With more than 50 million users sending, spending, and investing through the app, Cash App has become one of the most popular peer-to-peer payment platforms in the U.S. But behind that convenience lies a bigger question: just how secure is your money, and your personal data, on it?

Cash App encrypts your data, offers PIN protection, and even supports biometric login. But in recent years, the platform has faced data breaches, insider leaks, and regulatory fines over fraud handling, raising legitimate concerns for anyone using it to store or transfer funds.

In this in-depth guide, we’ll break down is Cash App is safe, where it’s fallen short, and why adding a VPN makes a real difference in protecting your privacy.

Is Cash App Safe for Your Money?

Cash App has protections that make many everyday users reasonably safe. Deposits in Cash App Cash Card accounts get routed through partner banks and certain balances can be FDIC-insured depending on how funds are held.

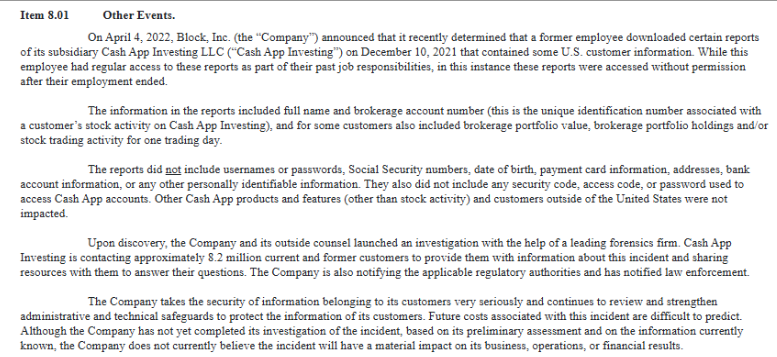

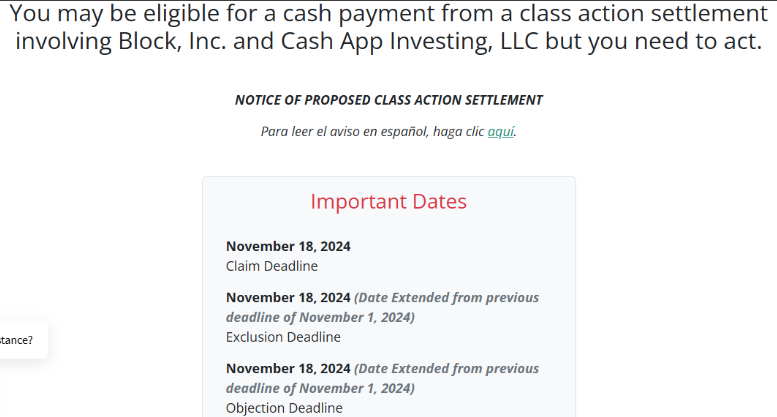

The app offers PINs, biometric logins, dispute flows, and automated fraud monitoring. That said, Cash App has been linked to multiple incidents where customer accounts or data were accessed improperly, the most prominent being a December 2021 case where a former employee downloaded customer reports exposing millions of users, plus later incidents that led to class actions and settlements. Those events raise the question: Is Cash App safe for large balances or trust-sensitive uses?

Is Cash App Safe — or Just Convenient? What You Need to Know Before You Trust It

At first glance, the app looks effortless. You tap, send, receive money, invest, maybe dabble in Bitcoin. The app collects transaction metadata, device identifiers, event-telemetry, all designed to help flag fraud and keep things moving. However, this comes with a trade-off: you’re providing detailed behavioral profiles, which can be shared with partners.

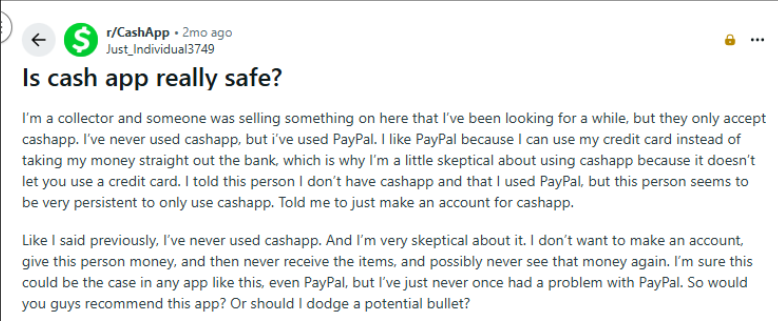

And here’s what users are saying:

“Cash app has no protection. You should never send money to purchase something for an item you don’t have in your possession.”

