If you’ve ever asked yourself, “Is Fidelity safe?” Before trusting your investments or retirement savings to Fidelity Investments, you’re asking a very timely question. With cyber-incidents becoming more sophisticated and frequent, it’s more important to understand not just the financial strength of your provider, but also how well it protects you.

In this guide, we’ll discuss whether Fidelity is safe, review the data breaches and risk factors, assess what protections the firm offers, and explain what you should know before choosing them as your investment or data-custody partner.

What is Fidelity?

Fidelity Investments is one of the largest and oldest financial services firms in the U.S., managing trillions in assets across retirement plans, brokerage accounts, and mutual funds. Founded in 1946, it’s known for offering a full suite of investment tools, including 401(k)s, IRAs, ETFs, and wealth management services.

Fidelity also provides online trading platforms, financial planning, and robo-advisory options for both beginners and professionals. With decades of trust and innovation, it’s a cornerstone of global investing, though, like all major institutions, it faces growing cybersecurity and privacy challenges.

Is Fidelity Safe for Your Money and Data?

If you’ve been asking yourself, Is Fidelity safe, after hearing about the 2024 data breach, you’re not alone. Fidelity is still considered safe for your money and data, as the 2024 breach didn’t compromise customer funds or core investment systems.

Fidelity is one of the biggest names in investing, but even giants can stumble when it comes to cybersecurity.

To be fair, Fidelity remains financially strong and well-capitalized. The company’s August 2024 breach didn’t involve stolen funds or hacked customer accounts, according to Security Magazine and Security Affairs. The firm immediately offered credit monitoring and identity theft protection to affected users, and many analysts say its core investment systems remain solid.

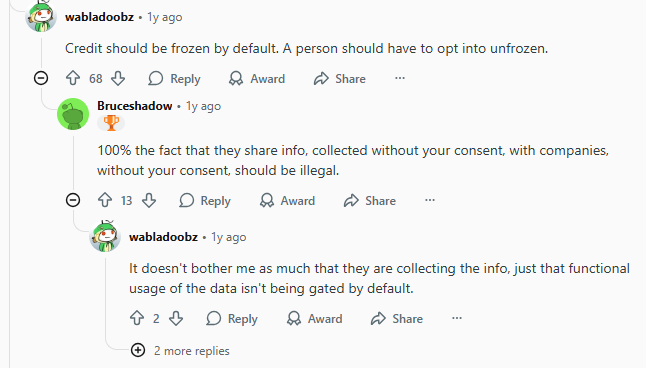

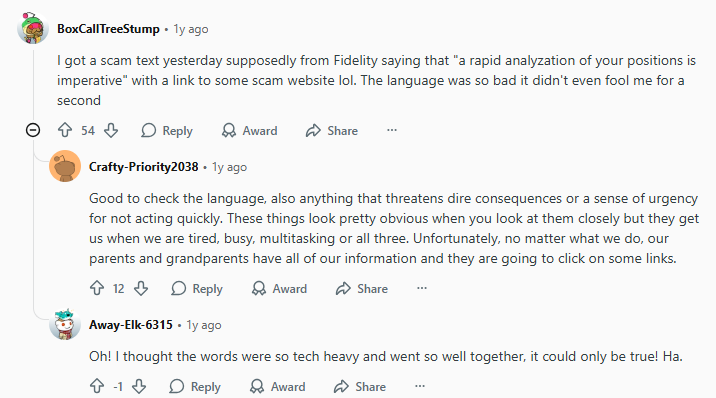

But the real question is how much of your personal data is truly safe. In August 2024, sensitive information like Social Security numbers, driver’s licenses, and document images of 77,000+ users were exposed. Some users reported phishing emails just days later (Reddit thread).

Cyber analysts on Twitter also weighed in — one post by @TheCyberSecHub called it “a wake-up call for financial institutions,” while @WSAV asked bluntly, “Was your account compromised?”

Fidelity is still safe for your money, but not bulletproof for your data. The breach shows that even the most trusted financial brands face digital threats, making vigilance and cybersecurity awareness more important.

How Fidelity Handles Fraud & Disputes

When you ask is Fidelity safe, you also need to know how the firm responds when things go wrong. Fidelity detected the August breach on August 19, 2024, shut down the compromised access and notified regulators, showing rapid incident response.

