If you’ve ever wondered, is SoFi safe, you’re not alone. The fintech boom has made digital banking convenient, but it’s also blurred the line between financial freedom and cyber risk. With SoFi managing everything from loans and credit cards to investing and checking accounts, you have every reason to ask how secure their money and data really are.

In this guide, we’ll unpack how safe SoFi actually is, what recent incidents reveal about its cybersecurity posture, and how you can stay protected with extra privacy layers, specifically when using public WiFi or managing your finances online.

What Is SoFi?

SoFi (Social Finance Inc.) is a U.S.-based online bank and fintech company founded in 2011. It started by offering student loan refinancing but now operates as a full-service digital financial hub, covering personal loans, investing, insurance, and even cryptocurrency trading.

SoFi is federally regulated, publicly listed on NASDAQ, and supervised by the Federal Deposit Insurance Corporation (FDIC), which means eligible cash balances are insured up to $250,000 per depositor. That alone makes many users think, “yes, SoFi is safe.” nBut as we’ll see, digital safety goes deeper than FDIC coverage.

Is SoFi Safe for Your Money?

Is SoFi safe from a financial standpoint?

SoFi’s capital strength and FDIC protection make it one of the stronger online banks. However, when it comes to cybersecurity and data privacy, the picture isn’t entirely flawless.

In May 2024, the Financial Industry Regulatory Authority (FINRA) fined SoFi $1.1 million for failing to properly verify user identities. This oversight allowed fraudsters to steal $8.6 million from accounts at other financial institutions using fake SoFi accounts created through weak identity-verification tools between 2018 and 2019.

A Reddit user summed it up perfectly:

“SoFi might be safe for deposits, but the identity-verification mess shows their system isn’t bulletproof.”

While SoFi emphasized that no customer SoFi accounts were directly compromised, the fine highlighted how a gap in verification protocols can ripple across the financial ecosystem.

Analysts noted that this wasn’t a traditional data breach, but rather a fraud and compliance lapse, showing how even a top fintech brand can become a gateway for broader financial exploitation.

Is SoFi Safe from Cyber-Hacks and Data Breaches?

Technically speaking, SoFi has not suffered a major data breach that exposed core banking systems or customer accounts. However, several cybersecurity concerns are there:

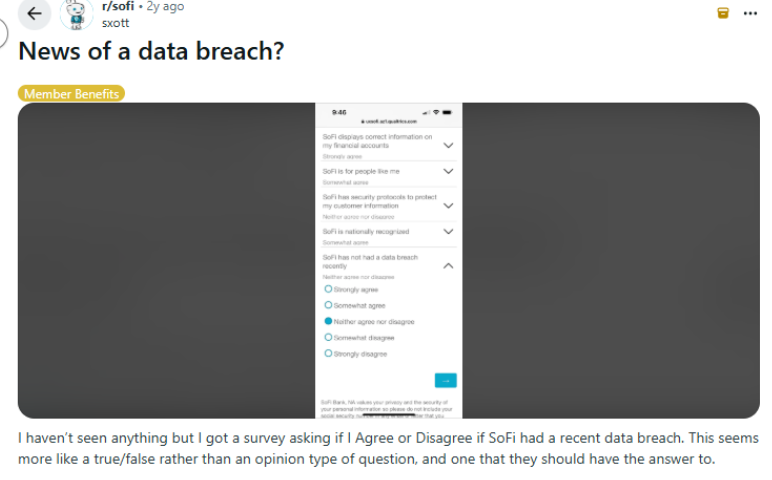

- Data leaks — In May 2023, users on Reddit speculated about a possible SoFi data vulnerability, with one saying:

“I got weird login attempts and alerts from SoFi, feels like there’s a data leak nobody’s talking about.”

While no official breach was confirmed, the chatter was public skepticism.

- Identity fraud — The 2024 FINRA case proved that SoFi’s reliance on third-party ID verification left cracks for bad actors.

- Phishing and social engineering — SoFi’s own security center warns about fake customer-support emails and cloned websites, a growing problem as scammers mimic SoFi branding.

So, is SoFi safe from cyber-hacks? Mostly, yes, its servers and encryption are strong. But the human factor remains the biggest threat.

How SoFi Protects Your Data

To its credit, SoFi uses a layered security framework:

- 256-bit encryption across its apps and servers.

- Firewalls and anomaly detection for suspicious logins.

