If you’ve ever paused before hitting “Send” and wondered, Is Zelle safe? You’re not alone. As peer-to-peer payment apps take over our daily transactions, the risks around privacy, data leaks, and scams are rising fast.

In this guide, we’ll pull back the curtain on how safe Zelle really is, what protections it doesn’t offer, and what you must know before trusting it with your hard-earned money.

Is Zelle Safe for Your Money?

Yes, Zelle is generally safe because it’s backed by major U.S. banks and uses secure encryption for money transfers. However, it lacks the buyer protection offered by credit cards or platforms like PayPal, meaning once you send money, you can’t reverse the transaction. Always use Zelle only with people you personally know and trust. For example, one user wrote:

“Zelle is only for transactions between yourself and people you trust.”

That tells you something, the service might be encrypted and bank-backed, but the trust factor still lies with you.

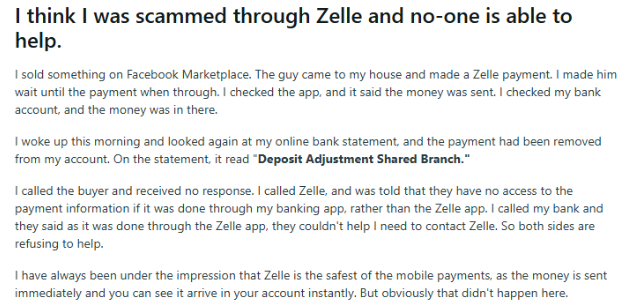

In fact, Zelle’s speed and direct bank access mean when things go wrong, they often go very wrong. One Reddit thread:

“No. Zelle has no buyer protections. It isn’t for goods and services. Your money is gone.”

Is it possible to get my money back if I use Zelle?

byu/Demain_Z inScams

These voices show that the question isn’t just is Zelle safe?, but “can you get your money back when it isn’t?”

The stats back it up: lawmakers found that only about 38% of fraud claims from Zelle transfers were reimbursed in 2023.

So yes, using Zelle can feel safe, if you’re sending money to a friend you trust, from a secure device, with your guard up. But if you’re buying from someone you don’t know, clicking a link from a random seller or responding to a “friendly” message saying you owe them a refund: well, the platform’s convenience becomes a huge risk.

Redditors report getting random Zelle payments and then receiving back-transfer demands:

“They will ask you to send them money back … when eventually Zelle pulls the money because of fraud, you’ll be on the hook.”

The verdict? Zelle’s not “unsafe” by default, but your behaviour becomes the weak link.

Is Zelle Safe from Privacy & Data-Security Threats?

Technically, yes, Zelle encrypts your data and operates within the security frameworks of major U.S. banks. But dig a little deeper, and the cracks start to show. According to Zelle’s Privacy Notice, the app collects, retains, and shares personal data for business and analytics, which means your financial info doesn’t always stay private.

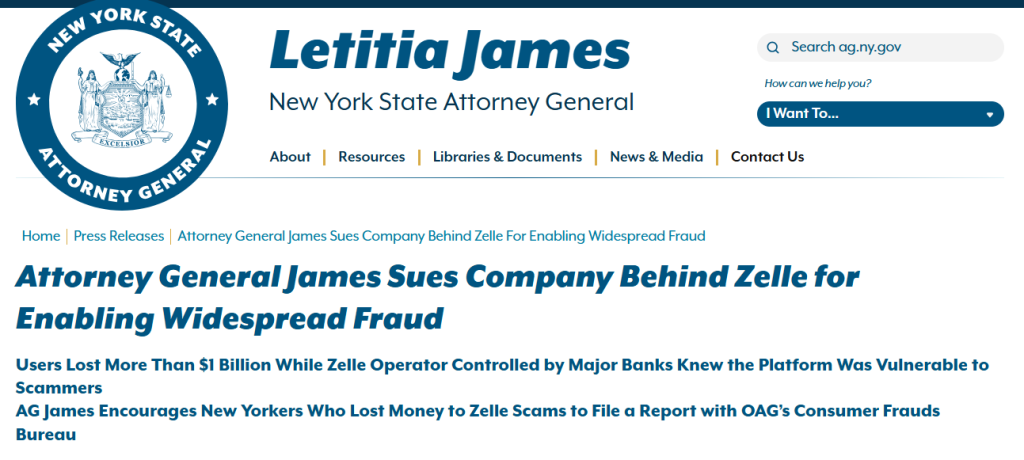

Zelle hasn’t suffered a major cyber breach, but social engineering scams remain rampant. The New York Attorney General’s lawsuit against its parent company, Early Warning Services, accuses it of failing to implement adequate anti-fraud controls, a red flag for privacy-conscious individuals. So, while Zelle’s system itself may be secure, your personal safety depends on vigilance, device hygiene, and using PureVPN to shield your data from unwanted exposure.