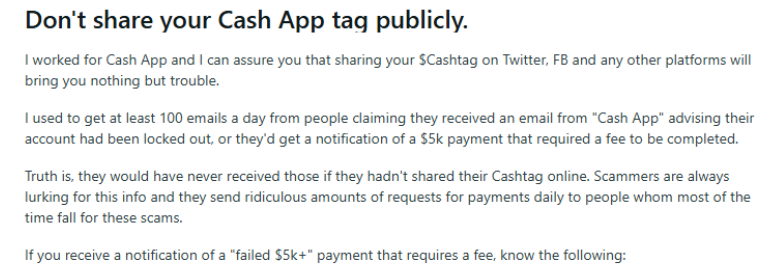

“I worked for Cash App … sharing your Cashtag … will bring you nothing but trouble.” Reddit

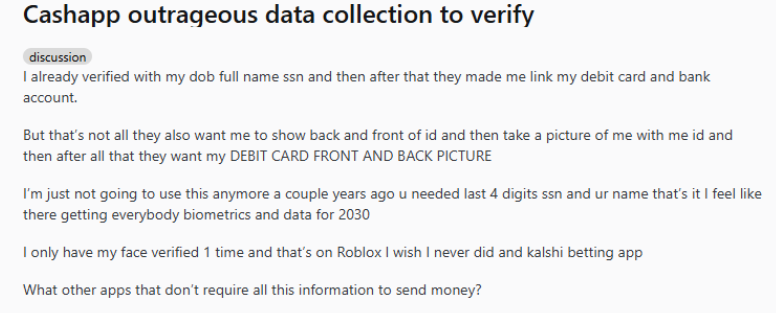

“Cashapp outrageous data collection to verify … they want my DOB, full name, SSN … then my debit card front & back.” Reddit

Regulators and courts began focusing on these issues in 2024-2025, highlighting weak internal controls and poor handling of disputed transactions, so when finding is Cash App safe, you need to consider both the safety of your money and the safety of your data.

Common Cash App Scams You Must Be Aware Of

One major factor you can’t ignore is the surge in scams targeting everyday users when finding out is Cash App safe. While Cash App itself uses encryption and security checks, scammers often exploit social engineering and fake profiles to trick users. Here are the most common Cash App scams.

1. Fake Customer Support Accounts

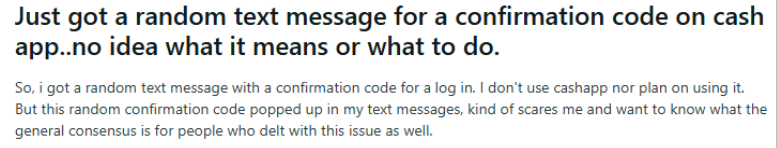

One of the most reported scams on Reddit and Twitter involves impostors posing as official Cash App representatives. They message users with fake “account verification” requests or promise to fix issues, only to steal login info or funds.

How to avoid it: Cash App never contacts users through social media. Always reach support through the in-app Help section.

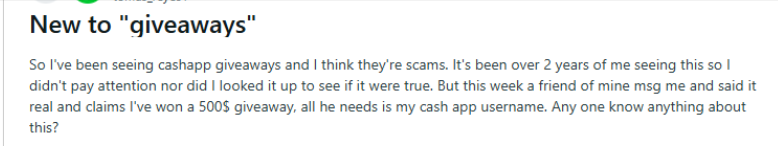

2. Giveaway Scams

If someone online promises “Send $10 to get $100,” it’s 100% a scam. These fake “Cash App giveaway” posts flood social media, preying on people looking for quick money.

How to avoid it: Real promotions appear only through Cash App’s verified channels, anything else is fraudulent.

3. Verification Scams

Fraudsters ask for sensitive details like your Social Security number, debit card images, or full name under the guise of “account verification.” These phishing attempts can lead to full identity theft.

How to avoid it: Never share personal details outside the app. Cash App will never ask for your SSN or card details via email or DMs.

