If you’ve ever wondered, is Sendwave safe? Before sending money across borders, you’re not alone. With mobile remittance apps like Sendwave gaining popularity, questions about data protection, fraud risks, and regulatory compliance are front and centre.

In this guide, we’ll pull back the curtain on how safe Sendwave really is, what protections it offers, what it misses, and what you must know before trusting it with your money.

What is Send Wave?

Sendwave is a mobile money transfer app that helps you send funds instantly to friends and family in countries across Africa, Asia, and Latin America. Founded in 2014 and now owned by WorldRemit, it’s designed for low-fee, fast international remittances.

The app connects directly to your debit card and delivers money to mobile wallets or bank accounts, no agents or cash pickup required. Sendwave is regulated by FinCEN (U.S.) and the FCA (U.K.), giving it a layer of financial oversight. However, while it’s convenient and affordable, you should stay alert to scams and verify recipient details before sending.

Is Sendwave Safe for Your Money?

Yes, Sendwave is safe, but it depends on how you use it, where you send the money, and how diligent you are.

Sendwave is regulated in key markets. The app is registered with major authorities (e.g., the U.K.’s FCA and U.S.’s FinCEN) which enhances its legitimacy. The platform uses strong encryption and claims to encrypt user data with 256-bit encryption and protect transactions with passkey login and other layers. The company holds customer funds in dedicated accounts (at least in the UK context) so that, if they hold your money temporarily, it’s segregated from their operational funds.

But you must still stay cautious! Because transfers are nearly instant and go to mobile wallets or bank accounts in many countries, once you hit “Sendwave”, recovering funds is often very difficult or impossible.

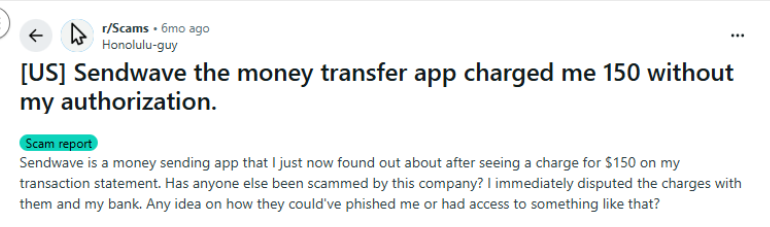

On Reddit users have raised concerns:

“Sendwave is not safe. Scammers are using that a lot. They do not have robust checks and balances.” Reddit

Also, the Consumer Financial Protection Bureau (CFPB) took action against Sendwave’s parent company (via Chime) for misleading users about transfer speed and cost and failing to handle consumer disputes appropriately.

So, if you’re sending money to someone you trust, in a country where Sendwave supports delivery, from a secure device, Sendwave can be safe. However, if you’re dealing with unfamiliar recipients, using public Wi-Fi, or trusting promotional claims without verification, the risk increases significantly.

Is Sendwave Safe from Privacy & Data-Security Threats?

Technically, yes, Sendwave employs industry-leading encryption and standard protections. But that doesn’t mean your data is invulnerable.

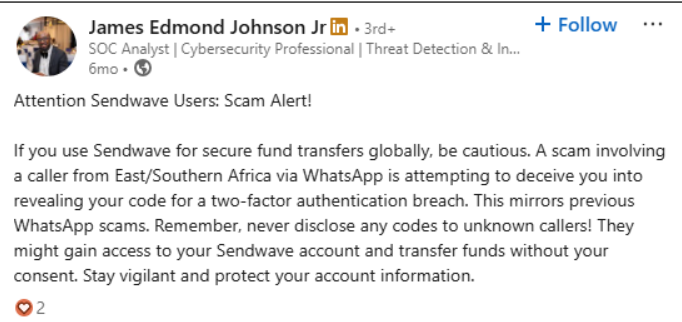

Sendwave explains that data is encrypted as soon as it’s entered into the app and remains protected in transit. They also publish guidance about phishing scams and warn users about fraudulent messages pretending to be from Sendwave.

However, because the app deals with personally identifying information (PII), transaction history, device identifiers, and recipient banking/mobile wallet details, the data footprint is significant. The Reddit commentary indicates worry about how smoothly these systems handle fraud and account misuse:

“They charged me $150 without my …” Reddit

So while Sendwave’s system appears solid, you still carry responsibility: keeping your device secure, avoiding public networks, verifying recipients, and being alert to social engineering.

How Sendwave Handles Fraud & Disputes

Because money transfers via Sendwave are typically final or near-final, the fraud and dispute handling becomes a key concern.

- Sendwave monitors for suspicious activity and claims to use technology to detect fraud in registrations, logins and transactions.

- But as the CFPB’s action noted, Sendwave (or its parent) was found to have inadequate error handling, disclosure practices and dispute investigations.

- If you send money to a wrong recipient or fraudulent party, you will likely not be able to reverse the transfer, especially once delivered. Sendwave’s documentation states they cannot reverse funds that the recipient has already utilized.

Therefore, the dispute process is reactive rather than protective. Fraud prevention is better than reclaiming lost funds, you should assume that once the money is out, your recourse is limited.

What You Can Do to Make Sendwave Safer for You

Given the above, you should treat Sendwave like a fast but final money-transfer tool. To tighten your safety:

- Use strong, unique passwords, and enable two-factor authentication (2FA) if available.

- Ensure your phone and app are fully updated, and avoid using public WiFi or shared devices when sending funds.

- Double-check recipient details: name, phone number, mobile wallet or bank account. Sending a small test amount first is wise.

- Use a secure network or VPN when using the app in untrusted locations.

- Regularly monitor your account and transaction history for unauthorized activity.

- Avoid sending money to strangers or for deals/promotions you didn’t initiate.

- Understand the terms: read the agreement, know your protection rights (especially since Sendwave isn’t a bank in some markets). For example, in the UK your funds aren’t covered by the FSCS deposit protection.

How a VPN Can Keep You Safe on Sendwave

Using a VPN while sending money through Sendwave adds a layer of privacy and protection. Here’s why PureVPN is your best companion for secure transfers:

- Protects your financial details and login credentials from interception.

- Keeps your data safe even when using unsecured networks.

- Lets you safely use Sendwave from countries with internet restrictions.

- Masks your IP address, preventing data tracking and profiling.

- Ensures smooth, lag-free money transfers across 70+ countries.

Final Words: Is Sendwave Safe?

Sendwave is safe, but consider diligence. Its strong encryption, regulatory registration, mobile-first design, and speed make it a solid option for remittance transfers.

Because transfers often finalize quickly, because full refunds or reversals are rare, and because your data is collected and used, your experience depends as much on you as on the app.

So, if you are thinking is Sendwave safe, you must use it carefully, know who you’re sending to, and secure your device and network with PureVPN.

Frequently Asked Questions

Yes, technically, the platform supports sizable amounts (subject to verification). But a higher value means greater risk, once sent, recovery is difficult. The same protections for smaller amounts apply.

Yes, that’s the primary design of Sendwave. But “safe” doesn’t equal risk-free: each corridor (sender country → recipient country) has different payout methods, rules, and protections; be sure to check.

Sendwave compares reasonably well in encryption and data practices, but it lags somewhat in dispute/refund mechanisms and transparency of exchange-rate markups. For buyer protection or recourse, some competitors may be stronger.