How Zelle Handles Fraud & Disputes

Zelle’s official policy says they’ll investigate unauthorized transactions, like if someone hacked your account, but they don’t cover “authorized” payments, even if you were tricked into sending them. Some banks are starting to step up; a few now reimburse victims of confirmed scams, but it’s not consistent.

If you spot suspicious activity, contact your bank immediately; speed is everything. Turn on alerts, enable multi-factor authentication, and never trust random “Zelle support” messages online. So, Zelle’s dispute process is reactive, not protective, meaning you need to be proactive about your own safety.

How to Make Zelle Safer for You

If you’re using Zelle, you can take proactive steps to strengthen your safety, data privacy and fraud protection.

- Use unique, strong passwords and enable multi-factor authentication (MFA) for your bank account.

- Ensure your bank app, operating system, and device security are up to date.

- Use a secure phone number and email for Zelle enrolment, one you don’t share casually.

- Enable transaction alerts so you’re notified immediately when money is sent or received.

- Avoid using public WiFi or shared devices when using your banking app or Zelle.

- Only send money to people you know and trust. Verify the recipient’s phone number or email is correct.

- Regularly review your statements for unauthorized transactions and act quickly if you spot something.

- If you’re in a region with access, consider using PureVPN when using your banking app in untrusted networks.

- Educate yourself on common Zelle scams, e.g., fake “bank alerts”, impersonation, requests via social-media to send via Zelle.

Zelle vs Other Payment Apps: Which One Is Really Safe?

When it comes to sending money online, speed isn’t everything, safety is. Apps like PayPal, Venmo, and Cash App may look similar to Zelle, but they differ greatly in privacy, fraud protection, and refund policies. Here’s a quick comparison.

| Feature / Platform | Zelle | PayPal | Venmo | Cash App | Apple Pay |

| Ownership | Early Warning Services (owned by major U.S. banks) | PayPal Holdings, Inc. | PayPal Holdings, Inc. | Block, Inc. | Apple Inc. |

| Data Encryption | Yes, bank-level encryption | Yes, TLS & HTTPS | Yes | Yes | Ye, hardware-based encryption |

| Buyer Protection | None for personal payments | Strong protection for purchases | Limited | Limited | Purchases protected via Apple Pay |

| Refunds for Scams | Rarely refunded | Usually refundable | Depends on case | Limited | Usually refundable |

| Fraud Risk | High (instant, irreversible transfers) | Low | Moderate | Moderate | Low |

| Privacy Practices | Collects and shares user data for analytics (Zelle Privacy Notice) | Retains transaction data for compliance | Shares limited data | May share with third parties | Minimal data sharing |

| User Verification | Linked bank account, phone, or email | Verified PayPal account | Phone or email | Phone or email | Apple ID + Face/Touch ID |

| Reported Scams (2024–2025) | >$125M annually (MarketWatch) | Lower, mostly seller disputes | Growing via social scams | Fake support cases rising | Minimal |

| Ease of Reversal | Almost impossible | Easy for eligible claims | Hard | Hard | Possible via bank/Apple |

Frequently Asked Questions

Yes, technically the network supports large transfers, but the risk increases when the recipient isn’t known. Because Zelle does not offer purchase-protection, you should treat large transfers with extra caution and verify recipient details.

No, Zelle isn’t completely safe from cyber-hacks. While it uses bank-grade encryption, hackers often exploit users through phishing emails and fake Zelle alerts.

No, Zelle works primarily in the U.S. with U.S.-based banks and U.S. mobile numbers/emails. If you’re outside the U.S. then Zelle likely won’t be available or may have restrictions. Check with your financial institution.

In terms of banking-level integration and infrastructure, Zelle is strong. But unlike PayPal or Venmo, Zelle’s “buyer protection” is minimal. If you’re sending money for a purchase from someone you don’t know, PayPal might give you more recourse than Zelle.

Final Words: Is Zelle Safe?

Yes, for many common uses, Zelle is safe. If you’re sending money to someone you trust, within the U.S., using your bank’s app, and you’ve followed good security habits, Zelle delivers a reliable way to transfer funds quickly.

But your data is collected, retained, and shared for business purposes; fraud and scams do happen; and the protections you get for loss of money via Zelle may be less robust than what you expect. Choose your financial providers wisely!