Alipay is one of the world’s largest mobile payment platforms, used daily by hundreds of millions of people for everything from online shopping and bill payments to QR-code purchases and peer-to-peer transfers. As a major part of China’s cashless economy, it has become essential for locals, expats, and tourists. With its increasing global reach, many new users wonder: Is Alipay actually safe?

The short answer: Yes, Alipay is generally very safe, relying on advanced encryption, biometric verification, risk monitoring, and secure data-handling practices. But like any financial tool, it comes with limitations, potential risks, and user responsibilities.

This guide breaks down all aspects of Alipay’s safety, including security features, privacy concerns, risks for foreign users, and how to use the app safely.

What Is Alipay and How Does It Work?

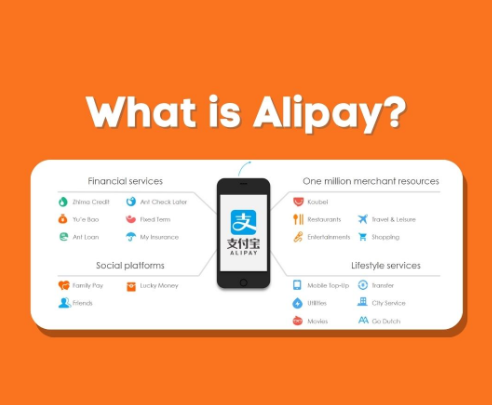

Alipay is a digital wallet and mobile payment platform that functions similarly to Apple Pay, Google Pay, and PayPal, but with far more features. It allows users to:

- Pay for goods and services through QR codes

- Make online purchases

- Transfer money

- Store digital IDs and cards

- Pay utility bills, transit fares, and more

- Access mini-programs for shopping, food delivery, travel bookings, and lifestyle services

Originally launched by Alibaba Group, Alipay has evolved into a massive financial ecosystem. Its wide adoption means that safety, reliability, and fraud prevention are major priorities.

Alipay Payment Methods

Whether you’re using the international version of the Alipay app or one of its localized services, it’s helpful to understand the payment methods available. Alipay offers several ways to pay, each designed to provide a smooth, user-friendly experience. Although the methods differ in how they are funded or processed, they all function seamlessly within the Alipay ecosystem, allowing fast, secure transactions both online and in person.

Alipay+ Payment Method

Alipay+ is a cross-border payment solution that allows users from different countries to pay with their own local e-wallets when traveling or shopping internationally. It connects regional wallets (like GCash, TrueMoney, and Kakao Pay) to merchants that accept Alipay, making global payments easier without needing a Chinese bank account.

Wallet Balance

Users can store money directly in their Alipay wallet and use the balance to make purchases. This method supports instant payments and is often preferred for small everyday transactions such as food, transport, and retail shopping. Tourists may have access to limited wallet features depending on the region.

Mobile Banking App

Some users can link Alipay with their mobile banking apps. This allows instant transfers from a bank account to Alipay without needing a physical card. It’s convenient, fast, and usually supports real-time verification.

Bank Transfer

Alipay allows users to top up their accounts via bank transfer. Depending on the country and bank, transfers may be instant or take a few hours. This option is commonly used in regions where card linking is restricted or when transferring higher amounts.

Online Banking

You can make payments using online banking through Alipay’s secure gateway. This means logging in to your bank’s online portal during checkout to authorize the transaction. It adds an extra layer of verification and is particularly useful for larger or high-risk payments.

Card Payments (Debit & Credit Cards)

Alipay supports linking domestic or international debit and credit cards. Once added, the card can be used for direct payments or wallet top-ups. While international cards work, approval may vary depending on the issuing bank, currency controls, or merchant type. For tourists, this is often the easiest way to get started.

OTC (Over-the-Counter) Payments

In some countries, Alipay lets users deposit cash into their wallets over the counter at partner locations such as convenience stores, payment centers, or agent outlets. This is especially useful for users who do not have bank accounts or prefer handling cash.

Is Alipay Safe?

Alipay incorporates multiple layers of security that make it safer than carrying cash or entering card details directly into websites. Advanced encryption, biometric login, fraud detection, secure storage, and transaction monitoring help ensure your data and money stay protected.

However, Alipay is not without limitations, especially for foreigners or international use, and its security depends partly on your personal practices.

So while Alipay is safe, how safe it is for you depends on where you use it, how you use it, and what protections you enable.

How Alipay Protects Users: Key Security Features

Alipay employs several strong security mechanisms designed to protect both your data and your money. These include:

1. End-to-End Encryption

All payments, transfers, and personal details are encrypted. This prevents hackers from intercepting your financial data or login credentials.

2. Biometric Authentication

Users can activate fingerprint scanning, Face ID, or device-based verification. This helps prevent unauthorized access even if someone knows your password.