- Multi-Factor Authentication (MFA) for account access.

- Biometric verification on mobile devices.

- Independent security audits and penetration testing.

The company’s transparency reports show compliance with U.S. and global data-protection standards, including the California Consumer Privacy Act (CCPA) and GDPR-like frameworks.

However, experts point out that SoFi’s centralized ecosystem, combining loans, investments, and crypto, means a single compromised credential could expose multiple services at once.

How SoFi Handles Fraud & Disputes

SoFi’s fraud response is generally responsive but reactive. The firm investigates unauthorized activity and may reimburse affected users after verification, but this depends on whether the issue stemmed from their systems or from user error.

If you send money to a scammer, or fall for phishing, SoFi may not recover your funds. Like Zelle and Cash App, disputes involving authorized transfers (even if tricked) are difficult to reverse. SoFi’s help center now emphasizes faster reporting and MFA setup. Still, Reddit users have expressed frustration:

“SoFi froze my account for a week after reporting fraud — good they acted, but my bills were stuck.”

— r/sofi subreddit discussion

That shows progress, but also how challenging fintech fraud handling can be.

How to Make SoFi Safer for You

To ensure your SoFi experience remains secure, take these proactive steps:

- Enable MFA and biometric logins — Always verify logins with an additional authentication factor.

- Use strong, unique passwords — Never reuse them across platforms.

- Avoid public Wi-Fi when managing money — or use a VPN for encrypted access.

- Monitor transactions frequently — Report anomalies fast.

- Turn on instant alerts for account activity.

- Don’t click links in unsolicited messages claiming to be from SoFi.

- Freeze your credit if you suspect identity misuse.

Your account is only as safe as your digital hygiene.

How a VPN Can Keep You Safe on SoFi

Even if SoFi’s servers are protected, your connection might not be. That’s where PureVPN adds a crucial safety layer.

Why Use PureVPN with SoFi?

- Encrypts your internet connection, blocking hackers from intercepting banking data.

- Prevents identity leaks when accessing SoFi on public Wi-Fi.

- Masks your IP address, keeping your online activity private from snoopers.

- PureVPN scans 24/7 to alert you if your SoFi login, email, or personal data appear on breach forums.

- Real-time alerts and constant network monitoring keep your financial identity safe.

- Use SoFi securely from anywhere, even when traveling.

Is SoFi Safe Compared to Other Platforms?

Here’s a quick comparison of SoFi vs other fintechs in terms of safety:

| Feature / Platform | SoFi | Chime | Robinhood | Fidelity |

| Regulation | FDIC insured | FDIC insured | SEC & FINRA regulated | SEC & SIPC regulated |

| Encryption | 256-bit | 256-bit | 256-bit | 256-bit |

| Buyer Protection | Limited | Moderate | Moderate | Strong |

| Reported Breaches | None major | Minor fraud cases | Credential leaks (2021) | Data breach (2024) |

| Dispute Handling | Moderate | Moderate | Weak | Strong |

| Fraud Risk (2025) | Medium | Medium | Medium | Medium-High |

Final Thoughts: Is SoFi Safe in 2026?

SoFi is a financially solid institution, protected by FDIC insurance and reinforced by modern encryption. Yet, its track record, including the 2024 $1.1M FINRA fine and past identity-verification lapses shows that safety isn’t automatic.

Ultimately, SoFi is as safe as you make it. Use MFA, be cautious with phishing, and monitor your data with PureVPN’s dark-web monitoring and 24/7 breach alerts to ensure your financial life stays locked down.

Frequently Asked Questions

Yes, SoFi Bank deposits are FDIC-insured up to $250,000, making it financially secure. However, protect your data with MFA and PureVPN to avoid phishing or credential theft.

So far, yes. There’s been no major SoFi data breach, but identity-fraud lapses (like the 2024 case) remind us that even secure platforms need user caution.

Financially, yes. But smaller fintechs with stricter KYC (Know-Your-Customer) checks may offer better fraud resistance.

Mostly. SoFi partners with licensed exchanges, but crypto remains high-risk and uninsured. So, it is better to stay cautious.

No, SoFi doesn’t sell your personal data to third parties. However, like most financial apps, it may share limited information with partners for fraud prevention, analytics, or regulatory compliance. Always review SoFi’s privacy policy to understand how your data is collected, stored, and protected.