Equifax has recently begun distributing additional settlement payments to individuals who previously filed claims related to the massive 2017 data breach. These new payments are being issued via electronic prepaid cards, following a court-approved redistribution of unclaimed or remaining settlement funds.

What is Equifax?

Equifax is one of the three major credit reporting agencies in the United States, alongside Experian and TransUnion. It collects and maintains consumer credit information, including credit history, loan and payment data, and public records.

Businesses and lenders use Equifax’s data to assess creditworthiness when making decisions about loans, credit cards, mortgages, and other financial products.

Equifax also provides credit monitoring, identity theft protection services, and analytics to help consumers and companies manage credit and financial risk.

Background of the Breach and Settlement

In 2017, Equifax, one of the largest credit reporting agencies in the U.S., suffered a cybersecurity breach that exposed sensitive personal information — including Social Security numbers, birth dates, addresses, and credit card details — of approximately 147 million people. This breach is considered one of the largest and most severe data breaches in history, putting millions at risk of identity theft and fraud.

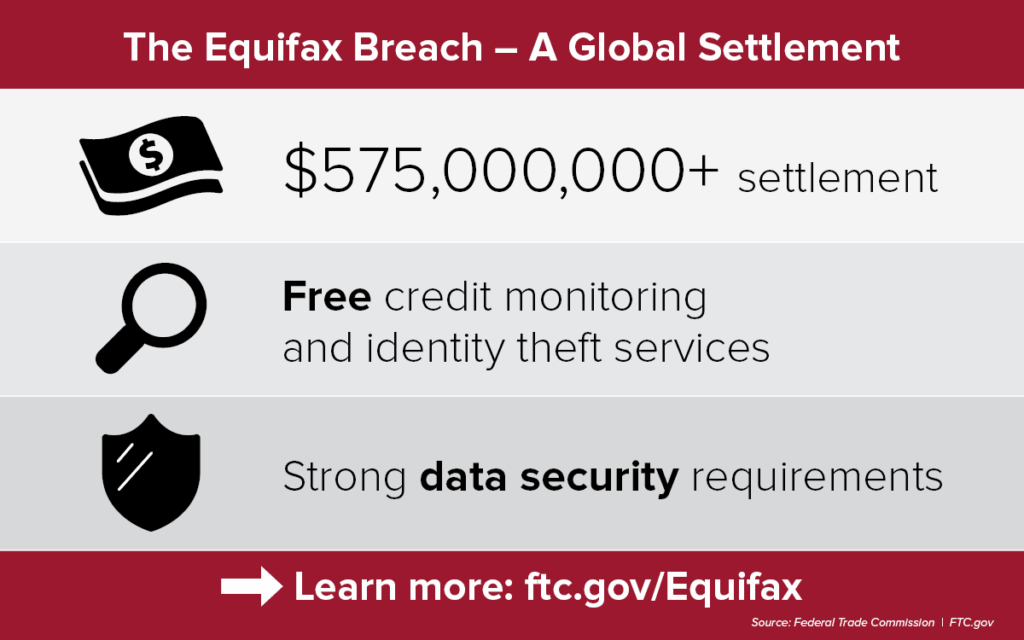

In response, Equifax agreed to a settlement valued at up to $700 million, which included $425 million earmarked specifically for consumer relief. Eligible individuals could file claims for reimbursement of out-of-pocket losses, compensation for time spent addressing the breach’s impact, and access to free credit monitoring services.

Additional Payments via Prepaid Cards

After the initial claims periods closed, some funds from the settlement remained undistributed. Recently, the settlement administrator has begun redistributing these remaining funds as additional payments to claimants. These payments are sent through electronic prepaid cards, providing recipients a convenient way to access their compensation.

Eligible individuals who had already received a prior settlement payment may receive a pro rata share of the leftover funds. The prepaid cards serve as a safe and efficient method to deliver these payments directly to consumers.

How to Identify Legitimate Payment Notifications

Equifax urges recipients to exercise caution and verify the authenticity of any communication regarding these payments. Legitimate emails concerning the settlement will only come from the official addresses:

Recipients should be wary of phishing scams or fraudulent messages claiming to be related to the settlement.

Redeeming the Prepaid Card

To redeem the prepaid card, recipients must visit the official redemption website at www.myprepaidcenter.com/redeem. The site provides clear instructions for card activation and usage. For any questions or assistance, the card servicer can be contacted at 1-833-678-6289.

What This Means for Affected Individuals

This distribution represents an important milestone in Equifax’s ongoing commitment to compensate those impacted by the breach. While initial claims deadlines have passed, this new round of payments allows eligible consumers to receive additional funds from the settlement pool.

Affected individuals should ensure they follow official channels and stay alert for legitimate communications to avoid falling victim to scams. More information and updates about the settlement and payment process can be found on the official Equifax Data Breach Settlement website.