3. Real-Time Risk Monitoring

Alipay uses AI-driven fraud detection to identify unusual behaviour such as rapid transfers, suspicious device logins, or irregular purchases. Transactions can be paused or flagged for verification.

4. Escrow System for Online Purchases

When shopping on platforms like Taobao, Alipay holds funds until the buyer confirms receipt of items. This reduces fraud and increases buyer protection.

5. Secure Payment Tokenization

Merchants never see your actual card or bank information. Alipay issues a secure, temporary token instead.

6. Account Alerts and Transaction Notifications

You receive real-time updates, enabling immediate action if something seems off.

Together, these features make unauthorized access extremely difficult.

Is Your Data Safe with Alipay?

While Alipay uses strong technical security, some users have concerns about data privacy — especially outside China.

Here’s what to know:

- Alipay collects transaction history, device details, location data, and behavioral patterns.

- Data is used for fraud prevention, personalization, regulatory compliance, and app functionality.

- Alipay states that it minimizes data storage time and does not share sensitive data with merchants.

- Like many major fintech apps, Alipay is regulated by local authorities, which may have different privacy standards than Western regions.

Bottom line: Technically, Alipay keeps your data secure, but it does collect a lot of it. Privacy-sensitive users should review settings carefully.

Is Alipay Safe for Tourists and International Users?

Yes, but with limitations. Tourists often use Alipay’s “Tour Pass” or international card features, which are safe but less flexible than domestic accounts.

- International cards are accepted, but some payments may be limited or fail depending on the merchant.

- Regulations may require additional identity verification, especially for large transfers.

- App features for foreigners are simplified, meaning some mini-programs or financial services might not work.

- Refunds and disputes can be more complicated compared to domestic accounts.

For everyday travel, taxis, food, shopping, public transport, Alipay is safe and convenient.

Risks and Limitations You Should Be Aware Of

Even though Alipay is secure, there are risks to consider:

1. Phishing Scams and Fake QR Codes

Scammers sometimes create fake payment QR codes. If you scan one, you may unknowingly send money to a criminal.

2. Lost Phone Without Biometric Lock

If your device lacks a strong lock or you don’t use Face ID/fingerprint login, unauthorized access becomes easier.

3. Limited International Consumer Protection

Unlike banks offering chargebacks or FDIC-like insurance, Alipay’s refund and dispute process can vary widely by region.

4. Account Freezes

Alipay is strict about unusual transactions. International users sometimes face sudden freezes or requests for extra verification.

5. Privacy Concerns

As a massive ecosystem, Alipay collects more user data than typical payment apps. Some users may find this uncomfortable.

How to Use Alipay Safely: Best Practices

To maximize your safety, follow these tips:

Enable All Security Features

Turn on biometrics, passcodes, and app lock.

Use Trusted QR Codes Only

Never scan codes from unverified sources or strangers.

Don’t Store Large Balances

If you’re a tourist, avoid keeping big amounts in your in-app wallet.

Monitor Your Transaction History

Check regularly for unfamiliar payments.

Avoid Public Wi-Fi for Payments

Use mobile data or a secure network instead.

Verify Merchants Before Paying

Especially when shopping online.

With these habits, you significantly reduce the risk of fraud.

Is Alipay Regulated and Financially Secure?

Yes. Alipay is overseen by financial regulators and is required to follow fintech compliance, security frameworks, and anti-money-laundering rules.

However:

- It is not a bank, meaning balances may not have deposit insurance.

- Regulations differ worldwide.

- Dispute resolution may be slower for cross-border users.

Still, Alipay’s massive scale and long-standing reputation make it one of the safer fintech platforms globally.

Is Alipay Safer Than WeChat Pay?

When comparing Alipay and WeChat Pay, it becomes clear that both platforms prioritize user security at a very high level. Each uses advanced encryption, multi-factor authentication, biometric login options, and real-time risk monitoring to protect user accounts and transactions. Both also comply with financial regulations that require personal data to be stored only for approved periods and processed under strict security controls.

WeChat Pay, like Alipay, applies multiple layers of security, including physical server protections, bank-level encryption, fraud detection systems, and internal management controls designed to reduce the risk of unauthorized access, data misuse, or financial loss. Users can further safeguard their accounts by enabling fingerprint or facial recognition, setting strong passwords, and reviewing transactions regularly.

FAQs

Yes. Alipay is safe for tourists, especially for small everyday payments, but international features are more limited.

It’s highly unlikely due to strong security layers. Most issues come from phishing, fake QR codes, or weak user passwords.

Yes. Merchants never see your real card number, Alipay uses encrypted tokens.

Alipay collects data but claims not to share sensitive details with merchants. Privacy laws vary by region.

Immediately change your password, enable biometrics, review transactions, and contact Alipay support for account protection.

Yes, it reduces the risk of theft or loss and uses biometric/technical safeguards that cash cannot provide.