They have since faced class-action lawsuits, alleging insufficient protection of customer data. However, because the issue was data exposure rather than fund theft, many of the protections clients expect (e.g., full reimbursement) may not apply in the same way.

So, Fidelity’s dispute management appears competent, but the residual risk to your identity remains, and your personal vigilance is still key.

Is Fidelity Safe Compared to Other Institutions?

Yes, in several ways, Fidelity stands among top financial institutions. Its scale, regulatory oversight, and financial strength are major advantages.

But in terms of data safety and identity security is Fidelity safe? Many financial institutions have lower levels of data exposure; Fidelity’s high-profile breach places it under additional scrutiny. If you’re weighing providers, evaluate not just investment fees and performance, but also data-security track record and how they manage identity risk.

Possible Limitations and Real-World Concerns About Fidelity’s Safety

The August breach shows that even trusted firms can have major vulnerabilities: weak internal access, insufficient monitoring, or third-party exposures. The firm’s disclosures show financial accounts weren’t directly impacted, but identity theft risks remain.

Class-actions and regulatory demands may translate to increased oversight, fees or service changes for clients. Your data could be circulating in dark-web markets, meaning phishing risks escalate.

How to Make Fidelity Safer for You

Not sure about is Fidelity safe? Here’s how to enhance your safety:

- Use unique, strong passwords for your Fidelity login and link multi-factor authentication (MFA) immediately.

- Regularly review your account statements and report unusual activity, including small “test” withdrawals or account changes.

- Enable alerts for any login or account changes within Fidelity.

- Consider freezing your credit or placing a fraud alert with major bureaus if your personal data was involved.

- Use secure networks (avoid public WiFi) when accessing your Fidelity account or financial apps.

- Monitor identity-theft watchlists and dark-web exposure reports.

- Keep updated with Fidelity’s communications about the breach and whether you were affected, and follow their recommended steps.

- Ask Fidelity about their data-security practices: encryption, internal access controls, third-party vendor oversight.

How PureVPN Can Keep You Safe While Using Fidelity

When personal data leaks, it often ends up circulating on the dark web, and that’s where PureVPN’s advanced Dark Web Monitoring can help. It continuously scans underground marketplaces for stolen credentials, alerting you instantly if your information appears there.

Plus, with PureVPN, you make sure to

- Protect your financial details and login credentials from interception.

- Keep your data safe even when using unsecured networks.

- Let you safely use Sendwave from countries with internet restrictions.

- Mask your IP address, preventing data tracking and profiling.

- Ensure smooth, lag-free money transfers across 70+ countries.

Final Words

So, is Fidelity safe? The honest answer is yes, to a large extent, regarding your funds and investments, but, when it comes to your personal data and identity, prudence is essential. The August 2024 breach affecting 77,000 customers and the earlier November 2023 incident at a related entity, show that even heavyweight institutions face serious cyber-challenges.

Frequently Asked Questions

Fidelity has improved its internal security since the 2024 breach, adding more monitoring and customer alerts. However, the incident proved that vulnerabilities exist. Stay cautious.

Yes, Fidelity remains one of the most trusted custodians for retirement assets. Your investments are held separately from corporate funds. Still, hackers often target login credentials, so to keep your 401(k) truly secure, combine Fidelity’s tools with PureVPN’s 24/7 real-time threat scanning.

Mostly. Fidelity’s app uses biometric logins and encrypted sessions, but you still face risks on public Wi-Fi or compromised phones. So, is Fidelity safe to use on mobile, only if you access it via secure networks or connect through PureVPN’s encrypted tunnel to prevent snooping and phishing attempts.

Absolutely, the platform is beginner-friendly, regulated, and transparent. But many new users underestimate data-sharing risks. So, Fidelity is safe for new investors, as long as you use strong passwords, MFA, and privacy-protection tools like PureVPN to keep your personal info secure.

Not entirely. Even after tightening its systems, scammers still impersonate Fidelity through fake emails and texts. To minimize this risk, enable email alerts, ignore unsolicited messages, and use PureVPN’s dark web alerts to know if your credentials ever leak online.