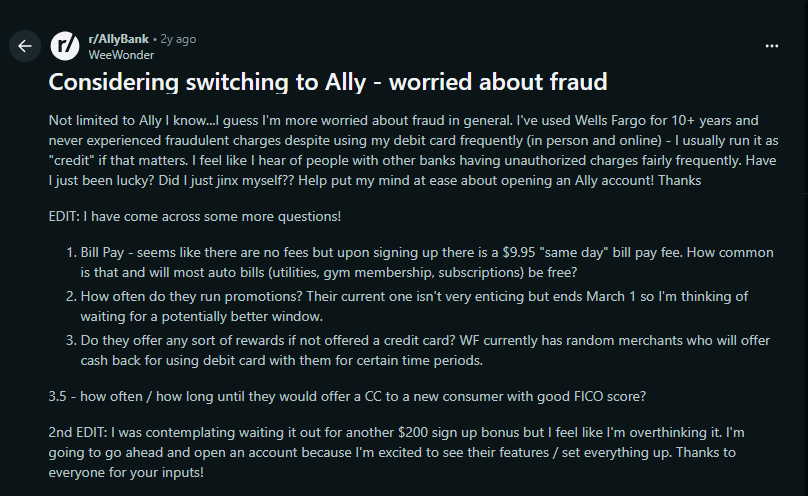

Many users on the Reddit forum for Ally report favourable outcomes when they’ve used the fraud/dispute channels.

“Ally customer for 12 years. They’ve always done well for me. Never had any issues with fraud they didn’t completely resolve for me.”

But there are also risks as discussed by some:

“Someone hacked into our account and initiated a wire transfer of 14K … This can’t happen 😨😰 … DO NOT USE ALLY BANK, EVER.”

Someone hacked our account and initiated a wire transfer

byu/Jezahb inAllyBank

“Ally Bank froze my account, and I have been unable to access my own money for a week. Every time I call, they refuse to verify me…”

Ally Bank Locked Me Out, Won’t Verify Me, & Is Holding My Money Hostage – HELP!

byu/Infamous_Act_5371 inpersonalfinance

What am I missing with Ally bank? All I get are problems…. slow transfers, system issues, bad customer service, etc. I want to like them but they keep making it hard.

byu/tcampbell011 inAllyBank

These posts suggest that while the system works for many, the user experience can vary, especially when large sums, wires, or external transfers are involved. Also note that some users mention that using VPNs or unusual login locations triggered fraud flags.

Is Ally Bank Safe Based on Public Trust Ratings?

When assessing is Ally Bank safe? Your research should include not only the bank’s security disclosures and policies, but also how customers and independent reviewers experience it in real-life.

- According to the Better Business Bureau (BBB) profile, Ally Bank holds an A+ rating at one of its regional profiles, which suggests the bank has responded to complaints and meets certain trust-criteria.

- On the review platform Trustpilot, however, the picture is quite different: hundreds of reviews give Ally a very low rating (~1.4/5) with frequent complaints about customer service, frozen accounts, and difficulty resolving issues.

- Independent review sites such as Finder list Ally as having an A rating from the BBB and mention mixed customer feedback, suggesting fewer complaints than many large banks, but still some red flags.

So yes — on paper, from institutional review sources, Ally looks solid. But the paper picture differs from how some customers experience things.

Possible Limitations and Real-World Concerns About Ally Bank Safety

Even though Ally Bank looks safe, there are still things to keep in mind:

- No physical branches, not ideal if you prefer in-person service.

- Cash deposits require workarounds, like using partner ATMs or money orders.

- Phishing scams, some fraudsters impersonate Ally via fake texts or calls.

- Multiple data breaches in the past which make its reputation shaky.

- FDIC coverage limits balances above $250,000 per category are not protected.

These aren’t deal-breakers, but they remind you that safety also depends on your digital hygiene. Always confirm URLs, enable MFA, and use a VPN for public connections.

How to Make Ally Bank Even Safer for You

Even though Ally Bank looks safe, but you can go further to prevent breaches by taking proactive steps:

- Use unique, complex passwords that mix characters and symbols.

- Enable MFA and update recovery information regularly.

- Set transaction alerts for real-time account tracking.

- Avoid public WiFi logins unless protected by PureVPN.

- Keep your devices updated with the latest OS and antivirus patches.

- Regularly review your statements to catch errors or unauthorized use.

So, despite trusting any platform blindly, it is important to build your own safe habits to create a shield against cyber risks.

Frequently Asked Questions

Yes, up to FDIC limits. For larger balances, consider opening multiple accounts under different ownership categories.

Yes. Ally Invest accounts are protected by SIPC insurance, covering securities up to $500,000.

It uses multi-layer encryption and AI-driven monitoring, but you should still avoid logging in through unsafe networks.

Yes, but remember, international transactions may incur third-party fees. Always verify through the official platform.

Ally Bank’s security technology stands shoulder to shoulder with major players like Capital One 360 and Discover Bank. Its commitment to transparency and user trust makes it one of the most reliable online banking options today.

Final Words

Is Ally Bank safe? Absolutely, for most people, it’s one of the most secure online banks in the U.S. With FDIC insurance, robust cybersecurity, fraud protection, and a responsive support team, Ally checks every box for modern digital safety.

Still, safety isn’t one-sided. A bank can protect you only if you protect yourself, with secure devices, private connections, and awareness of phishing threats. PureVPN adds an extra layer, when banking from shared or public networks.