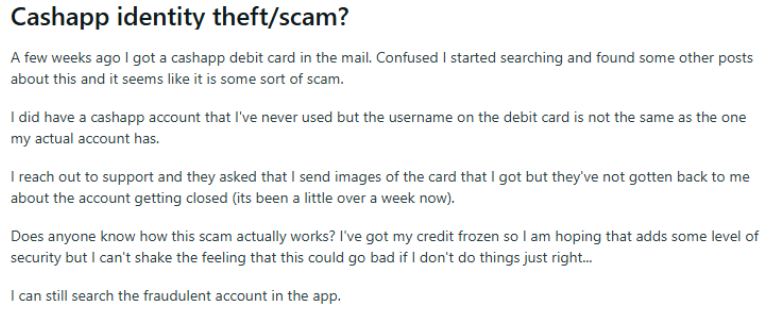

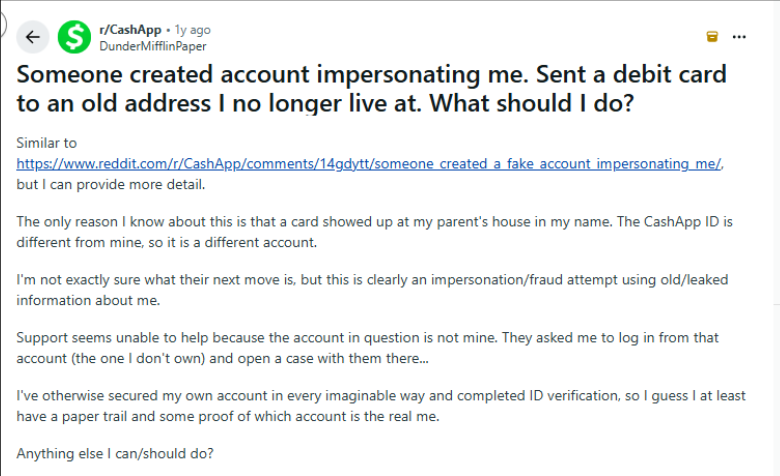

4. Impersonation Scams

Scammers use stolen Cashtags or mimic sellers to trick buyers into paying for fake products or services. Once the payment is sent, the scammer disappears, and recovering your money is nearly impossible.

How to avoid it: Before sending money, double-check usernames, verify seller credibility, and never transact with strangers outside trusted platforms.

How a VPN Makes Cash App and Other Payment Services Safer

A VPN won’t fix corporate missteps or retrospective poor policies, but it strengthens the parts of safety you control, and that matters when you are using Cash App.

1. Encrypt Public Wi-Fi Traffic

Whether you’re checking your balance at an airport or transferring funds from a café, PureVPN encrypts every packet of data traveling between your device and the internet. That means hackers, snoopers, or rogue networks can’t intercept your login credentials.

2. Mask Your IP and Location

Cash App logs device and network information to power fraud detection. But that same data can also feed behavioral profiling. PureVPN hides your real IP address and location, reducing digital footprints and making it much harder for trackers or data-brokers to link your identity across apps and services.

3. Minimize Tracking Signals

Even though Cash App still collects in-app telemetry, PureVPN cuts network-level exposure and blocks many third-party trackers that operate outside the app, which ensure fewer data leaks, less profiling, and a genuinely more private way to manage your money online.

Steps to Make Cash App Safer Right Now

You must always practise prudence when it comes to managing payments and finances. Here’s how:

- Turn on PIN or biometric lock for the Cash App.

- Enable instant transaction notifications and monitor activity daily.

- Use strong, unique passwords and a password manager.

- Freeze or disable your Cash Card instantly if it’s lost or compromised.

- Verify recipients and avoid sending money to unknown people.

- Check settlement pages or CFPB notices if you suspect you were impacted by past incidents.

Conclusion

Cash App is convenient and provides many security features that protect everyday users, but it is not flawlessly safe. Past insider incidents, unauthorized-access problems, and material regulatory actions show real weaknesses.

If privacy and maximum protection matter, combine Cash App’s controls with personal security, enable 2FA, use a VPN on public networks, monitor transactions, and don’t keep large sums solely in the app.

Frequently Asked Questions

Cash App isn’t ideal for keeping large sums. It offers protections but has been subject to breaches and regulatory findings; for large savings, keep funds in diversified traditional bank accounts with strong dispute processes.

Yes, in December 2021 insider incident occurred where an employee accessed exposed user reports, plus subsequent unauthorized-access issues that led to class actions and settlements. Regulators later ordered refunds and penalties related to fraud handling.

No. A VPN improves personal privacy and network security, but cannot change Cash App’s internal controls or historical data-handling practices.

Not always. Cash App operates via partner banks, and only certain funds tied to the Cash Card or specific accounts may be FDIC–insured. For plain peer-to-peer balances, there may be no deposit insurance.

Is the cash app safe for sending money when you use official security features like PIN, biometrics, and account verification.

To ensure is the cash app safe, enable two-factor authentication, avoid unknown users, and monitor transactions regularly.