Chances are, if you’re considering a modern digital bank or fintech app, Revolut has crossed your radar. It promises perks like easy foreign currency spending, sleek budgeting tools, crypto access, and instant transfers.

But with any app that handles your hard-earned money, it’s worth understanding how safe it really is. In this blog, we’ll find out whether or not Revolut is safe, and most importantly, how you can protect yourself while using it.

What Is Revolut?

Revolut is a Lithuania-based fintech company offering digital financial services, such as current accounts, debit cards, currency exchange (often with better rates than traditional banks), budgeting, and crypto trading.

It operates in many countries, often under e-money or bank licenses, depending on the jurisdiction. It’s meant to be a “one-stop” financial hub for people who travel, make digital transactions, or want extra flexibility outside traditional banking.

Revolut’s Security Features & What the Privacy Policy Says

To figure out how safe Revolut is, it helps to look at what they promise in their privacy policy and what’s required by law. Revolut states that customer money is safeguarded. In many regions, it operates under e-money or banking regulations that require financial safeguarding or deposit protection.

Their privacy policy confirms compliance of GDPR (for EU/EEA), and general global data protection laws where applicable. There are systems for fraud detection and protection, and support for features like locking cards, disposable (virtual) cards, phone, and in-app verification procedures.

Revolut also uses encryption to protect data in storage and transit, along with multi-factor authentication to secure account access. So, if you take these things into consideration, Revolut has many of the right building blocks. But as with all financial techs, “on paper” doesn’t always mean perfect in practice.

Is Revolut Safe?

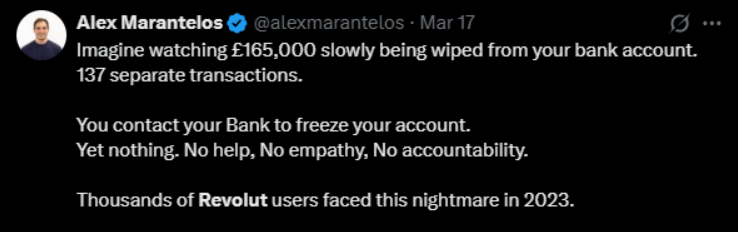

When you scroll through public discussions, people love Revolut’s for its slick design, low FX fees, and instant payments. Others complain about sudden account freezes, poor customer support, and vague responses when things go wrong.

In September 2022, Revolut suffered a cyberattack via social engineering that affected around 50,150 customers globally (20,687 in the EEA). The exposed data included names, addresses, emails, phone numbers, partial payment card data, and account information, though Revolut stated no funds, PINs, or passwords were taken.

Regulators in Lithuania and the EU launched investigations after the breach and Revolut was later fined €3.5 million by the Bank of Lithuania for deficiencies in its anti-money laundering controls. Many users have also reported issues like delayed support responses, frozen accounts, and identity verification troubles, especially when fraud is suspected.

Revolut also collects extensive data, including your name, device ID, transaction history, and location. While necessary for compliance, this data passes through several third-party partners handling payments, crypto, and fraud detection. If any of those partners experience a breach, your data could be at risk too.

Finally, Revolut’s automated fraud-detection systems can be overly aggressive, sometimes flagging legitimate transactions and locking accounts. Combined with limited customer support, this continues to fuel user frustration and doubt around how “safe” Revolut truly is in real-world use.

How to Use Revolut Safely

Like any digital finance app, your safety on Revolut depends on how you use it. Here are key ways to strengthen your protection and reduce risks:

Enable all security features

Turn on every available security feature, including two-factor authentication (2FA), biometric unlocks, and the card freeze/unfreeze option. These tools help block unauthorized logins and prevent fraudulent use if your card or device is compromised.

Avoid storing large balances

Revolut is an e-money institution in many regions, not a traditional bank, meaning funds may not always fall under full deposit insurance (like the FSCS or FDIC). Keep only what you need for spending, and move larger savings to insured bank accounts.

Watch out for phishing and scams

Fraudsters often impersonate Revolut via fake emails, texts, or social media messages. Revolut will never ask for your PIN, password, or one-time code. Always check the sender address and avoid clicking links that redirect you outside the app or official site.

Use virtual or disposable cards

If you want to make online purchases, Revolut offers single-use or virtual cards that automatically change details after a transaction. This reduces exposure if a merchant’s system is hacked or compromised.

Monitor your transactions and alerts

Enable instant payment notifications and review your activity on a regular basis to identify anything suspicious. Unrecognized charges should be reported to Revolut support immediately through the in-app chat.

Understand local regulations

Depending on where you live, Revolut may operate under an e-money license or a full banking license. That difference affects deposit protection and dispute resolution rights, so it’s important to check your region’s coverage.

Keep your app and device secure

Always update your Revolut app and mobile OS to the latest version. Use a strong passcode or biometric lock on your phone, and make sure to avoid installing unverified apps that might access sensitive data.

Use a VPN on public Wi-Fi

If you have to access Revolut over public Wi-Fi networks like those at cafes, airports, and hotels, do not forget to use a VPN to encrypt your connection and protect login or transaction data from interception.

Review Revolut’s privacy and terms updates

Revolut occasionally updates its privacy policy and data-sharing terms. Skimming these updates helps you stay informed about how your information is processed or if any new partners handle your data.

Conclusion

Revolut is safe to use, but it’s not flawless. Some privacy policy ambiguities, past breaches, occasional customer service failures, and geographic variations in protection mean you should use Revolut smartly. If you’re going to use Revolut, enable security features, stay alert to phishing, don’t stash all your cash there, and understand your local regulatory protections.

Frequently Asked Questions

Yes, several users have reported that accounts have been suspended or restricted for “suspicious activity” or KYC verification issues, sometimes without detailed explanation. This is especially common with large or unusual transfers.

Crypto trading within Revolut carries added risk due to regulatory limits and reliance on external wallet providers. Use it cautiously, only with small amounts, verified sources of funds, and full awareness that crypto is not protected like fiat balances.

That depends on your country. In some regions, Revolut operates as a fully licensed bank with deposit insurance (up to €100,000 in Lithuania, for example). In others, it functions as an e-money institution, meaning funds aren’t covered by deposit protection schemes

Exercise caution. Revolut works well for daily transactions, travel, and smaller balances. But for significant savings or business funds, a traditional bank with full deposit insurance and responsive support may be safer