With over 14 million users and counting, Chime has become one of the biggest names in digital banking, but that popularity also raises serious questions about security and privacy. Chime promises FDIC-insured deposits, fraud alerts, and slick app security. But dig a little deeper, and things get more complicated.

With sudden account freezes and data-tracking concerns, it’s fair to ask whether your money — and your personal information are truly safe. In this guide, we’ll break down how Chime protects your funds, the risks most people overlook, and how you can stay safe. By the end, you’ll have a clear answer is Chime safe, or just convenient?

Is Chime Safe and How Does it Work?

Though many people consider Chime an online bank, technically, it isn’t one. Chime partners with banks, specifically The Bancorp Bank, N.A. and Stride Bank, N.A., that hold customer deposits and are FDIC-insured. Because of this layered structure (fintech company + partner banks), users often doubt its safety.

Key features supporting safety:

- Deposits held via partner banks are FDIC-insured up to standard limits (typically up to $250,000 per depositor, per bank).

- Encryption, strong infrastructure controls, and standard security frameworks like NIST CSF, ISO 27001, PCI-DSS used by Chime.

- Features to help protect you: two-factor authentication, biometric login, instant transaction alerts, ability to block cards instantly.

Because Chime itself is not a bank, your deposits are held by partner banks, you’re not directly a depositor of “Chime Bank”. Some confusion arises here. Online-only banking means you won’t have in-branch services, which may impact how you handle certain issues.

Some user complaints have emerged (account closures, refund delays), which raise questions around operational risk. Importantly for the data-conscious, Chime’s privacy and tracking practices raise additional questions about how data is collected and used when you ask, is Chime safe, from a privacy angle.

Is Chime Safe for Everyone? The Risks and Limitations You Can’t Ignore

Chime’s safety can not be answered with a qualified “yes”, it’s important to highlight downsides, especially in terms of data privacy and tracking, plus operational limitations.

There have been user reports of account closures without clear notice or difficulty in retrieving funds. For example:

“Chime closed my account … any money in my account I’m unable to access.” (via user forum) Reddit

Also, the Consumer Financial Protection Bureau (CFPB) fined Chime $3.25 million in 2024 for delaying refunds to customers closing accounts. Because Chime is not a bank, some protections may differ compared to traditional banks: for instance, you are a depositor of the partner bank, not Chime itself. Users should verify the bank partner and whether their funds fall under the $250k insurance limit.

If the partner bank fails or if Chime’s servicing fails, there may be delays or complexities in accessing your funds, not common, but possible. The broader fintech-risk environment reminds us about these limitations.

One of the major angles often missed when thinking is Chime safe, deals with how Chime tracks and uses your data. Chime’s systems collect user event data (sign-ups, card transactions, app behaviour) to power fraud detection and analytics, for instance, Chime uses AWS Glue, Amazon Kinesis, and Amazon SageMaker to monitor real-time user events.

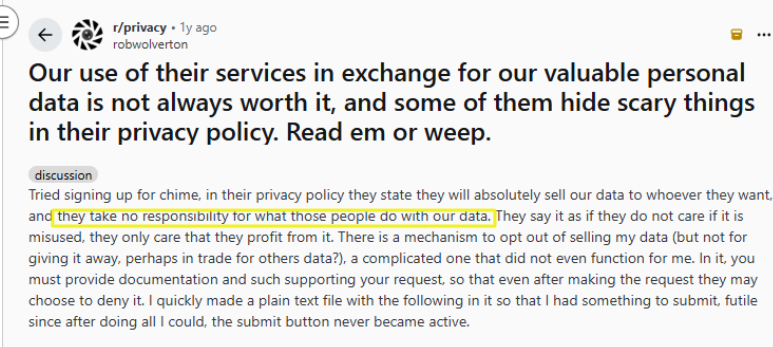

User complaints have pointed out that data sharing and tracking practices can be opaque. On Reddit, one user posted:

“Tried signing up for Chime, in their privacy policy they state they will absolutely sell our data to whoever they want, and they take no responsibility for what those people do with our data.”

The privacy notice states that clicking external links means you leave Chime’s domain and may interact with third parties whose tracking and data use differ. Because your financial transactions generate rich telemetry, if data is aggregated, shared, or sold, there’s a risk beyond the usual “money-theft” risk, your identity, spending patterns, or behaviour could be used to target you, or build profiles.

Therefore, while Chime’s infrastructure focuses on protecting your money, your concern that is Chime safe, should include is my data safe, and the partial answer is that while Chime implements many protections, the tracking and data sharing remain areas of concern and require your vigilance.

How to Use Chime Safely, Tips That Actually Work

It’s not just about trusting Chime’s systems, it’s also about taking a few smart precautions on your end.

- Add an extra layer of protection by enabling 2FA or using biometric login (Face ID or fingerprint).

- Chime lets you receive instant notifications for every debit card transaction to spot unauthorized activity.

- You can lock or unlock your Chime card in one tap within the app if your card is lost.

- Keep your Chime credentials secure with a strong password you don’t reuse anywhere else.

- A reliable VPN keeps your connection encrypted and your IP address hidden. Use PureVPN to keep online banking private.

- Double-check which bank holds your account to confirm coverage.

- If you get a random call or text about your account, verify it through the official app before sharing any details.

- Don’t rely on any single digital bank for all your funds. Spread savings across multiple institutions to minimize risk.

- Visit Chime’s privacy section and see how your data is used. Opt out of unnecessary data sharing.

- Monitor your credit file and transaction history regularly.

Conclusion

For most users, Chime is safe. It offers a solid mix of protection, modern banking features, FDIC-insured deposits, and strong security architecture. But safe doesn’t mean risk free. Some operational service risks, scam exposures, and privacy issues are there.

Use Chime for your daily banking, maintain awareness, use a VPN when using unsecured networks, track your data exposure, and it can be a smart modern banking choice. Stay safe!

Frequently Asked Questions

Yes to an extent, your funds are FDIC-insured through partner banks up to applicable limits (usually $250,000). If you have more than that, you should evaluate diversification or additional protections.

Yes, for debit card spending, direct deposits, transfers, Chime provides many standard protections, such as encryption, alerts, card freeze, zero liability.

Yes, your money is protected via the partner banks that are FDIC-insured. Chime itself is the fintech interface. Make sure to check which bank has your funds.

While there’s no major breach of customer deposit data publicly disclosed, there have been operational issues such as account closures and refund delays. In addition, the tracking/data-privacy angle shows risk, users report data-sharing practices that raise concerns.

To keep yourself safe while using Chime, make sure you’re dealing with the official app or website. Don’t trust unsolicited calls or texts, monitor your transactions. Be aware of your data and use a VPN when in doubt, and be proactive in privacy.