If you’ve ever linked your bank account to apps like Venmo, Robinhood, or Acorns, chances are you’ve already used Plaid, without even realizing it. But as fintech grows, so do user concerns: is Plaid safe for your sensitive banking data?

This blog takes you inside how Plaid works, its encryption standards, real-world legal challenges, and what privacy issues you could face.

What is Plaid?

When a fintech app asks you to “connect your bank” and you see the familiar screen for Plaid Inc., you might not stop thinking is Plaid safe?

Plaid is a fintech infrastructure company that acts as a bridge between your financial institution and the apps you use, budgeting tools, payment services, and investment platforms. It enables thousands of apps to link to your bank account and read balances, transactions, account details under your consent.

In many cases you’ll enter your bank credentials (or OAuth through your bank) in Plaid’s screen, then Plaid passes a secure token to the app so the app doesn’t store your raw password.

Is Plaid Safe to Use?

Industry reviews say Plaid is mostly safe or reasonably safe as a bank-link aggregator. As, Plaid has implemented strong security protocols. For example, Plaid states it is certified in ISO 27001, ISO 27701, SOC 2, uses AES-256 encryption, TLS, MFA, independent audits.

Also, Plaid has not been publicly reported as having suffered a data-breach with a massive leak of credentials. However, it has faced major legal and privacy controversies (data collection, usage) which make us think is Plaid safe for both security and privacy.

Also, your safety depends not only on Plaid’s controls, but your bank, the app you link to, the network you’re on, and how you use all these.

Here’s what people think:

“Plaid is very sensitive to privacy concerns due to a lawsuit on that topic that they settled a bit ago. The result … they tightened up data retention …”

“Yes, Plaid is safe. Most companies now will only use plaid. … It’s becoming harder and harder to link your bank account SECURELY without plaid.”

PLAID is a legit company… but during the process they asked me to provide them with my banking user and password. That is just insane.”

These show mixed sentiments: trust but also discomfort. Thus, when thinking about Plaid being safe, you’ll need to consider both sides.

How Plaid Protects Your Data

When it comes to protecting your financial data, Plaid doesn’t cut corners. It starts with bank-grade AES-256 encryption and TLS protocols, which lock down your information during transfer, the same technology trusted by major financial institutions.

To add another layer of defense, Plaid steps in with multi-factor authentication (MFA) even when your bank doesn’t, ensuring that no one can access your data without your explicit verification.

Beyond that, the company holds globally recognized certifications like ISO 27001, ISO 27701, and SOC 2, which prove that its systems undergo rigorous, independent security audits. But Plaid’s commitment doesn’t stop at infrastructure, it empowers users, too.

Through the Plaid Portal, you can easily view which apps have access to your bank account, disconnect any you no longer trust, or delete connections entirely, giving you complete visibility and control.

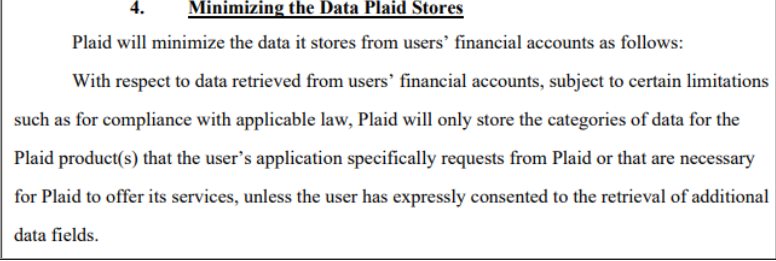

And after its $58 million legal settlement, Plaid doubled down on data minimization, pledging to store only the information truly needed and discard the rest. Taken together, these safeguards make a compelling case that the answer to is Plaid safe, is a yes, but safe doesn’t always mean risk-free, so it’s wise to stay alert and protect your financial privacy.

Risks to Know If You Are Using Plaid

Even if Plaid is safe, risk remains.

- Over-permission or data scope risk: When you link via Plaid, you may grant an app broad access (transactions, multiple accounts) even if you only wanted a simple service.

Mitigation: Check what data the app is requesting and which accounts you’re linking. Unlink unused apps via Plaid Portal.

- Credential entry risk: Some banks/apps still require you to input your bank login into Plaid’s interface (screen-scraping mode). Reddit users flagged this.

Mitigation: Prefer apps/banks that support OAuth (you login directly at your bank, token passed). If you entered credentials, consider changing your bank password and enabling MFA.

- Third-party app risk: Plaid may secure the link, but if the app you connect to is insecure, your data/credentials may still be at risk.

- Mitigation: Use trustworthy apps, check reviews, enable strong passwords + MFA, keep apps updated.

- Network risk: If you link your bank on public WiFi without additional encryption, you expose your session.

Mitigation: Use PureVPN when linking on untrusted networks.

- Data-collection/retention risk: Even if there’s no breach, your financial history may be stored and used by Plaid or the app.

Mitigation: Review Plaid Portal, disconnect what you don’t need, periodically change bank password, enable alerts for any unusual linkages.

How a VPN Enhance Your Security While Using Financial Apps

When you’re linking your bank account via Plaid, you involve multiple systems: your device, your network, your bank, Plaid, the fintech app. PureVPN adds an extra protective layer:

- Encrypts your network connection on public WiFi or mobile hotspot, reducing risk of interception or WiFi-based attacks.

- Masks your IP address, limits tracking of your device location when linking banking/fintech apps.

Conclusion

Yes, Plaid is among the safer methods for linking your bank account to fintech apps. It has strong technical safeguards, no known major breach, and allows user controls. But remember that safety is not without any risk. The privacy history, the broad data access, and the network/user-practice risks mean you should treat Plaid as a trusted but still require vigilance platform.

Frequently Asked Questions

Yes, Plaid is generally considered safe for linking your bank account to apps like Venmo, Robinhood, or Mint. It uses AES-256 encryption and TLS protection, the same level of security banks rely on, to keep your data protected while in transit. However, while the technology is secure, always remember that no online platform is 100% risk-free.

No, Plaid has not experienced a direct cyberattack or traditional data breach. However, it has faced privacy controversies, including a $58 million class-action settlement in 2021 over allegations of collecting and using customer data without proper consent. This was a legal and ethical issue, not a hacking incident, but it did lead to stricter privacy controls.

Yes, Plaid is safe for both international users and those who connect via VPNs. Using PureVPN can add an extra privacy layer by encrypting your internet traffic, reducing risks from network monitoring or phishing attempts. It’s specifically more useful if you often log into financial apps while traveling or using public Wi-Fi.

Plaid does not store your banking username or password in plain text. Instead, it uses tokenization, which replaces sensitive credentials with encrypted tokens that apps use to verify your identity, meaning Plaid cannot actually see or misuse your raw login details.