If you’re researching reliable international money transfer services, Remitly likely came up. It markets itself as a fast, cost-effective way to send money across borders. But before trusting it with your hard-earned cash, it’s wise to dig into how safe it really is.

In this blog, we’ll look at how secure Remitly really is, from its safety features and privacy practices to user concerns, plus steps you can take to protect your funds.

What Is Remitly?

Remitly is a fintech remittance service founded in 2011 and headquartered in Seattle. It allows users to send money internationally through various delivery methods, including bank deposits, cash pickups, and mobile wallets.

Currently, Remitly operates in dozens of sending countries and serves over 170 receiving countries and territories. Unlike traditional banks, Remitly isn’t a deposit-taking institution in most regions and functions as a licensed remittance and digital financial services provider.

Remitly’s Security Features & What the Privacy Policy Says

Remitly is heavily regulated, which adds to its credibility. It’s registered as a Money Services Business in the US and licensed by the Financial Conduct Authority (FCA) in the UK, complying with global AML and KYC rules to keep your funds secure.

The platform uses bank-level encryption like TLS and AES-256, along with multi-factor authentication and strict access controls to protect user data. Advanced fraud detection systems constantly monitor transactions, and Remitly’s privacy policy ensures sensitive details, like your ID or bank info to stay protected.

Customer funds are safeguarded in separate accounts and protected under local financial regulations. Plus, Remitly’s Trust & Safety Center and Cybersecurity Policy give users clear guidance on staying safe. Overall, it combines regulation, encryption, and transparency to make sending money online secure and reliable.

Is Remitly Safe?

Yes, by and large, Remitly is a safe, legitimate service for sending international money transfers, provided you use it with care.

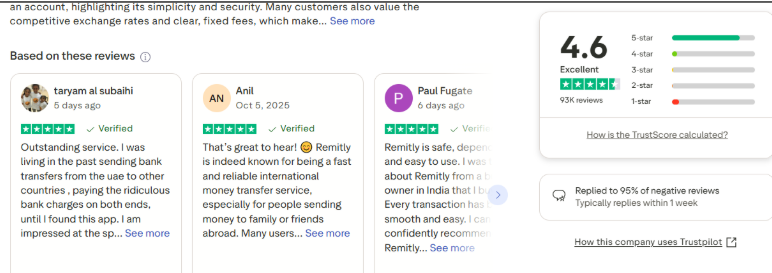

It operates under regulation in major markets and holds appropriate licensing. It uses strong encryption, fraud detection, verification, and safeguarding measures. User reviews are generally positive for Remitly, holding an average Trustpilot score of around 4.6 out of 5, with many users praising its safety and reliability.

However, it is not perfect, with delays, support issues, and user-targeted scams are real concerns. Because of that, Remitly is best used for average or moderate-value transfers, not as a long-term account or high-volume business instrument unless you’re very comfortable with the risk and have backup options.

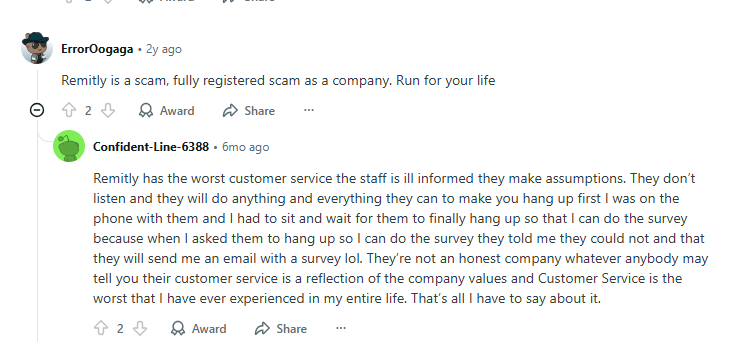

Even with strong systems, no service is perfect. Some users report delays or issues with customer support or transaction processing times in more complex cases. On forums, there are anecdotal claims of funds lost or stuck transfers, though these are hard to verify independently.

Because Remitly handles cross-border payments, the speed and success sometimes depend on intermediary banks, local partners, and regulatory filters, which are factors beyond Remitly’s direct control. Also, like any financial service, it’s a target for phishing, impersonation, and social-engineering scams.

In some countries, local laws might not require Remitly to provide full deposit protection like traditional banks. Insurance guarantees may not apply, and some features such as instant transfers or specific payment options can vary by region, affecting delivery speed and reliability.

How to Use Remitly Safely

Remitly is generally secure, but your account safety also depends on how you use it. Here are some practical ways to protect your money and data:

- Use a strong, unique password: Create a password that’s long, random, and never reused on other accounts. Storing it in a reputable password manager reduces the risk of forgetting or exposing it.

- Enable two-factor authentication (2FA): Always activate 2FA through an authenticator app or SMS (if supported in your region). This adds a crucial layer of protection, even if your password is compromised.

- Double-check recipient details: Verify the recipient’s name, bank account, and country before confirming a transfer. Even a small typo or mismatched bank code can result in delays or misrouted funds that are difficult to recover.

- Don’t keep large balances: Remitly is a transfer service, not a bank. Avoid using it as a storage account and transfer only what you need, then withdraw or move the rest to a secure, insured financial institution.

- Avoid public Wi-Fi for transactions: Public networks are prime targets for hackers who intercept sensitive data. If you must use one, connect through a reliable VPN to encrypt your internet traffic and prevent snooping.

- Watch out for impersonation scams: Remitly will never ask for your password, one-time codes, or full ID over email, SMS, or phone. Be cautious of phishing messages pretending to be “support” or offering fake refunds or bonus transfers.

- Keep your devices and app updated: Install updates for your phone, operating system, and Remitly app regularly. Updates patch known vulnerabilities that hackers can exploit.

- Monitor account activity and set alerts: Enable transaction notifications so you’re instantly aware of any unauthorized activity. Review your transfer history frequently to catch potential issues early.

- Report suspicious behavior immediately: If you notice unusual login attempts, failed transfers, or unexpected requests for personal data, contact Remitly support directly from within the app or official website, and never from third-party links.

- Understand your protection level: Regulations differ by country. Check if Remitly is operating under a banking or e-money license where you live, and whether your funds qualify for safeguarding or deposit protection under local law.

Conclusion

Remitly is broadly safe, well-regarded, and backed by regulatory frameworks and strong technical safeguards. But “safe” never means risk-free. As long as you use it conscientiously and don’t treat it like a bank for long-term storage, it’s a solid option for international transfers.

Frequently Asked Questions

Yes. As with many financial services, if activity looks suspicious or triggers compliance rules, your account may be locked or require verification. This is standard for AML/KYC enforcement.

Remitly sometimes offers refunds or investigations for delayed or failed transfers, depending on the case and jurisdiction.

It depends. The higher the amount, the more scrutiny and risk. Remitly sometimes imposes limits. If you’re sending large sums, verify details carefully, consider splitting transactions, and use extra caution.

Traditional banks have decades of regulatory oversight, deposit insurance regimes, and infrastructure. Remitly offers certain advantages like speed and specialization, but in exchange, you accept fintech-style risks such as platform downtime, partner dependencies, and regulatory complexity. It’s always best to stay prudent whenever your finances are involved.